Last Update 16 Dec 25

Fair value Increased 1.16%DPLM: Upgraded Rating Will Support Resilient Growth Narrative And Fair Valuation

Analysts have nudged their blended price target for Diploma modestly higher, reflecting a slightly richer fair value of about £59.02 per share. This is underpinned by an increased GBP 6,200 Street target and growing conviction that the company offers resilient, above market growth with improving profit margins.

Analyst Commentary

Bullish analysts highlight that the incremental lift in the price target underscores growing confidence in Diploma's ability to sustain premium growth rates and execute consistently across its core end markets. The latest target move is viewed as validation that recent performance trends justify a higher valuation multiple versus sector peers.

They also note that the shift from a more cautious stance to a positive rating reflects a reassessment of Diploma as one of the more dependable growth stories in the current market backdrop, with a business mix that is less vulnerable to cyclical swings than many industrial names.

As a result, the modestly increased target price is seen as capturing both the company’s operational momentum and scope for further upside if management continues to deliver on its strategic and margin expansion plans.

Bullish Takeaways

- Recent upgrades and target increases signal rising conviction that Diploma can sustain above-market, mid to high single digit organic growth, supporting a premium valuation multiple.

- The view of Diploma as one of the safest growth names in its group underpins the argument that earnings quality and visibility justify a higher fair value per share.

- Analysts see the improved margin trajectory and disciplined capital allocation as key drivers of upside to both earnings forecasts and free cash flow generation.

- Re-rating from a more cautious stance to an Outperform view suggests that execution risk is perceived to be lower than previously thought, reducing the discount investors may apply for uncertainty.

Bearish Takeaways

- Bearish analysts caution that even with the revised target, much of the anticipated growth and margin improvement may already be reflected in the share price, limiting near-term upside.

- The premium rating versus peers leaves little room for disappointment if volume growth slows or integration of bolt-on acquisitions proves more challenging than expected.

- Any deterioration in end-market demand or supply chain conditions could pressure the elevated expectations embedded in current forecasts and valuations.

- There is ongoing concern that, with limited value opportunities elsewhere in the group, investors may be over-relying on Diploma as a defensive growth name, increasing the risk of a sharper de-rating if sentiment turns.

Valuation Changes

- Fair Value was nudged higher from approximately £58.34 to about £59.02 per share, indicating a modest uplift in the intrinsic valuation.

- The Discount Rate edged up slightly from around 8.23 percent to about 8.25 percent, reflecting a marginally higher required return.

- Revenue Growth was revised down modestly from roughly 6.56 percent to about 6.35 percent, implying slightly more conservative top line expectations.

- The Net Profit Margin increased from approximately 12.98 percent to about 13.51 percent, signaling an improved outlook for profitability.

- The Future P/E eased from around 41.39 times to roughly 40.48 times earnings, suggesting a small compression in the forward valuation multiple.

Key Takeaways

- Recent acquisitions and operational upgrades enable Diploma to drive revenue synergies, scale efficiencies, and organic margin expansion in high-growth specialist markets.

- Sustained demand in key end markets and a strong pipeline for bolt-on acquisitions support long-term revenue growth, market share gains, and robust earnings momentum.

- Operational risks from acquisitions, market exposure, and industry shifts may constrain growth, compress margins, and create volatility in Diploma's future performance.

Catalysts

About Diploma- Supplies specialized technical products and services in the United Kingdom, Europe, North America, and internationally.

- Continued integration and cross-selling potential from recent acquisitions (Haagensen and Alfa Laboratories) provide increased exposure to high-growth life sciences and sealing solutions markets, positioning Diploma to capture revenue synergies and drive future organic growth-supporting both revenue and margin expansion.

- Positive momentum in end markets such as aerospace, defense, data centers, and industrial automation-driven by growth in automation, digital infrastructure, and compliance requirements-suggests ongoing robust demand for specialized controls and technical products, underpinning medium-to-long-term revenue growth.

