Key Takeaways

- Consolidation of core assets, superior production efficiency, and minimal integration risk are set to enhance growth, cash flow stability, and profit margins.

- Strategic drilling and a strong North Sea gas position secure resilient revenues and sustained long-term demand despite wider industry challenges.

- Reliance on acquisitions and UK North Sea focus heighten exposure to regulatory, market, and operational risks, challenging long-term revenue stability and profitability amid global energy transition.

Catalysts

About Ithaca Energy- Engages in the development and production of oil and gas in the North Sea.

- Analysts broadly agree that the consolidation of core assets like Cygnus and Seagull will enhance scale and efficiency, but the scale of recent acquisitions combined with demonstrated high production efficiency and zero integration risk could drive materially higher medium-term production and EBITDA than expected, accelerating top-line growth and cash flow.

- Analyst consensus attributes production outperformance mainly to incremental efficiency gains, but the operational discipline underpinning perfect safety and production metrics-such as consistently industry-leading production efficiency and significant emissions reductions-implies sustainably lower OpEx and higher net margins through both cost leverage and regulatory capital access advantages.

- Ithaca's aggressive activity in infill drilling, rapid tieback development, and high-return infrastructure-led programs-demonstrated by faster-than-expected new well delivery and production ramp-suggests a self-funding growth platform capable of outpacing basin-wide decline rates, supporting multi-year volume growth and resilient revenue streams.

- The growing strategic value of North Sea gas as energy security pressures intensify in the UK/EU, along with Ithaca's advantaged asset base and large gas weighting, positions its future realised prices and margins to benefit disproportionately from supply tightening and policy-driven price floors.

- Slow adoption of alternatives in petrochemicals and heavy industry is establishing a durable long-term demand floor for Ithaca's barrels, providing visibility on stable or rising cash flows and dividends well into the next decade-even as major competitors face steeper declines or exit the basin.

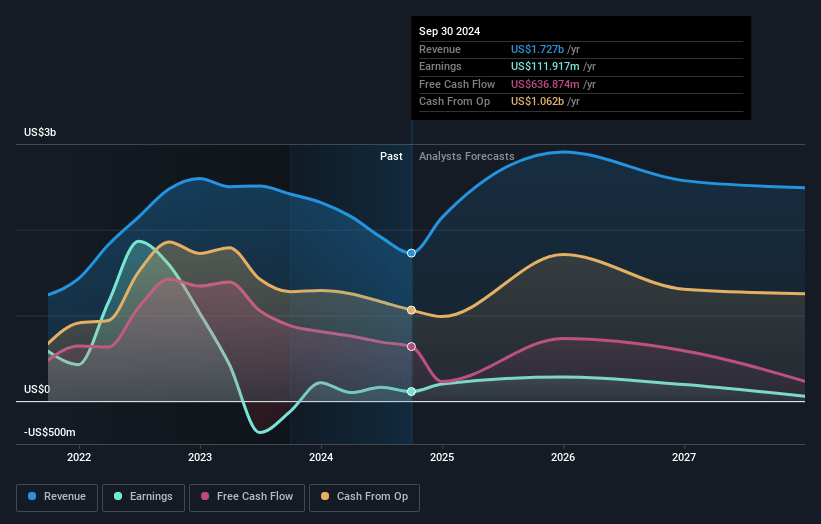

Ithaca Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ithaca Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ithaca Energy's revenue will grow by 9.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -6.7% today to 7.2% in 3 years time.

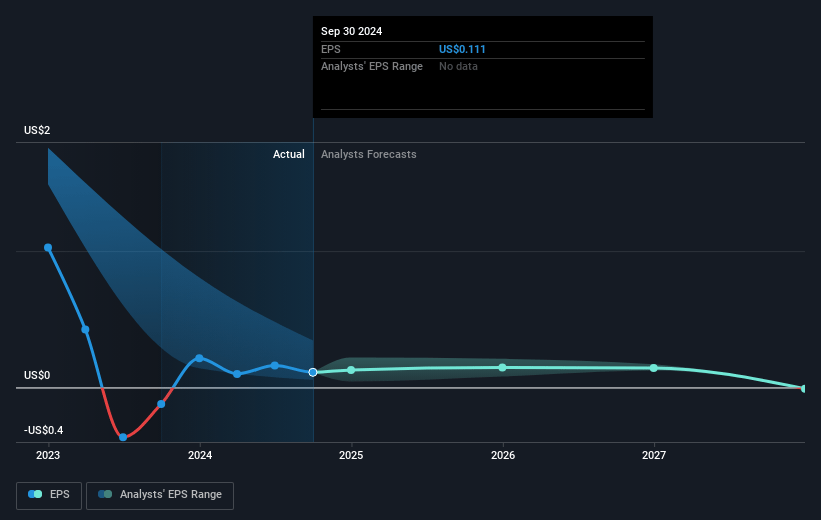

- The bullish analysts expect earnings to reach $206.5 million (and earnings per share of $0.21) by about July 2028, up from $-148.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.6x on those 2028 earnings, up from -24.8x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 9.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

Ithaca Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global energy transition and growing electrification, coupled with mounting ESG pressures and climate-focused regulation, are likely to reduce long-term oil and gas demand, resulting in a shrinking market opportunity for Ithaca and placing downward pressure on its future revenues and earnings.

- Ithaca's geographic concentration in the UK North Sea exposes the company to region-specific risks such as the UK's windfall taxes, maturing asset base, and the potential for tighter local environmental regulations, all of which could erode revenue stability and compress net margins over time.

- The company's continued reliance on acquisition-led growth to replenish reserves introduces balance sheet risk and the possibility of earnings dilution or underperformance if future acquisitions prove expensive, fail to yield expected synergies, or become difficult to integrate.

- As North Sea assets mature, Ithaca faces rising decommissioning liabilities, which will likely translate into significant future cash outflows, adversely impacting free cash flow generation and squeezing net margins in the long run.

- Long-term structural trends within the industry, such as the forecasted decline in global oil demand after peak levels and the increasing competition from well-funded national oil companies and diversified energy majors, threaten Ithaca's market share and could drive sustained weakness in revenues and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ithaca Energy is £2.02, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ithaca Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.02, and the most bearish reporting a price target of just £0.96.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $206.5 million, and it would be trading on a PE ratio of 32.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of £1.65, the bullish analyst price target of £2.02 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.