Last Update03 Oct 25Fair value Decreased 3.78%

Analysts have slightly lowered their price target for Baltic Classifieds Group from €3.83 to €3.69. They cite more moderate expectations for revenue growth and profitability margins.

What's in the News

- Baltic Classifieds Group has revised its full year 2025 earnings guidance, stating that revenue and profit growth are expected to be 3% to 4% lower than previously anticipated (Key Developments).

Valuation Changes

- The Fair Value Estimate has decreased slightly from €3.83 to €3.69.

- The Discount Rate has fallen marginally from 8.58% to 8.44%.

- The Revenue Growth Forecast has reduced from 14.07% to 13.26%.

- The Net Profit Margin is almost unchanged, moving very slightly from 60.56% to 60.48%.

- The estimate for the future P/E Ratio has declined from 36.48x to 35.65x.

Key Takeaways

- Accelerating digital adoption and value-added service integration are expanding customer base, ARPU, and supporting sustained revenue and margin growth.

- Operational leverage, disciplined cost control, and bolt-on acquisitions are enhancing monetization streams and building a stronger competitive advantage.

- Heavy reliance on core Baltic markets, limited diversification, pricing risks, competitive threats, and regulatory pressures all threaten future growth, profitability, and long-term market position.

Catalysts

About Baltic Classifieds Group- Owns and operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania.

- The ongoing expansion of digital adoption and internet penetration in the Baltics continues to increase the consumer base for online classifieds, underpinning sustained demand and providing a runway for high-margin revenue growth.

- The group is well-positioned to benefit from the accelerating shift in ad budgets from traditional to digital advertising channels in emerging European markets, which should lead to increased advertising revenue and improved net income over time.

- Further roll-out and integration of value-added services (like property valuation tools, data analytics, AI-powered features, and transactional models) is expanding ARPU and increasing customer stickiness, supporting both top-line growth and margin expansion.

- Baltic Classifieds Group demonstrates strong operational leverage with scalable technology and disciplined cost control, as seen in expanding EBITDA margins and cash conversion, which should translate into higher net margins as revenues grow.

- Bolt-on acquisitions (like Untu) and the ability to cross-sell or integrate new data-driven services across existing platforms create new monetisation streams and enhance the company's competitive moat, providing future uplift to consolidated revenues and earnings.

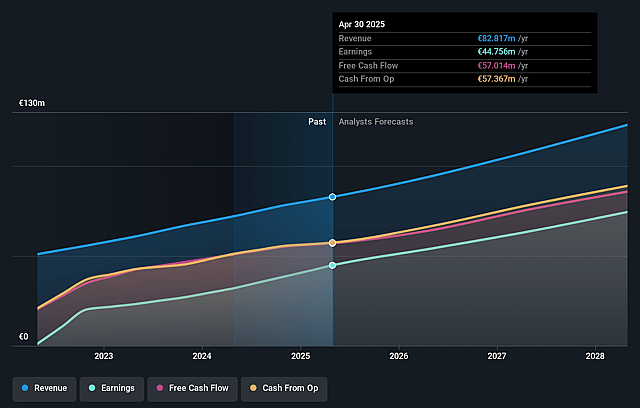

Baltic Classifieds Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Baltic Classifieds Group's revenue will grow by 14.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 54.0% today to 60.6% in 3 years time.

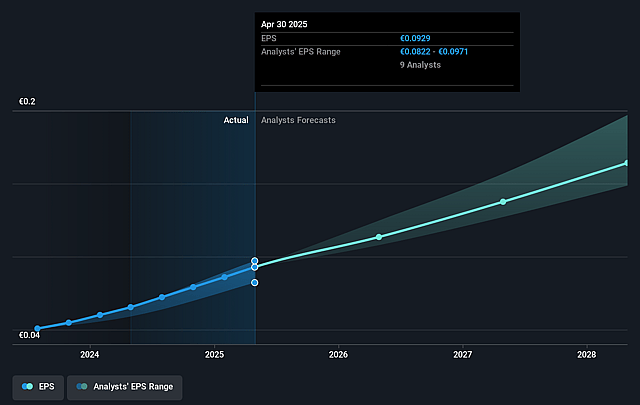

- Analysts expect earnings to reach €74.4 million (and earnings per share of €0.16) by about September 2028, up from €44.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €66.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.5x on those 2028 earnings, down from 39.6x today. This future PE is greater than the current PE for the GB Interactive Media and Services industry at 27.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.58%, as per the Simply Wall St company report.

Baltic Classifieds Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Baltic Classifieds Group relies heavily on its core verticals (property, automotive, jobs) in small Baltic markets, which exposes the company to local macroeconomic volatility and demographic decline; long-term, this may result in stagnant or declining revenues if underlying transaction volumes contract.

- Limited geographic diversification means expansion into new markets could be capex-intensive and slower to deliver returns; if regional market saturation occurs or growth in core markets slows, this could directly pressure revenue growth and net margins.

- Increasing monetization through frequent pricing and packaging changes (listing and subscription fee increases) runs the risk of user churn or pricing fatigue, particularly among price-sensitive segments, potentially leading to weaker long-term customer relationships and impacting both revenues and earnings visibility.

- Emerging competition from global, free or low-cost digital marketplaces (such as Facebook Marketplace or pan-European platforms) and advances in AI-driven search/matching by larger tech firms could erode market share, undermine pricing power, and force Baltic Classifieds to lower fees, impacting future revenue and margin resilience.

- Regulatory headwinds-including ongoing rises in Baltic corporate tax rates and potential for broader EU data privacy legislation-could increase compliance costs and limit data-driven monetization opportunities, squeezing net profitability over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.834 for Baltic Classifieds Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.16, and the most bearish reporting a price target of just £3.41.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €122.9 million, earnings will come to €74.4 million, and it would be trading on a PE ratio of 36.5x, assuming you use a discount rate of 8.6%.

- Given the current share price of £3.2, the analyst price target of £3.83 is 16.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.