Key Takeaways

- Disruptive clinical platforms and a strong pipeline position Innate for accelerated market capture, higher valuation, and potential major partnerships or acquisition interest.

- Innovative technology, regulatory momentum, and operational efficiency enable sustained margin expansion and resilience against funding challenges, supporting long-term earnings growth.

- Heavy reliance on partnerships, limited proprietary assets, financial constraints, and intense competition create significant risks to long-term revenue growth and investor confidence.

Catalysts

About Innate Pharma- Operates as a biotechnology company that develops immunotherapies for cancer patients in France and internationally.

- Analyst consensus expects recently launched clinical trials for IPH65 and IPH45 to merely broaden future revenue streams, but these platforms have the potential to disrupt current standards of care in both oncology and autoimmune diseases, which could drive a step-change in the company's top line and significantly accelerate market capture compared to expectations.

- While analysts broadly highlight the FDA breakthrough therapy designation and ongoing partnership talks for lacutamab as accelerating revenue, the consistent improvement of long-term clinical data-coupled with regulatory momentum and possible best-in-class positioning-suggests a much higher valuation for accelerated approval, royalty rates, and licensing deals, directly impacting both revenue and near-term earnings power.

- Innate is uniquely positioned to capitalize on the rising global incidence of cancer and the surge in personalized immuno-oncology, potentially making its diverse, first-in-class pipeline a target for multiple large-scale partnerships or outright acquisition, which could unlock substantial upfront payments and long-term revenue streams far above current assumptions.

- The proprietary ANKET platform's modular "plug-and-play" technology, which allows rapid targeting of new tumor and autoimmune indications as new biomarkers are discovered, gives Innate the ability to scale its pipeline efficiently as the companion diagnostics field grows, ultimately leading to higher R&D productivity and sustained margin expansion.

- Having recently secured €50 million from Sanofi and maintaining operational efficiency, Innate is well placed to weather industry-wide funding headwinds, allowing it to strategically invest in high-value programs and reach multiple value inflection points without significant dilution, thereby supporting strong future earnings and cash flow leverage.

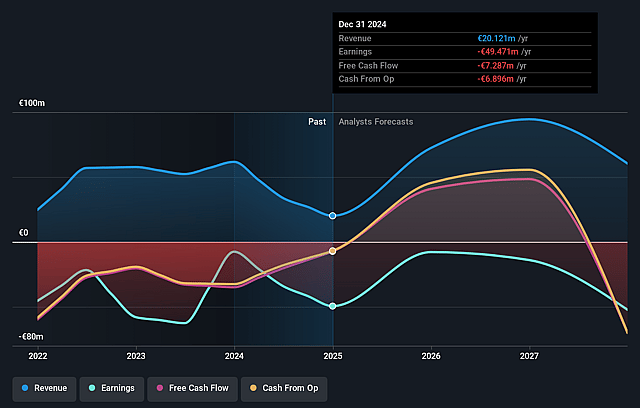

Innate Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Innate Pharma compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Innate Pharma's revenue will grow by 89.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -245.9% today to 5.3% in 3 years time.

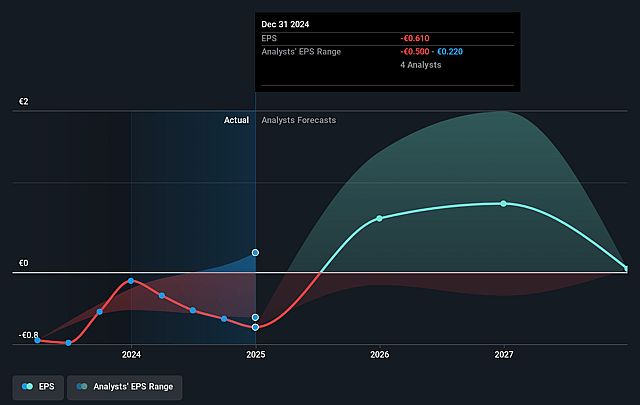

- The bullish analysts expect earnings to reach €7.2 million (and earnings per share of €0.06) by about September 2028, up from €-49.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 95.0x on those 2028 earnings, up from -3.3x today. This future PE is greater than the current PE for the GB Biotechs industry at 14.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.19%, as per the Simply Wall St company report.

Innate Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Innate Pharma's dependency on milestone and partnership revenue, especially from AstraZeneca and Sanofi, exposes it to significant revenue risk if any partnered program is deprioritized, delayed, or discontinued, which could sharply reduce topline growth.

- Persistent operating losses and a cash runway currently projected only through to mid-2026 heighten dilution risk for shareholders, as further capital raises would suppress net margins and earnings per share over the long term.

- The company's limited proprietary pipeline, as demonstrated by the need to reassess and potentially re-invest in assets like IPH6101 recently returned by Sanofi, increases the risk that setbacks in any single clinical program could erode future revenues and weaken investor confidence.

- Intensifying pricing pressure from healthcare payers and governments globally, combined with the narrow indications of some lead late-stage assets, may restrict the ability to secure premium pricing and sustained revenue growth upon commercialization.

- Growing competition from both large pharma firms with broader resources in oncology and innovative new approaches such as CAR-T and next-generation immunotherapies may reduce Innate Pharma's market share and hinder the commercial potential of its NK cell-focused pipeline, negatively affecting long-term revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Innate Pharma is €6.2, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Innate Pharma's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €6.2, and the most bearish reporting a price target of just €2.49.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €136.3 million, earnings will come to €7.2 million, and it would be trading on a PE ratio of 95.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of €1.78, the bullish analyst price target of €6.2 is 71.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.