Key Takeaways

- Evolving traveler preferences and technological disadvantages threaten Hostelworld's ability to retain market share and drive sustainable revenue growth.

- Geographic, demographic, and regulatory pressures expose the business model to risks in profitability, cost structure, and market expansion.

- Growth in social-powered bookings, digital innovation, direct app usage, expanded inventory, and stronger balance sheet all support long-term earnings and market expansion.

Catalysts

About Hostelworld Group- Operates as an online travel agent focused on the hostel market in Europe, the United States of America, Asia, Africa, and Oceania.

- Increasing geopolitical instability, regulatory burdens, and the potential for climate-driven travel disruptions threaten to curtail international travel among price-sensitive, younger demographics-Hostelworld's core customer base-which could structurally limit long-term revenue growth and hinder recovery in average booking values as demand becomes more volatile.

- The accelerating global shift toward alternative accommodations, such as Airbnb and short-term rentals, continues to erode the traditional hostel market, exposing Hostelworld to secular declines in hostel bookings and undermining its ability to sustain or grow its core revenues as younger travelers increasingly favor these options.

- Reliance on a concentrated market segment-the hostel niche-combined with limited brand diversification leaves Hostelworld exposed to demographic headwinds in developed economies, such as stagnating or declining populations of young adults, which will constrain addressable market expansion and cap future earnings growth.

- Despite investments in digital and app-based features, the persistent technological gap between Hostelworld and larger OTAs like Booking.com and Expedia-who outspend on innovation, marketing, and distribution-risks further erosion of market share, limiting customer acquisition and compressing long-term net margins as competitive pressures intensify.

- Growing sustainability and ESG expectations are likely to drive higher compliance and operational costs for both Hostelworld and its hostel partners, resulting in industry-wide margin compression and potential price hikes that jeopardize Hostelworld's value proposition for budget-conscious travelers, ultimately impacting profitability and cash flow sustainability.

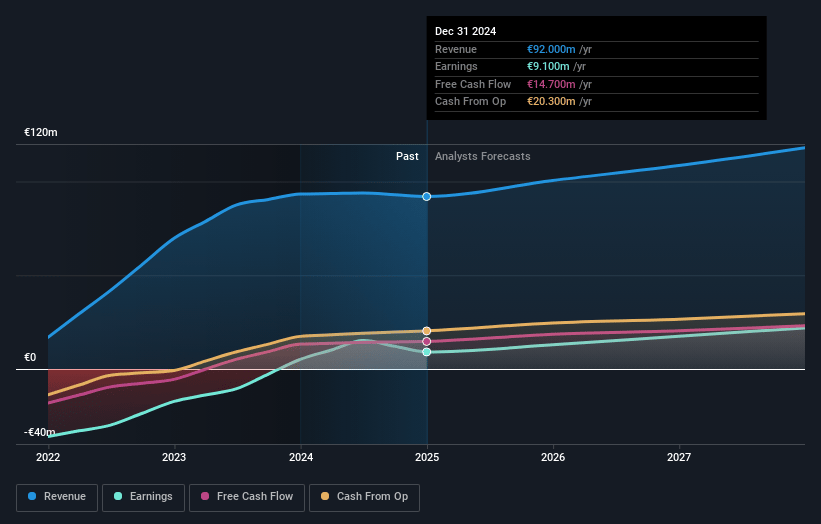

Hostelworld Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Hostelworld Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Hostelworld Group's revenue will grow by 10.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 9.9% today to 12.9% in 3 years time.

- The bearish analysts expect earnings to reach €15.9 million (and earnings per share of €0.14) by about July 2028, up from €9.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, down from 19.9x today. This future PE is lower than the current PE for the GB Hospitality industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.35%, as per the Simply Wall St company report.

Hostelworld Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong growth in Hostelworld's social-powered platform, with 80% of bookings now made by engaged social network members who book 2.2 times more frequently and show higher retention, is likely to drive recurring revenue expansion and support long-term earnings growth.

- The successful migration to a modern, fully cloud-native tech stack, along with ongoing investment in AI-driven social features and user experience enhancements, positions Hostelworld to benefit from digital adoption trends and can improve customer acquisition and margin expansion over time.

- Direct app bookings have increased 16% year-over-year and now account for 47% of the booking mix, which reduces Hostelworld's reliance on expensive third-party channels and leads to more efficient marketing, lowering acquisition costs and supporting improved net margins in the long run.

- Hostelworld's expanding inventory, rising market coverage (from 74% to 77%), and a robust pipeline of sustainable, certified hostels help broaden its addressable market, cater to evolving traveler preferences, and underpin future revenue growth potential across new and existing regions.

- The company has returned to a net cash position by repaying debt ahead of schedule and improving free cash conversion, creating a stronger balance sheet that enables reinvestment in growth initiatives, resilience against shocks, and the capacity to drive sustained earnings and margin improvements.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Hostelworld Group is £1.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Hostelworld Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.33, and the most bearish reporting a price target of just £1.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €122.9 million, earnings will come to €15.9 million, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 8.3%.

- Given the current share price of £1.27, the bearish analyst price target of £1.3 is 2.3% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.