- The company's investments in facility upgrades and operational integration (e.g. consolidating Haagensen into a new state-of-the-art M Seals facility) create opportunities for cost synergies, operational efficiencies, and enhanced scalability, likely to contribute to sustainable margin improvement.

- Strength in the North American Seals business and recovering trends in European end-markets (industrial PMIs) highlight Diploma's ability to benefit from supply chain regionalization and onshoring, which can support revenue stability and market share gains.

- A strong and growing pipeline for disciplined bolt-on acquisitions, along with a track record of integrating and scaling new businesses in fragmented markets, provides visibility on sustained inorganic growth and operating leverage, indicating continued upward momentum in earnings and cash flow conversion.

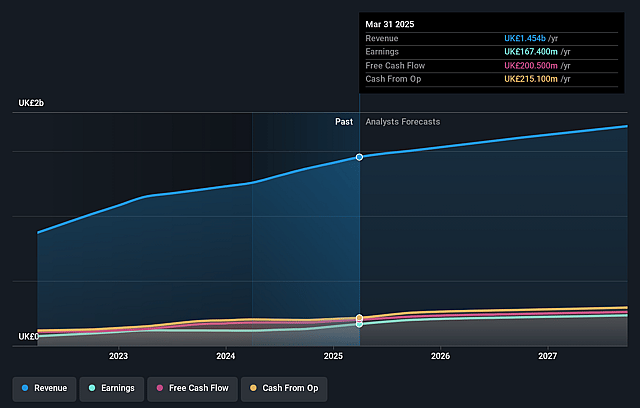

Diploma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Diploma's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.5% today to 13.4% in 3 years time.

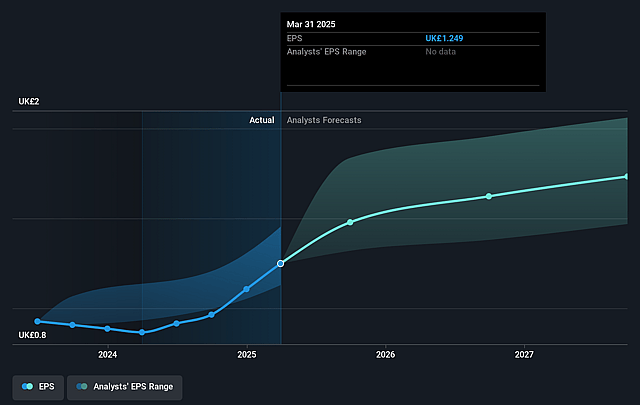

- Analysts expect earnings to reach £233.8 million (and earnings per share of £1.73) by about September 2028, up from £167.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £280.3 million in earnings, and the most bearish expecting £196.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.9x on those 2028 earnings, down from 42.8x today. This future PE is greater than the current PE for the GB Trade Distributors industry at 15.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

Diploma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing integration challenges from recent and future acquisitions could lead to operational inefficiencies, higher costs, and distraction from core business execution, potentially impacting net margins and earnings in the long term.

- A slowdown or uncertainty in the broader M&A market may make it more difficult for Diploma to sustain its historic growth rates through bolt-on acquisitions, thereby limiting inorganic revenue growth opportunities.

- Overexposure to cyclical industrial end-markets, including the currently tough UK Seals market and a normalizing aerospace sector, makes Diploma vulnerable to economic downturns, leading to potential volatility in revenue and earnings.

- Commoditization and increased digitalization in industrial distribution encourage manufacturers to pursue more direct-to-customer models or use digital procurement platforms, potentially eroding Diploma's intermediary role and squeezing gross margins and revenue.

- Fluctuating input costs (such as copper) and the reliance on pass-through pricing may expose Diploma to margin compression if cost increases cannot be fully or promptly passed on to customers, affecting profitability in periods of volatility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £53.992 for Diploma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £61.5, and the most bearish reporting a price target of just £44.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £1.7 billion, earnings will come to £233.8 million, and it would be trading on a PE ratio of 38.9x, assuming you use a discount rate of 8.2%.

- Given the current share price of £53.4, the analyst price target of £53.99 is 1.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Diploma?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.