Last Update 01 Aug 25

Fair value Increased 14%The notable increase in Gaming Realms’ future P/E ratio alongside a decline in net profit margin suggests the market anticipates higher growth despite margin pressures, prompting a consensus analyst price target upgrade from £0.583 to £0.663.

What's in the News

- Gaming Realms expects H1 2025 revenue of approximately £16.0 million, up 18% year-on-year from £13.6 million.

- High Roller Technologies is partnering with Gaming Realms to offer its gaming content in Ontario, with launch anticipated in the second half of 2025 pending regulatory approval.

Valuation Changes

Summary of Valuation Changes for Gaming Realms

- The Consensus Analyst Price Target has significantly risen from £0.583 to £0.663.

- The Future P/E for Gaming Realms has significantly risen from 13.17x to 19.62x.

- The Net Profit Margin for Gaming Realms has significantly fallen from 42.89% to 34.72%.

Key Takeaways

- Expansion into new regulated markets in North America and Brazil offers significant growth potential, positively impacting revenue through increased geographic reach.

- Strong Slingo brand performance and strategic partnerships in lotteries and social gaming enhance revenue and margins through diverse income streams.

- Heavy reliance on the Slingo brand and uncertain regulatory landscapes could hinder revenue growth and sustainability amidst rising competition and market volatility.

Catalysts

About Gaming Realms- Develops, publishes, and licenses mobile gaming content in the United Kingdom, the United States, Isle of Man, Malta, Gibraltar, and internationally.

- The expansion into new regulated markets, particularly in North America and Brazil, creates potential revenue growth opportunities as more states in the U.S. plan to legalize iGaming, expanding Gaming Realms' footprint geographically. This is expected to impact revenue positively.

- Optimizing and growing existing partnerships with operators, particularly in the U.S. and Canada, suggests potential for organic revenue growth, as 70% of growth came from existing partners, and new partnerships further layer additional revenue. This should positively impact overall earnings.

- The strong performance and popularity of the Slingo brand, alongside strategic brand licensing in sectors like lotteries and social gaming, enhances brand strength and consumer engagement. This likely contributes positively to both revenue and net margins through diverse income streams.

- The integration of third-party games and development of new, innovative games such as unique Slingo formats position the company to exploit growing market demand in iGaming, potentially increasing revenue and profitability.

- Strategic share buybacks using surplus cash, aimed at increasing shareholder value, as well as investments in additional game development and potential acquisitions, are expected to enhance earnings per share and cash flow management in the future.

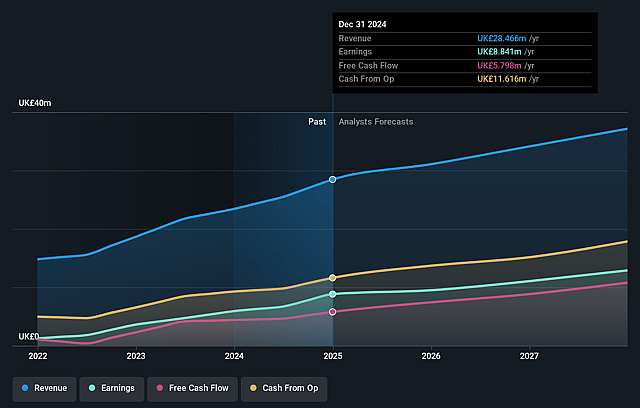

Gaming Realms Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gaming Realms's revenue will grow by 9.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 31.1% today to 34.7% in 3 years time.

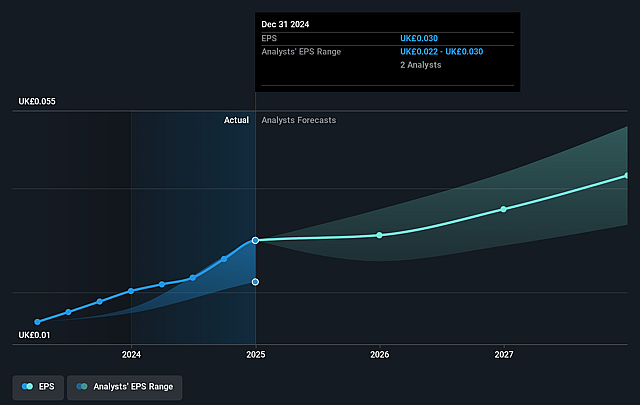

- Analysts expect earnings to reach £12.9 million (and earnings per share of £0.04) by about September 2028, up from £8.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £15.9 million in earnings, and the most bearish expecting £9.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.6x on those 2028 earnings, up from 16.4x today. This future PE is greater than the current PE for the GB Entertainment industry at 15.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.2%, as per the Simply Wall St company report.

Gaming Realms Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The volatility in revenues from brand licensing and potential lumpiness in financial periods could lead to unpredictable earnings, affecting net margins.

- The reliance on the success of the Slingo brand means a failure to further innovate or diversify could impact revenue growth and long-term sustainability.

- Increasing competition within the U.S. iGaming market, particularly as new states regulate, could dilute Gaming Realms' market share, impacting future revenue potential.

- Uncertainty around regulation in key markets like the U.K. could lead to potential restrictions and compliance costs, negatively affecting profit margins and earnings.

- The potential plateauing of growth in mature markets like the U.K. and Italy may limit revenue growth if newer markets don't develop as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £0.663 for Gaming Realms based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.75, and the most bearish reporting a price target of just £0.57.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £37.2 million, earnings will come to £12.9 million, and it would be trading on a PE ratio of 19.6x, assuming you use a discount rate of 9.2%.

- Given the current share price of £0.5, the analyst price target of £0.66 is 25.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.