Last Update 11 Nov 25

Fair value Decreased 19%HFG: Management Will Support Upside Through Dividend Increase And Expansion Plans

Analysts have lowered their average price target for Hilton Food Group from £10.04 to £8.15, citing reduced revenue growth forecasts and more conservative margin expectations.

Analyst Commentary

Analyst reactions to Hilton Food Group's recent developments have been mixed, with both optimistic and cautious perspectives shaping their revised outlooks. These views reflect divergent opinions on valuation, execution, and the company's growth trajectory.

Bullish Takeaways

- Some bullish analysts maintain a Buy rating, indicating confidence in Hilton Food Group's long-term growth prospects despite near-term adjustments.

- In certain cases, price targets remain well above current trading levels, suggesting upside if the company successfully executes operational improvements.

- Support from select analysts highlights perceived resilience in Hilton Food Group's core business and belief that margin pressures can be managed over time.

- Ongoing expansion plans and partnership opportunities are expected by optimistic analysts to support future revenues and market positioning.

Bearish Takeaways

- Bearish analysts have downgraded ratings and cut previous price targets, reflecting reduced expectations for short-term performance.

- Recent guidance on revenue and margin growth has led to concerns about Hilton Food Group's ability to achieve profitability goals in a tougher operating environment.

- Margin compression is a key risk cited, as cost headwinds and competitive pressures could weigh on financial results.

- Analysts expressing caution also point to execution risks surrounding strategic initiatives, which may limit the company's ability to outperform in the near future.

What's in the News

- The Directors of Hilton Food Group have approved the payment of an interim dividend of 10.1 pence per share for 2025, an increase from 9.6 pence previously. The dividend is scheduled for payment on 28 November 2025 to shareholders on the register at 31 October 2025 (company announcement).

Valuation Changes

- Consensus Analyst Price Target has fallen significantly from £10.04 to £8.15.

- Discount Rate has risen slightly, increasing from 6.82% to 7.07%.

- Revenue Growth expectations have dropped considerably, from 3.6% to 1.9%.

- Net Profit Margin estimates have decreased from 1.32% to 1.12%.

- Future P/E ratio has edged up, moving from 18.1x to 18.4x.

Key Takeaways

- Expansion into fast-growing international markets and partnerships with major retailers enhance revenue stability, broaden market reach, and reduce earnings volatility.

- Focus on innovation, value-added products, automation, and diversification supports higher margins, operational efficiency, and positions the company for sustainable long-term growth.

- Escalating input costs, operational disruptions, heavy investments, evolving consumer habits, and buyer concentration collectively threaten profit margins and earnings stability.

Catalysts

About Hilton Food Group- Engages in the food packing business.

- The planned launch of operations in Canada with Walmart (early 2027) and Saudi Arabia with NADEC (H2 2026), both targeting fast-growing markets with rising urbanization and protein consumption, is likely to significantly expand Hilton Food Group's addressable market, driving top-line revenue growth.

- Hilton's ongoing innovation in value-added products, including ready-to-cook and premium ranges, aligns with the consumer shift toward convenience-a trend that should sustain or accelerate demand for higher-margin lines, positively impacting earnings and net margins.

- Continued investments in automation, supply chain optimization, and digitalization-including strategic moves like the Foods Connected partnership-are anticipated to yield operational efficiencies that support margin expansion and improve ROCE over the longer term.

- Strategic partnerships and long-term supply contracts with leading retailers (Tesco, Walmart, Ahold Delhaize) are providing resilience and revenue stability, offering a buffer against short-term market volatility and ensuring steady cash generation for reinvestment and dividends.

- Diversification into new proteins (alternative species in seafood, plant-based, and premiumization within traditional meats) and new international markets reduces earnings volatility and positions the company to capitalize on long-term changes in global food consumption, supporting sustainable profit growth.

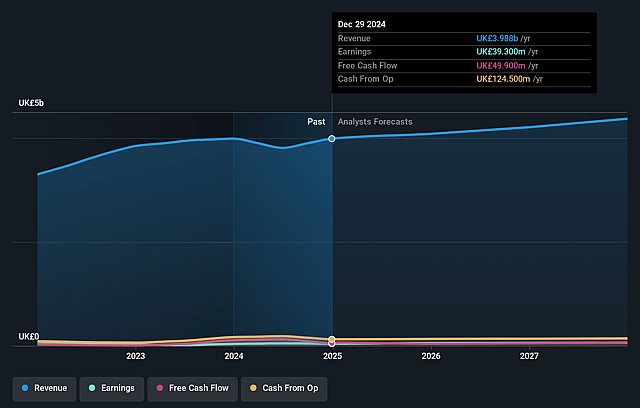

Hilton Food Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hilton Food Group's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.9% today to 1.3% in 3 years time.

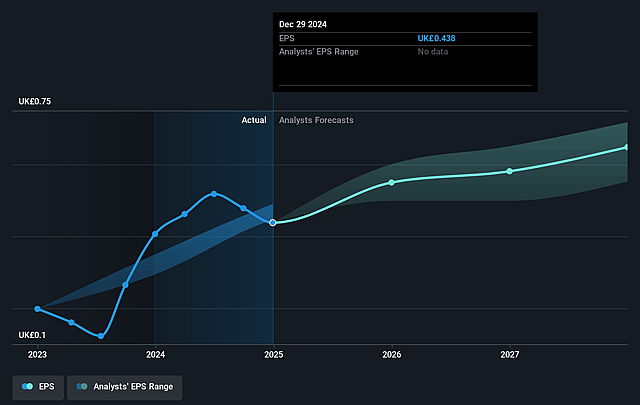

- Analysts expect earnings to reach £60.7 million (and earnings per share of £0.66) by about September 2028, up from £38.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £68 million in earnings, and the most bearish expecting £50.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, up from 15.7x today. This future PE is greater than the current PE for the GB Food industry at 15.7x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Hilton Food Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Inflated raw material prices (particularly for red meat and whitefish) and persistent protein inflation have contributed significantly to recent revenue growth, but ongoing or future input cost volatility may squeeze operating margins and undermine earnings consistency if price pass-through diminishes.

- The seafood segment, especially Foppen, is experiencing operational setbacks (FDA import compliance issues, logistics complications, and ongoing non-underlying costs) that hurt profitability; prolonged disruptions or inability to restore normal operations could continue to drag on group net margins and earnings.

- Capital expenditure and inventory investments are rising sharply (notably for Canadian expansion), driven by inflation in equipment, labor, and infrastructure. If these projects (Canada, Saudi Arabia) underperform or slow to deliver anticipated returns, there is a risk of overleveraging and ROIC compression, particularly as net debt has increased substantially.

- Ongoing consumer behaviors-such as trading down, product switching, and softening demand for higher-priced categories (notably seafood)-combined with structural shifts in protein consumption (towards alternative or plant-based proteins) could erode core meat and fish revenues over time.

- Over-reliance on large-scale supermarket contracts (e.g., Tesco, Walmart, Woolworths) exposes the company to margin pressure if these buyers consolidate or renegotiate tougher terms, or if retail consolidation increases their bargaining power, which could compress future net margins and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £10.042 for Hilton Food Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £11.2, and the most bearish reporting a price target of just £7.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £4.6 billion, earnings will come to £60.7 million, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of £6.79, the analyst price target of £10.04 is 32.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.