Last Update 20 Sep 25

Fair value Increased 7.59%The consensus analyst price target for Bakkavor Group has increased to £2.12, reflecting modest improvements in both net profit margin and revenue growth forecasts.

Valuation Changes

Summary of Valuation Changes for Bakkavor Group

- The Consensus Analyst Price Target has risen from £1.98 to £2.12.

- The Net Profit Margin for Bakkavor Group has risen slightly from 4.18% to 4.35%.

- The Consensus Revenue Growth forecasts for Bakkavor Group has risen slightly from 0.8% per annum to 0.9% per annum.

Key Takeaways

- Reliance on convenience trends and operational efficiencies may be insufficient to counteract volume declines, cost inflation, and shifting consumer preferences.

- Dependence on major UK supermarket customers poses risks as retailer power dynamics shift and demand for minimally processed, plant-based foods rises.

- Operational improvements, geographic diversification, and investment in efficiency bolster financial stability, competitive position, and future growth, mitigating risks from inflation and market changes.

Catalysts

About Bakkavor Group- Engages in the preparation and marketing of fresh prepared foods in the United Kingdom, the United States, and China.

- Investors may be overestimating the sustainability of Bakkavor's recent margin improvements, given ongoing cost inflation in labor and key ingredients (like dairy and egg) and the company's historical ability to recover only 70-75% of these inflationary pressures through price increases, which could compress net margins in future reporting periods.

- Current valuation could reflect excessive optimism that the increased consumer focus on convenience will continue to deliver steady top-line growth, despite underlying volume declines in the UK and category-specific pressures (e.g., desserts), which suggest that reliance on convenience trends alone may not offset segmental slowdowns in revenue.

- The market could be underpricing risks from growing consumer preferences for minimally processed, plant-based, and locally sourced foods, which may structurally erode demand for Bakkavor's predominantly prepared meal product lines, challenging medium

- to long-term revenue growth.

- Bakkavor's heavy dependence on a few large UK supermarket customers-combined with ongoing retailer consolidation and the rise of alternative digital food platforms-could weaken the company's future bargaining power and revenue stability as industry power structures shift.

- Investors potentially assume that momentum from operational efficiencies (factory closures, process excellence initiatives, automation) will persist indefinitely, but the availability of further 'easy wins' is finite, and underlying structural challenges-such as labor shortages, input price volatility, and regulatory scrutiny-could increasingly weigh on earnings as self-help gains diminish.

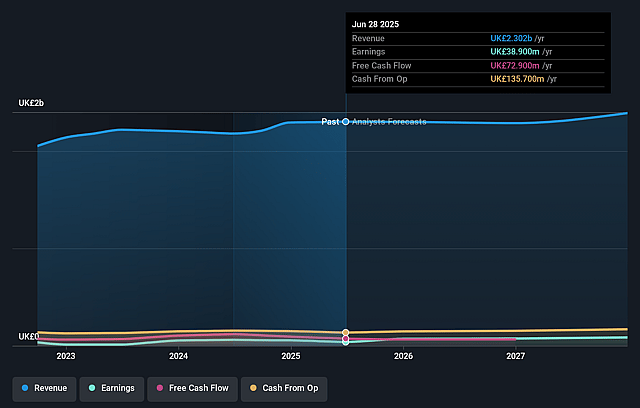

Bakkavor Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bakkavor Group's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.7% today to 4.2% in 3 years time.

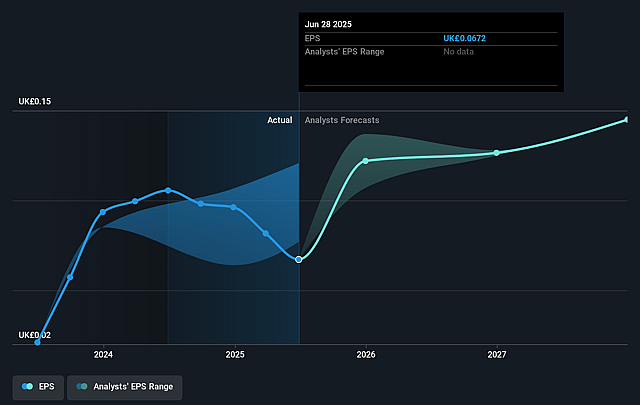

- Analysts expect earnings to reach £98.5 million (and earnings per share of £0.14) by about September 2028, up from £38.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, down from 33.4x today. This future PE is lower than the current PE for the GB Food industry at 15.7x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Bakkavor Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong and sustained margin improvement, driven by operational efficiency, factory optimization, and disciplined strategy execution, indicates Bakkavor can mitigate inflationary pressure and improve net margins, counteracting expectations of share price decline.

- Robust cash generation and a strengthened balance sheet-with leverage falling below 1x after the China divestment and substantial free cash flow-provide financial flexibility, reducing risk to earnings and suggesting resilience against adverse industry trends.

- Accelerating success in the U.S. market, with significant volume-driven growth and increasing profitability (U.S. margins now accretive to the group), creates new revenue pathways and diversifies risk away from the mature U.K. market, supporting future topline and earnings growth.

- Demonstrated ability to capture long-term market trends-such as growing demand for fresh prepared foods due to consumer preference for convenience, quality, and value-positions Bakkavor to benefit from secular shifts supporting stable or increasing revenues over time.

- Ongoing investment in automation, efficiency, ESG improvements, and customer relationships (including strong ties with leading U.K. retailers) underpins competitive advantages and customer retention, reducing revenue volatility and strengthening margin/profit outlook.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.975 for Bakkavor Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £2.4 billion, earnings will come to £98.5 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of £2.24, the analyst price target of £1.98 is 13.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.