Key Takeaways

- Optimized capital allocation and project milestones in Stepnoy Leopard are poised to enhance future earnings and revenue growth.

- Extended agreements and increased efficiency reduce operating costs, improve margins, and sustain cash flows.

- Nostrum faces financial stability risks due to reliance on agreements, high debt levels, and uncertainties in project capital expenditure and licensing extensions.

Catalysts

About Nostrum Oil & Gas- Operates as an independent mixed-asset energy company in the pre-Caspian Basin.

- Nostrum achieved significant milestones in the Stepnoy Leopard project, leading to an estimated 138 million barrels of gross 2P reserves and an economic value of $220 million, potentially increasing future revenue.

- Approval for a phased full field development plan for Stepnoy Leopard was secured, allowing optimized capital allocation and targeting production start-up by late 2026 to early 2027, expected to boost future earnings.

- Extension of the processing agreement with Ural Oil & Gas until 2031, with a fixed processing fee structure, ensures sustainable cash flows and increases the utilization of Nostrum's processing facilities, likely enhancing net margins.

- Increased third-party processing volumes and improved cost control, resulting in a 41% reduction in operating expenses per barrel, support a more efficient operation and are expected to positively impact future EBITDA.

- Successful operational improvements, including a 48% year-over-year increase in titled production volumes and maintaining 98% processing facilities uptime, are expected to drive future revenue growth.

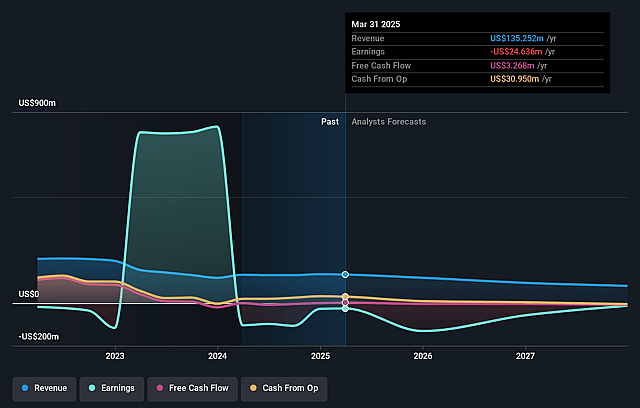

Nostrum Oil & Gas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nostrum Oil & Gas's revenue will decrease by 17.6% annually over the next 3 years.

- Analysts are not forecasting that Nostrum Oil & Gas will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Nostrum Oil & Gas's profit margin will increase from -18.2% to the average GB Oil and Gas industry of 10.3% in 3 years.

- If Nostrum Oil & Gas's profit margin were to converge on the industry average, you could expect earnings to reach $7.8 million (and earnings per share of $0.05) by about September 2028, up from $-24.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 1.6x on those 2028 earnings, up from -0.3x today. This future PE is lower than the current PE for the GB Oil and Gas industry at 11.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.94%, as per the Simply Wall St company report.

Nostrum Oil & Gas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on agreements with Ural Oil & Gas and uncertainties around volumes could impact revenue stability if volumes do not meet expectations or if the agreements are not sustained. This is a risk to future revenue projections.

- The transition to a fixed tolling fee structure with UOG leaves Nostrum exposed to limited pricing upside and could result in revenue variability despite changes in volume, impacting both revenues and net margins.

- Nostrum has a high level of net debt at $404.2 million, which increased from the previous year, indicating potential risks to financial stability and future earnings due to interest obligations and repayment pressures.

- The PSA license for the Chinarevskoye field will expire in 2031, and although there are plans to request an extension, any issues in obtaining it could result in an inability to leverage existing reserves and third-party processing facilities, impacting long-term revenue.

- Uncertainties in capital expenditure levels for projects like the Stepnoy Leopard field development and expansions in collaboration with UOG may lead to unforeseen financial strain and variability in future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £0.04 for Nostrum Oil & Gas based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $75.8 million, earnings will come to $7.8 million, and it would be trading on a PE ratio of 1.6x, assuming you use a discount rate of 12.9%.

- Given the current share price of £0.03, the analyst price target of £0.04 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.