Key Takeaways

- Rising protectionism, decarbonization costs, and shifting propulsion technologies threaten margins, cash flow, and relevance despite optimistic demand expectations.

- Heavy reliance on major aerospace customers and fragile supply chains heighten risks to revenue growth, production stability, and Melrose's long-term targets.

- Strategic focus on advanced aerospace technologies, high-margin services, and operational improvements is driving recurring revenue growth, profit stability, and enhanced resilience through market diversification.

Catalysts

About Melrose Industries- Designs and delivers aerospace components and systems for civil and defence markets in the United Kingdom, rest of Europe, North America, and internationally.

- The anticipated acceleration in global protectionism and reshoring poses a threat to Melrose's international supply chains, which could disrupt component availability, increase production costs, and limit access to overseas customers, thereby putting long-term revenue growth at risk and eroding net margins even as current industry commentary remains optimistic about demand ramp-up.

- The energy transition and regulatory push for decarbonization are likely to drive materially higher compliance costs and require higher capital expenditures for Melrose to meet emissions and sustainability standards, which would pressure free cash flow generation and hamper future net margin expansion, despite management's commitment to operational efficiency and higher margins.

- The emergence of new propulsion technologies such as electric and hydrogen aircraft threatens to make Melrose's existing product portfolio less relevant, potentially requiring unplanned and significant research and development investments that dilute returns and risk negative earnings growth if next-generation engine programs do not see timely or profitable adoption.

- Revenue concentration in a handful of global aerospace OEMs creates ongoing sensitivity to customer-driven production cuts, as well as risks from vertical integration by major customers, which could undermine both the ability to realize expected revenue growth and the negotiating leverage needed to sustain high net margins, regardless of Melrose's internal restructuring plans.

- Persistent industry supply chain fragility and critical material shortages, which have already led to production delays and muted volume growth, show limited signs of near-term resolution; this could constrain anticipated future build-rate increases from Airbus and Boeing, cause unpredictable working capital requirements, and ultimately inhibit Melrose's ability to meet its aggressive five-year revenue and margin targets.

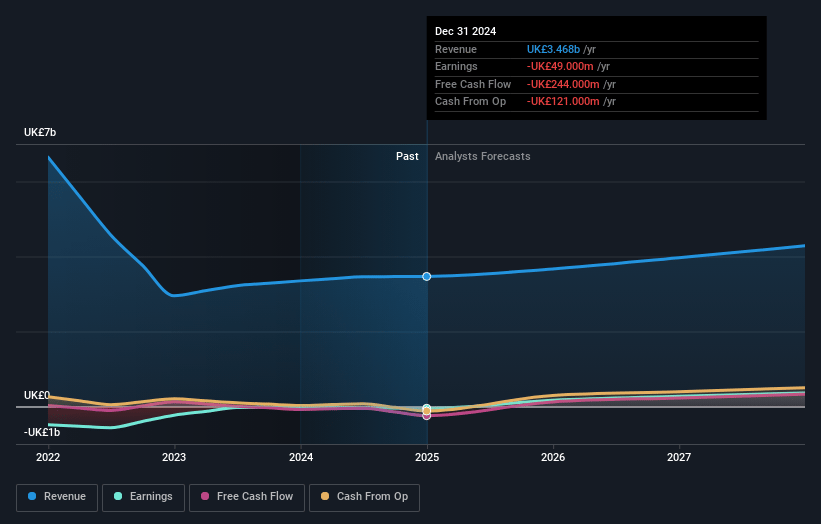

Melrose Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Melrose Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Melrose Industries's revenue will grow by 5.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -1.4% today to 8.4% in 3 years time.

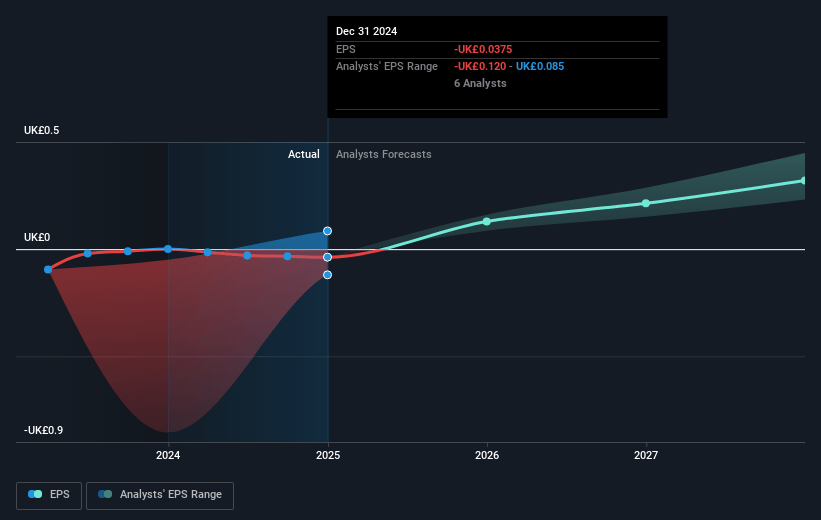

- The bearish analysts expect earnings to reach £343.3 million (and earnings per share of £0.27) by about July 2028, up from £-49.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.9x on those 2028 earnings, up from -135.2x today. This future PE is lower than the current PE for the GB Aerospace & Defense industry at 28.9x.

- Analysts expect the number of shares outstanding to decline by 2.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.03%, as per the Simply Wall St company report.

Melrose Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is poised to benefit from long-term structural growth in global air travel and defense spending, with record civil and defense order backlogs supporting higher production rates and increased demand for Melrose's components, which may drive sustained revenue and earnings growth.

- Melrose's strong focus on technologically advanced, high-margin aftermarket services and variable consideration from long-duration engine contracts positions it to generate recurring revenue, improving profit stability and supporting expanding margins and cash flows over the long term.

- Significant ongoing investment in additive manufacturing, lightweight materials, and next-generation aerospace solutions has already produced strategic wins with major OEMs and is likely to secure further share in future aircraft programs, which could boost revenue growth and technological relevance.

- The company's transformation initiatives including portfolio rationalization, cost optimization, and margin enhancement have resulted in substantial profit and EPS growth, with management guiding to further margin expansion and free cash flow inflection, supporting positive long-term earnings per share momentum.

- Exposure to defense platforms (such as the Gripen and F-35) and new contract wins in both military and commercial aerospace provide resilience against civil aerospace cyclicality, diversifying revenue streams and potentially offering upside to earnings in periods of geopolitical tension or increased defense budgets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Melrose Industries is £3.91, which represents two standard deviations below the consensus price target of £6.42. This valuation is based on what can be assumed as the expectations of Melrose Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £8.25, and the most bearish reporting a price target of just £3.9.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £4.1 billion, earnings will come to £343.3 million, and it would be trading on a PE ratio of 16.9x, assuming you use a discount rate of 8.0%.

- Given the current share price of £5.21, the bearish analyst price target of £3.91 is 33.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.