Catalysts

About Velocity Composites

Velocity Composites provides advanced engineered kits and supply chain management services for aerospace composite structures, helping major OEMs and Tier 1s improve efficiency and reduce waste.

What are the underlying business or industry changes driving this perspective?

- Imminent production rate increases on key widebody and narrowbody aircraft platforms, such as the A350 and 737 families, are expected to translate directly into higher throughput across existing contracts, supporting sustained revenue growth and operating leverage.

- Expanding presence in the U.S. with a fully commissioned freezer farm and proven delivery and quality KPIs positions the company as a preferred partner for new civil and aeroengine work. This supports incremental contract wins and higher earnings from a largely fixed cost base.

- A strategic shift toward a greater mix of long-duration defense programs in North America and Europe is set to diversify end markets, improve visibility and stabilize cash flows, underpinning higher medium term margins.

- Ongoing deployment of its Odoo based digital platform and data driven process controls is lifting labor and material efficiency. This is expected to structurally raise gross margins toward the upper end of management’s 25 to 30 percent target range and expand net margins over time.

- Rising industry wide adoption of outsourced composite kit preparation and inventory management, driven by OEM and Tier 1 capacity constraints, plays directly into Velocity’s hub and spoke and local supply model. This supports a growing pipeline of high margin contracts and stronger long term earnings.

Assumptions

This narrative explores a more optimistic perspective on Velocity Composites compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

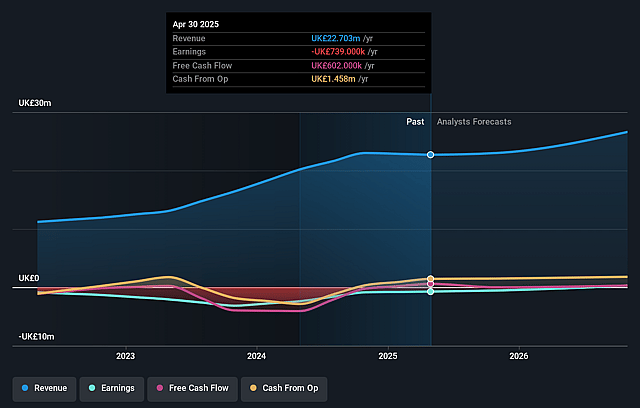

- The bullish analysts are assuming Velocity Composites's revenue will decrease by 9.4% annually over the next 3 years.

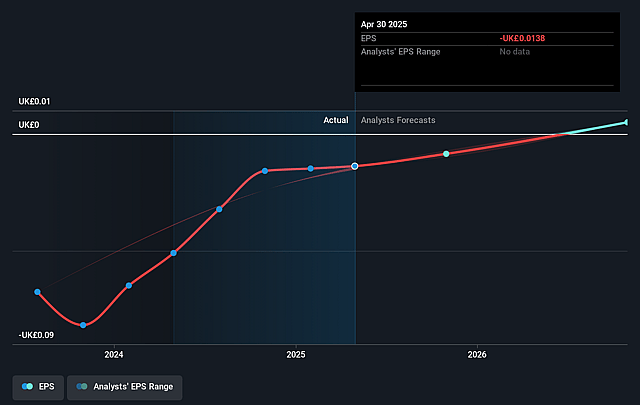

- The bullish analysts are not forecasting that Velocity Composites will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Velocity Composites's profit margin will increase from -3.3% to the average GB Aerospace & Defense industry of 7.6% in 3 years.

- If Velocity Composites's profit margin were to converge on the industry average, you could expect earnings to reach £1.3 million (and earnings per share of £0.02) by about December 2028, up from £-739.0 thousand today.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 33.3x on those 2028 earnings, up from -10.9x today. This future PE is greater than the current PE for the GB Aerospace & Defense industry at 23.4x.

- The bullish analysts expect the number of shares outstanding to grow by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.55%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Aircraft build rates on key platforms such as the A350 and 737 may once again be delayed or constrained by OEM specific issues, regulatory investigations or the protracted separation of Spirit facilities. This would keep aircraft production structurally below pre pandemic levels for longer and suppress Velocity Composites revenue growth and operating leverage over the medium term, limiting earnings expansion.

- The business remains heavily exposed to a small number of large aerospace customers and programs, including specific engine variants like those on the 787. Any program specific safety issue, redesign or cancellation could remove a meaningful proportion of group activity and create a sharp, program driven drop in revenue and gross margins.

- Management is relying on sustained margin improvement from operational efficiencies, Odoo enabled process control and labor productivity. If wage inflation, energy costs or underutilized capacity in the U.K. and U.S. persist, the company may struggle to maintain its targeted 25 to 30 percent gross margin range, leading to weaker net margins and constrained cash generation.

- The strategy assumes a steady ramp in large new U.S. and European contracts and a long term rebalance toward defense. Continued onboarding delays, stringent aeroengine qualification requirements and slow decision cycles on major defense programs could leave the sales funnel under converting and result in flat or only modestly higher revenues, limiting future earnings growth and returns on capital.

- Although current cash resources and the invoice discounting facility provide short term headroom, the combination of ongoing CBILS loan repayments, lease liabilities for long term assets like the U.S. freezer farm and any unexpected working capital spikes during ramp ups could strain liquidity and force dilutive equity raises or additional borrowing, putting pressure on net margins and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Velocity Composites is £0.6, which represents up to two standard deviations above the consensus price target of £0.5. This valuation is based on what can be assumed as the expectations of Velocity Composites's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.6, and the most bearish reporting a price target of just £0.4.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be £16.9 million, earnings will come to £1.3 million, and it would be trading on a PE ratio of 33.3x, assuming you use a discount rate of 8.5%.

- Given the current share price of £0.15, the analyst price target of £0.6 is 75.4% higher. Despite analysts expecting the underlying business to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Velocity Composites?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.