Key Takeaways

- Aggressive international expansion, major contract wins, and innovative proprietary technologies position Hunting for outsized, sustained revenue and profit growth well beyond current expectations.

- Strategic cost management, high-margin focus, and strong balance sheet enable value-accretive M&A, solidifying its role as a consolidator and tech leader in the energy sector.

- Heavy reliance on declining oil and gas markets, delayed energy transition, and competitive pressures threaten Hunting's revenue stability, margins, and long-term growth prospects.

Catalysts

About Hunting- Manufactures components, technology systems, and precision parts worldwide.

- Analyst consensus is that international expansion, especially via contracts with companies like Kuwait Oil Company, will drive significant revenue growth; however, the scale and pace at which Hunting is winning and successfully executing multi-year, mega-scale projects in the Middle East and globally could lead to an even sharper acceleration in revenue and order book growth, far exceeding current market expectations and creating step-changes in earnings power.

- While analysts broadly agree that cost efficiencies and restructuring will improve margins, the magnitude of margin uplift could be underestimated, as the company is not only cutting costs but also actively reallocating resources toward its highest-margin business lines and shedding structurally lower-return assets, paving the way for sustained double-digit EBITDA margin expansion and maximizing bottom-line leverage.

- Hunting's proprietary Organic Oil Recovery technology stands to revolutionize oil extraction with extremely high scalability, rapid global adoption, and unmatched operator economics, positioning this new product line to deliver exponential revenue and profit growth by the end of the decade and potentially becoming a dominant contributor to the group's earnings profile.

- The company's robust balance sheet strength and exceptional cash generation uniquely position it to act as a consolidator and technology leader in an industry facing capital constraints, opening the door to aggressive, value-accretive M&A activity and strategic investments that could turbocharge both top-line and bottom-line growth far beyond consensus models.

- Surging global energy demand-especially for electricity and natural gas-combined with Hunting's deep penetration into both emerging and established markets and its expansion in next-generation technology offerings (such as advanced subsea systems and decarbonization solutions), will drive persistent, high-quality revenue growth and increase resilience in cyclicality, thereby underpinning sustained upward re-ratings in both revenue and earnings multiples.

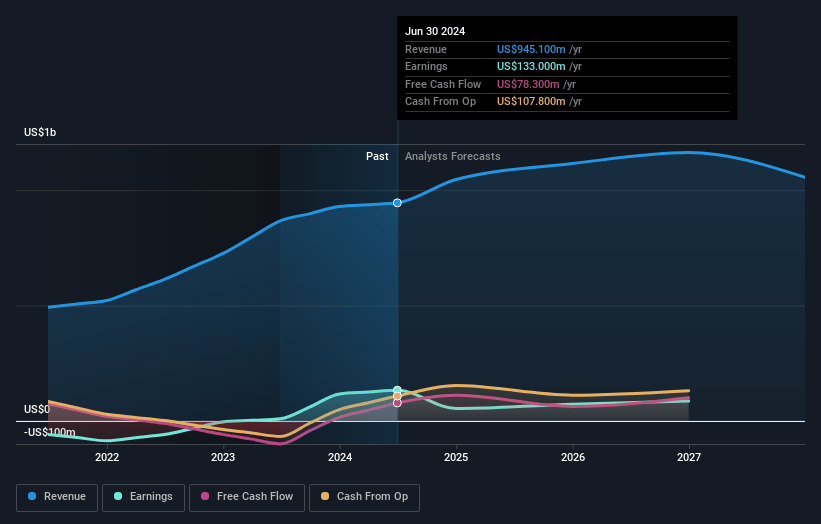

Hunting Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Hunting compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Hunting's revenue will grow by 9.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -2.7% today to 8.5% in 3 years time.

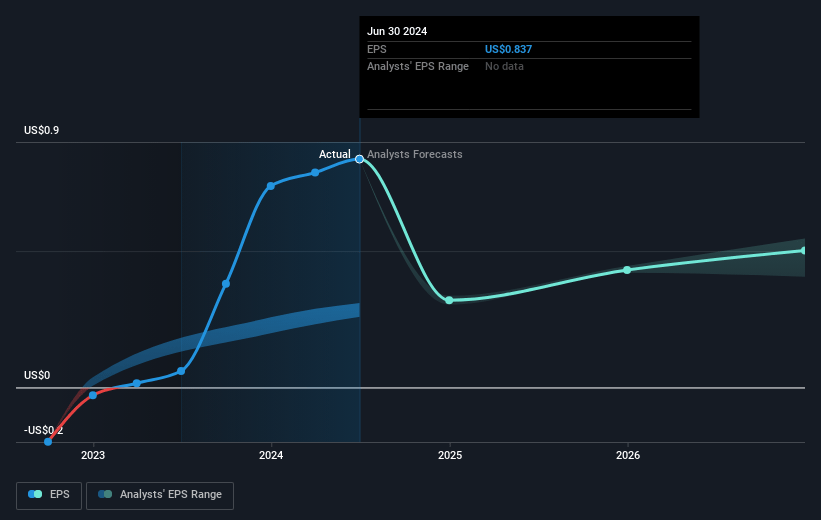

- The bullish analysts expect earnings to reach $116.4 million (and earnings per share of $0.74) by about July 2028, up from $-28.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, up from -23.8x today. This future PE is greater than the current PE for the GB Energy Services industry at 8.2x.

- Analysts expect the number of shares outstanding to decline by 1.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

Hunting Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Hunting's long-term revenue remains heavily reliant on oil and gas extraction equipment, a sector facing secular decline due to global decarbonization policies and the accelerating shift toward renewable energy, threatening revenue stability and long-term growth.

- Capital allocation and product development remain focused on legacy oilfield services such as OCTG and downhole equipment, increasing the risk of asset obsolescence and margin compression if the pace of the energy transition surpasses Hunting's pivot into emerging markets like geothermal or carbon capture, adversely impacting gross margins and earnings.

- High concentration in North American shale and traditional oil and gas markets leaves Hunting exposed to industry cyclicality and declining demand as energy consumption gradually shifts, creating ongoing volatility in revenues and net margins.

- With ESG investment trends pulling institutional capital away from fossil fuel-linked companies, Hunting faces potential reductions in access to funding and depressed valuation multiples, which may constrain its ability to finance growth initiatives and impact future earnings.

- Intensifying industry competition, including sector consolidation and the entrance of diversified energy conglomerates, raises the risk that Hunting could lose market share and pricing power, putting pressure on both revenue growth and operating margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Hunting is £6.04, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Hunting's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £6.04, and the most bearish reporting a price target of just £3.45.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $116.4 million, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 7.8%.

- Given the current share price of £3.14, the bullish analyst price target of £6.04 is 48.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.