Key Takeaways

- Early investments in high-growth tech sectors and maturing portfolio companies set the stage for strong future cash generation and portfolio growth.

- Increased capital resources and a robust platform accelerate deal flow, portfolio exits, and long-term management fee growth.

- Reliance on concentrated investments, intense competition, slow fundraising, and macroeconomic pressures threaten Molten Ventures' capital returns, portfolio growth, and revenue stability.

Catalysts

About Molten Ventures- Molten Ventures Plc, formerly known as Draper Esprit plc, is a private equity and venture capital firm specializing in directly investing as well as investing in other funds.

- Strong forward pipeline for realizations, with a maturing core portfolio (including near-term IPO/acquisition candidates like Revolut, Ledger, Aircall, Typeform, and Soldo), suggests significant cash generation and uplift in net asset value (NAV) and earnings is likely as more exits crystallize over the next 2-4 years.

- Exposure to high-growth technology themes (AI, cloud, digital health, quantum, crypto, space tech), combined with early entry into winners, positions Molten to benefit from the continued acceleration of global digital transformation-fueling future portfolio growth, NAV uplift, and higher realized returns.

- Robust availability of dry powder (cash, undrawn credit facility, and third-party AUM), plus discipline in capital allocation and ongoing efforts to build larger capital pools, enhance Molten's ability to capitalize on new opportunities, drive AUM growth, and increase future management/advisory fee revenue.

- Growing depth and scale of the European technology ecosystem, combined with Molten's platform model (investment, operational support, and proprietary deal flow), should expand deal flow and support consistent long-term growth in investment deployment, valued unrealized gains, and exit opportunities.

- Expanding secondary market activities (easier liquidity for late-stage private assets and ability to monetize investments within 2-3 years) offer flexibility in portfolio management, contribute to NAV realization, and provide more consistent cash flow to support buybacks and earnings growth.

Molten Ventures Future Earnings and Revenue Growth

Assumptions

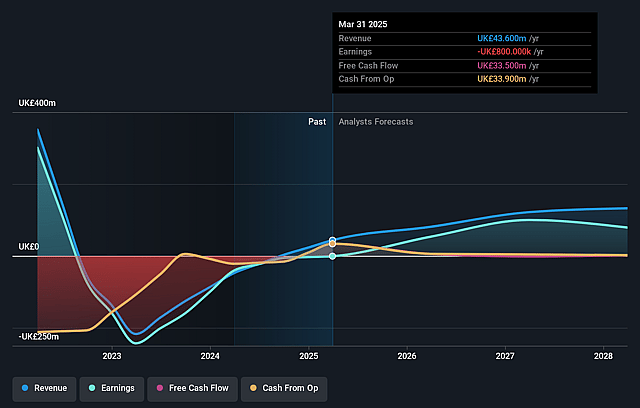

How have these above catalysts been quantified?- Analysts are assuming Molten Ventures's revenue will grow by 44.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.8% today to 59.5% in 3 years time.

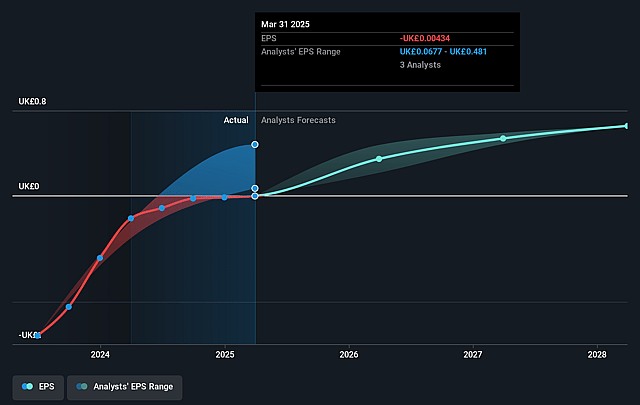

- Analysts expect earnings to reach £78.7 million (and earnings per share of £0.66) by about August 2028, up from £-800.0 thousand today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £120.5 million in earnings, and the most bearish expecting £37 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, up from -825.9x today. This future PE is greater than the current PE for the GB Capital Markets industry at 13.6x.

- Analysts expect the number of shares outstanding to decline by 2.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.7%, as per the Simply Wall St company report.

Molten Ventures Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent softness in technology sector public company multiples, combined with the uncertain appetite for tech IPOs, could limit lucrative exit opportunities for Molten Ventures' portfolio companies, negatively impacting their ability to return capital to shareholders and reducing realized revenue and earnings.

- Intense and ongoing competition for high-quality deals-particularly at the Series B and AI investment stages-could drive up entry valuations or cause Molten Ventures to miss out on the best opportunities, compressing net margins on exits and hindering long-term portfolio returns.

- The company's reliance on realizing value from a concentrated set of larger "core" investments (e.g., Revolut, Ledger, Aircall) increases its vulnerability to sector-specific downturns (such as fintech or crypto), potentially resulting in lumpy, volatile earnings and NAV growth if a few key portfolio companies underperform.

- The lack of near-term scaling in third-party fundraising for Series B institutional capital and the slow progress of new fund launches (such as Molten East) may constrain Molten Ventures' capital pool growth, thereby limiting its ability to capture larger, later-stage investment opportunities and impacting future revenue streams from management and performance fees.

- Continued adverse macroeconomic forces-such as FX headwinds, geopolitical instability, and the risk of further tightening in monetary policy-could pressure valuations across Molten's private and public portfolio companies, leading to valuation reductions, and directly depressing revenue, NAV, and ultimately the share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £5.572 for Molten Ventures based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £6.71, and the most bearish reporting a price target of just £4.59.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £132.3 million, earnings will come to £78.7 million, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 8.7%.

- Given the current share price of £3.61, the analyst price target of £5.57 is 35.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.