Key Takeaways

- Audience migration to digital audio, tech advancements, and major acquisitions are driving Audioboom's revenue, scale, and margin improvements.

- Exclusive partnerships and M&A opportunities boost content differentiation, premium pricing, and strategic value for future expansion.

- Heavy reliance on volatile digital advertising, competitive pressure from larger firms, and execution risks in acquisitions could constrain profitability, cash flow, and long-term growth.

Catalysts

About Audioboom Group- A podcast company, operates a spoken-word audio platform for hosting, distributing, and monetizing content primarily in the United Kingdom and the United States.

- The continued migration of audiences from traditional broadcast media to digital audio is expanding Audioboom's addressable market; combined with increasing advertiser budgets shifting to podcasting and expectations for per capita ad spend in the UK to rise sharply toward US levels, this sets up strong future revenue growth.

- The acquisition of Adelicious positions Audioboom as the second-largest podcast network in the UK, providing immediate scale, cross-selling opportunities, expanded inventory, and synergies via sales team and technology integration-all expected to lift revenue, improve gross margins, and be immediately earnings accretive in 2025 and 2026.

- Ongoing investments in proprietary advertising technology (Showcase marketplace and AI-driven targeting/brand safety tools) are attracting larger brand advertisers seeking efficient, measurable, and targeted campaigns, resulting in higher CPMs, better ad fill rates, and improved group gross and net margins.

- The growing popularity of on-demand, personalized content and Audioboom's continued expansion of exclusive partnerships with high-profile creators enhances audience engagement and content differentiation, supporting premium pricing and increasing average revenue per user and gross profit.

- Industry consolidation, with smaller networks lacking proprietary technology becoming targets, creates additional M&A opportunities for Audioboom to accelerate growth and capture outsized share, positioning the company for further revenue and earnings expansion and increased strategic value in future M&A scenarios.

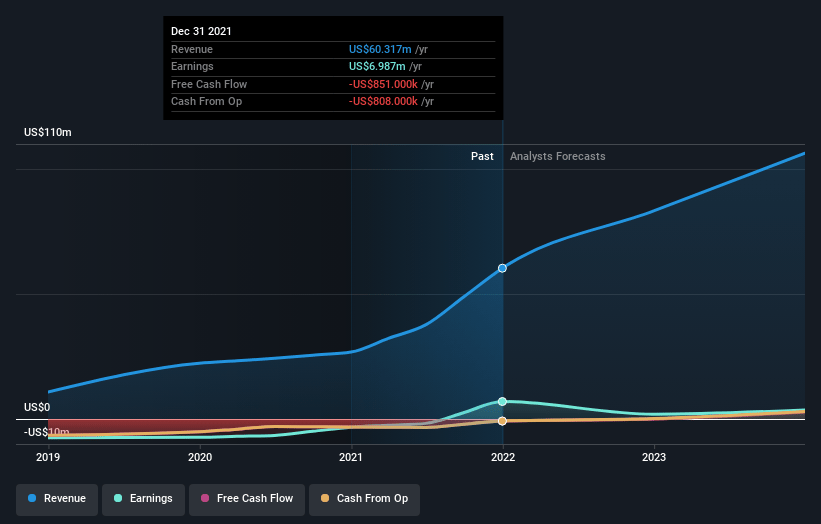

Audioboom Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Audioboom Group's revenue will grow by 16.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.7% today to 1.7% in 3 years time.

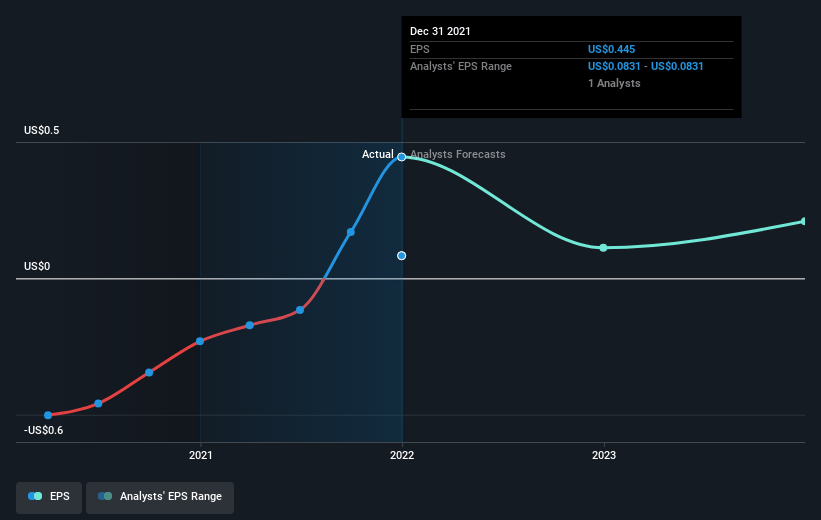

- Analysts expect earnings to reach $2.0 million (and earnings per share of $0.07) by about July 2028, down from $3.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 179.1x on those 2028 earnings, up from 21.0x today. This future PE is greater than the current PE for the GB Interactive Media and Services industry at 25.6x.

- Analysts expect the number of shares outstanding to decline by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.88%, as per the Simply Wall St company report.

Audioboom Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Audioboom's core business remains heavily dependent on the dynamic and often volatile digital advertising market; any softening in ad spend-especially if macroeconomic uncertainty or shifting trends favor video or other formats-could constrain revenue and EBITDA growth, as evidenced by management's remarks about seasonality and past challenging ad market conditions.

- The company is a mid-sized player in a fragmented industry dominated by significantly larger tech and media firms (Amazon, Spotify, iHeartMedia, Apple), making it vulnerable to increased competition, eroding margins, and potential future bargaining power loss, all of which could negatively impact gross margins and long-term earnings potential.

- There are growing signs of slower payment terms and increasing debtor days from advertising agency customers, introducing pressure on Audioboom's working capital and potential cash flow risk-even as the company claims collections remain strong at this stage.

- Audioboom's strategy relies heavily on M&A and integration of acquisitions like Adelicious, but successful integration and synergy realization are not guaranteed; execution risks, possible integration challenges, or over-estimated revenue/EBITDA contributions may impair anticipated profitability and cash generation in the coming years.

- Podcast content acquisition costs, talent retention, and market saturation/fatigue remain persistent industry-wide risks-if Audioboom struggles to consistently secure or retain top podcasts, or if the pace of consumer podcast engagement plateaus, revenue growth could stagnate and pressure net margins over the medium and long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £13.0 for Audioboom Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $117.9 million, earnings will come to $2.0 million, and it would be trading on a PE ratio of 179.1x, assuming you use a discount rate of 7.9%.

- Given the current share price of £3.32, the analyst price target of £13.0 is 74.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.