Last Update 06 Nov 25

Fair value Increased 2.19%SHEL: Future Performance Will Reflect Capital Returns and Energy Sector Uncertainties

Shell's analyst price target has increased from $80 to $82. Analysts cite stronger-than-expected operational and trading performance, improved profit margins, and a lower discount rate, which are supporting upward revisions in fair value estimates.

Analyst Commentary

Recent Street research on Shell reflects a balanced mix of optimism and caution, with several firms adjusting their price targets and recommendations in response to the company's operational and strategic developments.

Bullish Takeaways- Bullish analysts highlight Shell's stronger-than-expected operational and trading performance, especially in recent quarters. This has led to upward revisions in fair value estimates.

- Multiple research notes point to improved profit margins and robust returns of capital, reinforcing confidence in Shell's ability to generate value for shareholders.

- Ongoing efforts to address production gaps in the coming decade, alongside progressing decapitalization in renewables and focusing on cost reductions in chemicals, are seen as supporting future growth and efficiency.

- Major institutions such as JPMorgan have reaffirmed their positive outlooks by raising price targets and maintaining Overweight ratings. This reflects continued confidence in Shell's strategic execution and sector positioning.

- Some bearish analysts express concern about Shell's strategy to fund share buybacks through increased debt. They warn this could erode equity value over time.

- Updates to price targets, while frequently positive, are at times muted by disappointment regarding the magnitude of recent margin improvements relative to industry indicator expectations.

- Uncertainty around macroeconomic conditions and soft demand indicators in the energy sector are cited as potential headwinds to Shell's medium-term growth.

- Downgrades from certain research houses reflect worries about the sustainability of recent stock gains given ongoing capital return efforts and potential cash burn.

What's in the News

- OPEC+ will pause planned oil output increases next year after a modest production rise in December due to seasonal factors (Financial Times).

- Shell received authorization from the U.S. for Trinidad and Tobago to resume work with Venezuela on the Dragon offshore gas project, which had faced delays due to prior sanctions (Financial Times).

- Shell has restarted its process to sell Indian renewable power producer Sprng Energy, appointing Barclays to manage the planned full exit from its $1.5B investment (Economic Times).

- Wells Fargo initiated coverage of Shell with an Equal Weight rating and a $76 price target, citing return of capital as a key sector performance driver amid soft demand indicators (Wells Fargo).

- Shell lost an arbitration case to Venture Global regarding alleged withheld LNG cargoes, with other energy firms also involved in similar cases totaling up to $7.4 billion (Wall Street Journal).

Valuation Changes

- Fair Value Estimate has risen slightly from $30.84 to $31.52 per share, reflecting updated analyst assessments.

- Discount Rate has fallen moderately from 7.29% to 6.82%. This indicates a lower risk premium applied to Shell's future cash flows.

- Revenue Growth projections increased from 1.07% to 1.48% annually. This suggests improved expectations for Shell's top-line expansion.

- Net Profit Margin has edged higher from 6.88% to 7.59%. This highlights anticipated enhancements in operational efficiency and profitability.

- Future P/E Ratio has declined from 13.34x to 11.11x, signaling a more favorable valuation relative to expected earnings.

Key Takeaways

- Shell's focus on LNG expansion, operational efficiency, and high-grading its portfolio positions it for resilient revenue growth and stronger returns.

- Strong shareholder rewards and strategic flexibility help ensure stability and investor appeal despite market volatility and global energy shifts.

- Continued weakness in chemicals, slow energy transition, and LNG market risks may undermine long-term profitability, while high shareholder payouts threaten future financial flexibility.

Catalysts

About Shell- Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

- Shell's significant and growing investment in LNG, highlighted by the start-up and ramp-up of LNG Canada and new projects in Egypt and Trinidad & Tobago, positions the company to benefit from steadily rising global energy demand and LNG's role as a transition fuel. This is likely to drive long-term top-line revenue growth and support future earnings as Shell's LNG portfolio expands and gains more trading flexibility in key markets.

- Sustained operational efficiencies-demonstrated by nearly $4 billion in structural cost reductions since 2022, targeted at process transformation rather than portfolio trimming-should continue to drive margin expansion and improve net earnings, especially as further simplification and AI/digitalization are rolled out organization-wide.

- Shell's aggressive high-grading of its portfolio (divestment of non-core assets in Chemicals, Retail, and Renewables, and targeted upstream investments in deepwater and LNG) is redirecting capital to higher-return assets and geographies, underpinning higher operating leverage and future ROIC, and paving the way for more robust and resilient free cash flow.

- The company's strong shareholder returns policy-reflected in ongoing multi-billion-dollar buyback programs and a commitment to distributing 40–50% of cash flow from operations-combined with a solid balance sheet, is set to underpin EPS growth and maintain investor appeal, even in the face of cyclical price downturns.

- Shell is structurally positioned to benefit from long-term underinvestment in global oil and gas supply, which could result in tighter commodity markets and higher pricing, supporting profitability in the upstream segment and cushioning revenue as energy security becomes a renewed priority in Europe and Asia amid ongoing geopolitical risks.

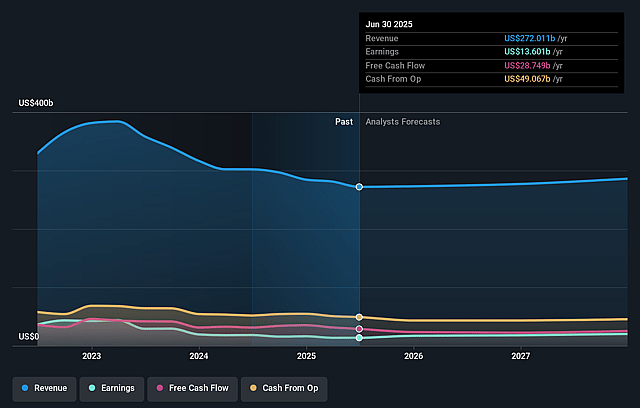

Shell Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shell's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.0% today to 6.9% in 3 years time.

- Analysts expect earnings to reach $19.9 billion (and earnings per share of $3.88) by about September 2028, up from $13.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $27.3 billion in earnings, and the most bearish expecting $14.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, down from 15.6x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 5.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Shell Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weak margins and sustained overcapacity in the Chemicals business, exacerbated by heavy supply from China and other regions, have resulted in negative free cash flow and required urgent cost and portfolio interventions, indicating a potential drag on segment profitability and group net margins over the long term.

- The company's continued reliance on oil and gas, with limited near-term detail on successful large-scale low-carbon or renewable energy transitions, exposes Shell to accelerating global decarbonization policies and shifts in energy demand, presenting long-term risks to revenue growth and asset value.

- Contract expiries and the loss of previously advantaged LNG supply contracts, paired with expectations for a more oversupplied LNG market, may limit price and margin upside, putting medium

- to long-term pressure on Integrated Gas revenues and net profit.

- Persistent underperformance or potential asset write-downs in loss-making assets such as Shell Polymers Monaca, divested (but not yet stabilized) sites, and non-core capital employed could result in lower returns on capital, further impacting group earnings and shareholder value.

- Heavy shareholder distributions via buybacks (~46% of cash flow from operations) sustained through balance sheet strength, may become less tenable if macro conditions worsen (e.g., falling oil prices, rising interest/lease costs), compromising funding flexibility and putting long-term dividend and buyback growth at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £30.324 for Shell based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £39.36, and the most bearish reporting a price target of just £27.06.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $286.9 billion, earnings will come to $19.9 billion, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of £26.94, the analyst price target of £30.32 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.