Key Takeaways

- Strategic cloud initiatives and data service expansions are set to boost revenue and enhance customer data consumption.

- Operational efficiency enhancements and tech platform advancements could improve margins, increase licensing revenue, and strengthen market position.

- Leadership changes, competition, and industry consolidation threaten stability, revenue growth, and financial metrics, while high capital expenditure could pressure margins and cash flow.

Catalysts

About London Stock Exchange Group- Operates as a financial markets infrastructure and data provider primarily in the United Kingdom and internationally.

- LSEG is anticipated to experience revenue growth through strategic initiatives such as expanding its cloud-based data services in partnership with Microsoft, improving the distribution of data, and the addition of new datasets, which should drive greater data consumption and revenue.

- The company is expected to enhance its net margins by continuing to improve operational efficiency. This includes a strategic focus on increasing the ratio of permanent internal engineers to contractors, which should result in cost savings and improved operating leverage.

- The integration and enhancement of its Workspace platform with advanced features and new capabilities, such as Open Directory and generative AI tools, could lead to higher licensing revenues and increased customer retention, positively impacting overall earnings.

- LSEG plans to augment its Post Trade solutions, including those related to uncleared derivatives and partnerships with financial technology firms, which should foster structural growth in this division and spur increased revenues.

- The company's strategic focus on innovation, such as the development of new integrated end-to-end solutions and partnerships, is designed to optimize the trade life cycle and data value chain across financial markets, potentially leading to stronger earnings and increased market share.

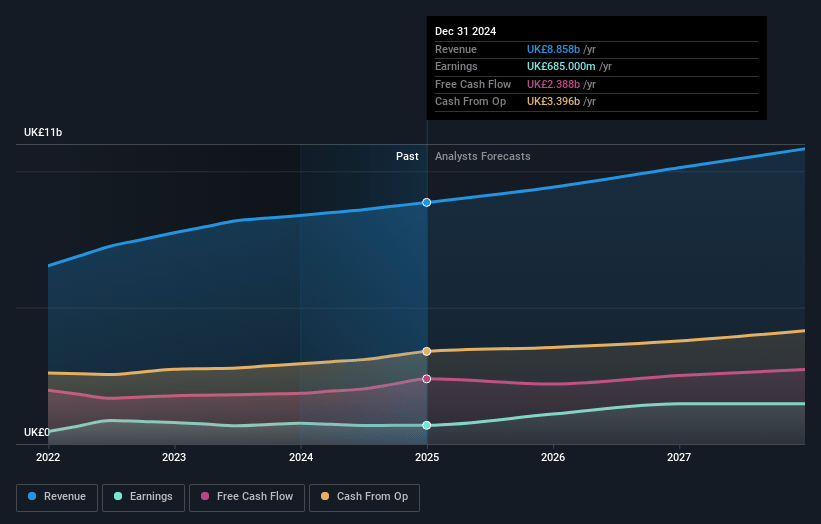

London Stock Exchange Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming London Stock Exchange Group's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.7% today to 15.1% in 3 years time.

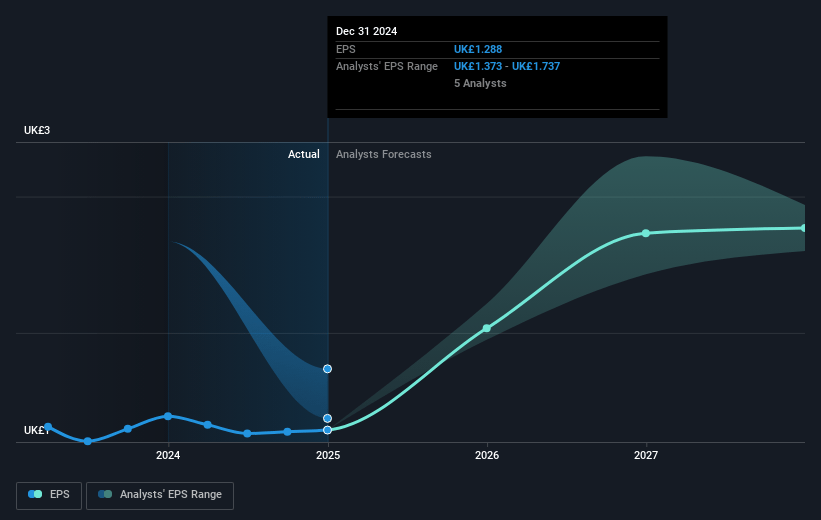

- Analysts expect earnings to reach £1.6 billion (and earnings per share of £3.24) by about July 2028, up from £685.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £2.2 billion in earnings, and the most bearish expecting £1.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.5x on those 2028 earnings, down from 79.7x today. This future PE is greater than the current PE for the GB Capital Markets industry at 13.4x.

- Analysts expect the number of shares outstanding to decline by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.59%, as per the Simply Wall St company report.

London Stock Exchange Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The departure of the Head of Data and fluctuations in senior management could lead to concerns about stability and continuity in leadership. This might impact strategic direction and execution within the Data & Analytics business, potentially affecting future revenues.

- Potential negative pricing pressure in data and desktop segments was mentioned, which could result from increased competition and impact revenue growth. Additionally, any contract losses, while not substantial, could have a cumulative effect on revenue.

- Headwinds from the consolidation of UBS and Credit Suisse might lead to contract cancellations or reductions, posing risks to the ASV metric and, consequently, impacting annual recurring revenue and overall revenue growth.

- Currency impact and refinancing activities might affect financial expenses, potentially decreasing net earnings if refinancing costs outweigh any benefits obtained from currency fluctuations.

- Capex intensity as a percentage of revenue is projected to remain relatively high, which, in the absence of matching revenue growth, could constrain net income margins and free cash flow in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £127.156 for London Stock Exchange Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £138.0, and the most bearish reporting a price target of just £112.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £10.5 billion, earnings will come to £1.6 billion, and it would be trading on a PE ratio of 53.5x, assuming you use a discount rate of 8.6%.

- Given the current share price of £103.75, the analyst price target of £127.16 is 18.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.