Last Update 31 Oct 25

Fair value Decreased 0.72%Analysts have slightly reduced their average price target for Marks and Spencer Group, lowering it by £0.03 to £4.16. They weigh recent execution risks and shifting momentum following both upgrades and downgrades from major firms.

Analyst Commentary

Recent Street research reveals a mix of bullish and bearish commentary on Marks and Spencer Group, reflecting both positive momentum and emerging concerns within the analyst community.

Bullish Takeaways

- Bullish analysts view the recent selloff as an attractive entry point. They believe it has created a favorable valuation relative to the company's long-term prospects.

- The business has shown good operational momentum, which contributes to increased confidence in its ability to drive growth moving forward.

- Some analysts have raised their price targets, citing improvements in business fundamentals and potential for upside based on emerging trends.

- Maintaining a Buy rating, certain experts continue to see room for share price appreciation despite recent market volatility.

Bearish Takeaways

- Bearish analysts are increasingly cautious about execution risk, particularly in the aftermath of the recent cyber disruption. This disruption could affect future performance.

- Several experts have either downgraded their ratings or lowered price targets, signaling a more reserved outlook on near-term returns.

- The shift in momentum following both upgrades and downgrades is seen as a sign that the shares may be trading closer to fair value, which dampens enthusiasm for further upside.

What's in the News

- Marks and Spencer Group will host an Analyst/Investor Day. This event will provide stakeholders with deeper insight into the company’s strategy and forward outlook (Key Developments).

Valuation Changes

- Fair Value Estimate: Slightly decreased from £4.19 to £4.16.

- Discount Rate: Marginally reduced from 7.59% to 7.51%.

- Revenue Growth: Increased from 4.13% to 4.49%.

- Net Profit Margin: Increased from 4.65% to 4.69%.

- Future P/E Ratio: Decreased from 14.37x to 13.96x.

Key Takeaways

- Strategic store expansion and digital investment could boost revenue through improved retail presence and increased online sales.

- Supply chain modernization and cost reduction efforts aim to enhance net margins and overall earnings.

- Significant challenges across international segments, digital investment pressures, and delayed infrastructure upgrades may hinder profitability and margin growth.

Catalysts

About Marks and Spencer Group- Operates various retail stores.

- Marks & Spencer’s focus on store rotation and acquiring new sites in high-growth locations indicates a future increase in revenue potential from improved retail presence and customer reach.

- The strategic investment in digital and technology initiatives is expected to enhance the online shopping experience, increasing digital sales and potentially raising overall revenue from the online segment.

- The company's plan to modernize its supply chain aims to create lower-cost and faster operations, which could enhance net margins through increased efficiency and reduced operational costs.

- Ongoing international business resets and leadership strengthening are expected to stabilize overseas performance, potentially reversing current declines and contributing to future revenue growth.

- The structural cost reduction program targeting £500 million savings by FY '28 should lower operational expenses, thereby improving net margins and enhancing overall earnings.

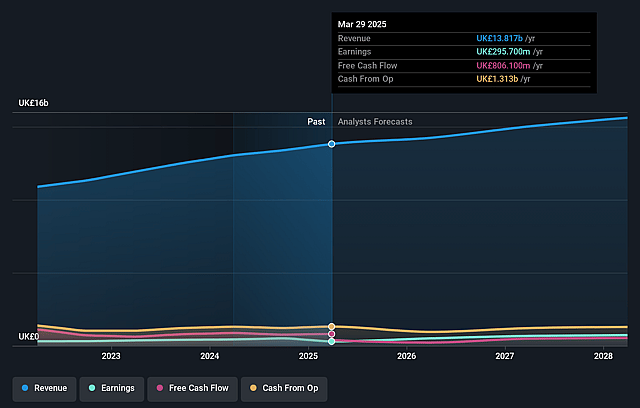

Marks and Spencer Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Marks and Spencer Group's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 4.6% in 3 years time.

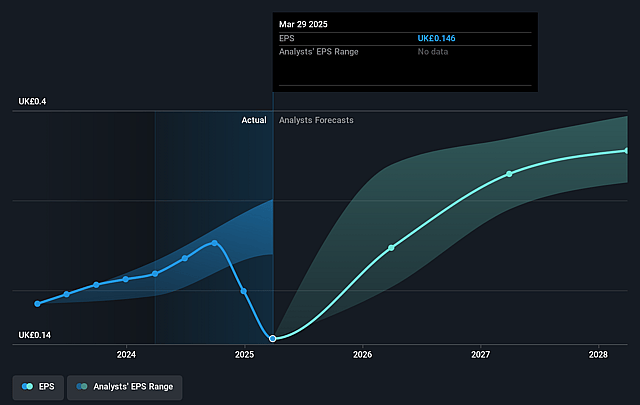

- Analysts expect earnings to reach £725.2 million (and earnings per share of £0.36) by about September 2028, up from £295.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, down from 22.9x today. This future PE is lower than the current PE for the GB Consumer Retailing industry at 16.8x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Marks and Spencer Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The International business showed a disappointing performance, with sales down 10% and a reduced operating profit margin, which could negatively impact global revenues and margin growth.

- The Clothing & Home segment experienced increased operating costs as a percentage of sales due to lower online margins, which could pressure overall earnings despite store margin gains.

- The reset actions in International and increased investment requirements to improve digital and technology infrastructure suggest continued higher expenses, potentially impacting net margins.

- Ocado Retail, while showing growth, continues to operate at a loss, constraining overall group profitability and indicating risks to future earnings from this partnership.

- Store rotation and infrastructure upgrades have not progressed as quickly as planned, which may prolong cost pressures and affect potential returns on capital, impacting future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £4.187 for Marks and Spencer Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.62, and the most bearish reporting a price target of just £3.42.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £15.6 billion, earnings will come to £725.2 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of £3.36, the analyst price target of £4.19 is 19.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.