Last Update 14 Dec 25

Fair value Decreased 0.82%CPG: Shares Will Benefit From Strengthened European Platform And Improved Returns Profile

Analysts have nudged their fair value estimate for Compass Group slightly lower to approximately $28.15 from about $28.38. This reflects a modestly higher discount rate, offset by stronger expected revenue growth and a higher future P/E multiple that support recent price target increases.

Analyst Commentary

Recent updates from major banks signal a generally constructive stance on Compass Group, with target price increases reflecting confidence in the company’s ability to sustain growth and enhance returns. However, the modest tweak to fair value also suggests that execution and valuation risks remain relevant for investors.

Bullish Takeaways

- Bullish analysts cite sustainably enhanced long term EBITA growth as a key driver supporting higher target prices and the potential for multiple expansion over time.

- The strengthened platform for European growth is viewed as a structural tailwind, underpinning expectations for above market revenue growth and improved operating leverage.

- An improved returns profile, including better capital allocation and margin discipline, is seen as not fully reflected in the current share price, creating scope for further re rating.

- Recent price target increases, including moves from JPMorgan and Goldman Sachs, reinforce the view that the upside case remains intact despite a slightly higher discount rate.

Bearish Takeaways

- Bearish analysts caution that a higher discount rate and already elevated valuation leave less room for error if growth or margin expansion falls short of expectations.

- The thesis around European growth and enhanced EBITA relies on continued flawless execution, raising concern that any operational missteps could quickly pressure the multiple.

- Some investors worry that optimistic assumptions about long term returns and platform strength may now be largely embedded in consensus forecasts, limiting incremental upside.

- There is also sensitivity to macroeconomic and cost inflation risks, which could compress margins and challenge the sustainability of the current growth narrative.

What's in the News

- Proposed final dividend increased to 43.3 cents per share for 2025, up from 39.1 cents in 2024, bringing the total annual dividend to 65.9 cents per share versus 59.8 cents previously, payable on 26 February 2026 to shareholders on the register as of 16 January 2026 (company announcement).

- New 2026 guidance targets underlying operating profit growth of around 10 percent in constant currency, supported by expected organic revenue growth of about 7 percent, indicating continued confidence in the medium term growth outlook (company guidance).

Valuation Changes

- Fair Value Estimate has edged down slightly to approximately $28.15 from about $28.38, reflecting a modestly more conservative valuation.

- Discount Rate has risen slightly to around 8.94 percent from roughly 8.84 percent, implying a marginally higher required return.

- Revenue Growth has increased modestly to about 7.57 percent from roughly 7.48 percent, indicating slightly stronger top line expectations.

- Net Profit Margin has decreased slightly to around 4.98 percent from about 5.07 percent, suggesting a marginally softer medium term profitability outlook.

- Future P/E has ticked up modestly to approximately 28.9x from around 28.3x, pointing to a small expansion in the assumed valuation multiple.

Key Takeaways

- Strategic focus on core markets and digital initiatives is expected to enhance organic revenue growth and improve future net margins.

- Acquisitions and expansion in underpenetrated regions provide long-term growth opportunities, supporting earnings and shareholder returns.

- Operational and financial challenges, including higher interest expenses and costs from sustainability initiatives, may pressure net margins and impact earnings.

Catalysts

About Compass Group- Provides food and support services in North America, Europe, Asia Pacific, and internationally.

- The strategic exit from noncore markets and continued investment in core markets through capabilities, CapEx, and M&A position Compass Group to drive higher net new business growth, likely enhancing future organic revenue growth.

- Increasing investment in digital initiatives and productivity, alongside achieving pre-pandemic unit margins, is expected to improve future net margins as scale grows and overhead leverage increases.

- Recent acquisitions, such as Dupont Restauration and 4Service, are expected to be accretive to profit from fiscal year '26 and beyond, boosting earnings growth through operational scale and synergies.

- The significant structural growth opportunity within the $320 billion addressable foodservices market, particularly in underpenetrated regions like Europe, offers long-term revenue growth potential as Compass expands its market share.

- A strong cash position supports ongoing shareholder returns, with flexibility for reinvestment into growth initiatives, possibly boosting future EPS through buybacks and dividend increases consistent with policy.

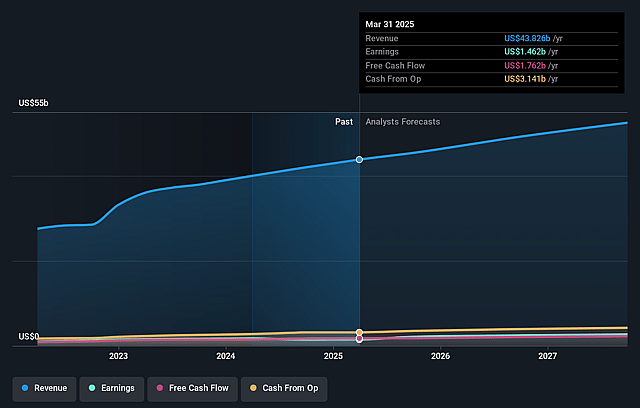

Compass Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Compass Group's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.3% today to 5.2% in 3 years time.

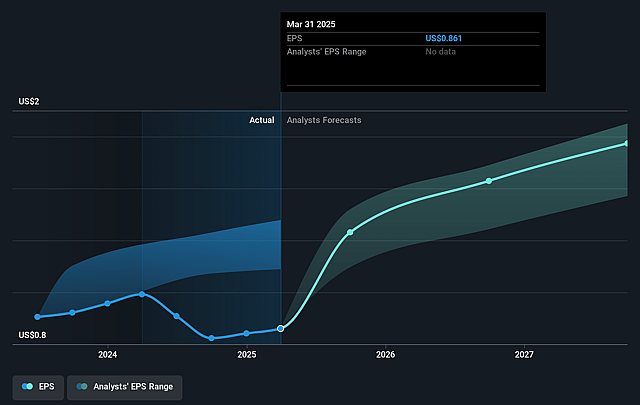

- Analysts expect earnings to reach $2.8 billion (and earnings per share of $1.67) by about September 2028, up from $1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, down from 39.4x today. This future PE is greater than the current PE for the GB Hospitality industry at 16.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.99%, as per the Simply Wall St company report.

Compass Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has seen an increase in interest expenses due to higher interest rates and debt, which could impact net margins and earnings in the near term.

- The disposal of noncore markets and recent acquisitions is expected to reduce profit by $30 million in fiscal year 2025, potentially impacting net earnings.

- The company's effective tax rate is relatively high at 25.5%, which could constrain net margins compared to companies with lower tax rates.

- Pricing trends are dependent on inflation rates, and while pricing is currently at 2% to 3%, any increase in inflation might squeeze profit margins if not passed on effectively.

- The company faces operational complexities due to allergens, dietary requirements, and sustainability initiatives, which could increase business costs and pressure net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £27.737 for Compass Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £30.76, and the most bearish reporting a price target of just £22.37.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $54.1 billion, earnings will come to $2.8 billion, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 9.0%.

- Given the current share price of £25.25, the analyst price target of £27.74 is 9.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Compass Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.