Key Takeaways

- Dependence on milestone payments and uncertain product approvals causes earnings volatility and risks reliable long-term growth.

- Intensifying pricing pressures and lack of significant commercial revenues threaten margins and may necessitate equity dilution or costly financing.

- Heavy dependence on external partnerships and funding, combined with pipeline concentration and rising competition, increases financial uncertainty and risks to future revenue and earnings growth.

Catalysts

About Innate Pharma- Operates as a biotechnology company that develops immunotherapies for cancer patients in France and internationally.

- Although the addressable market for innovative immuno-oncology drugs is expanding due to the rising global incidence of cancer and growing demand for targeted biologics, Innate Pharma faces significant challenges from intensifying global pricing pressures and cost containment efforts, which are likely to constrain future revenue growth and compress net margins even if new products are approved.

- While the company's robust clinical pipeline with multiple proprietary and partnered assets could, in theory, increase future product launches and bolster long-term earnings, the heavy reliance on milestone and partnership payments introduces cash flow volatility and uncertainty around revenue timing-hindering reliable earnings visibility and putting pressure on sustainable operating expenses.

- Despite regulatory designations such as FDA breakthrough and fast track status potentially accelerating development timelines for lacutamab, increasing regulatory scrutiny and the risk of delayed drug approvals across major markets may prolong R&D expense cycles and push back commercialization, negatively impacting both near-term and long-term earnings potential.

- Although international partnerships such as those with Sanofi and AstraZeneca provide some risk-sharing and non-dilutive capital, persistent negative net margins and a lack of meaningful commercial revenues from any product may eventually force equity dilution or unfavorable financing options, directly weighing on long-term EPS growth.

- While continued advances in biologics manufacturing could theoretically support better gross margins as products approach commercialization, Innate Pharma's concentrated late-stage pipeline raises the risk that clinical failure in any major asset would lead to sharp downgrades in revenue projections and threaten the long-term financial sustainability of the business.

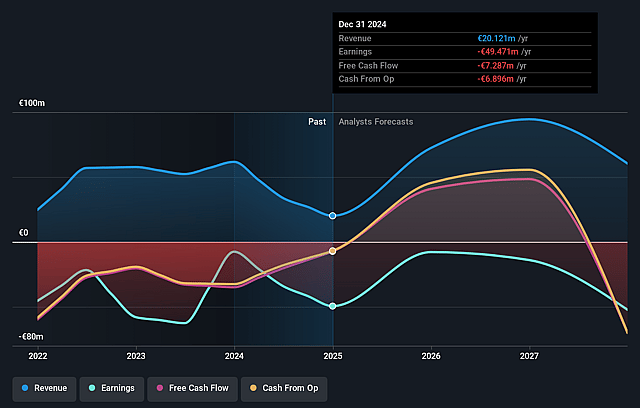

Innate Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Innate Pharma compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Innate Pharma's revenue will grow by 9.8% annually over the next 3 years.

- The bearish analysts are not forecasting that Innate Pharma will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Innate Pharma's profit margin will increase from -245.9% to the average GB Biotechs industry of 7.9% in 3 years.

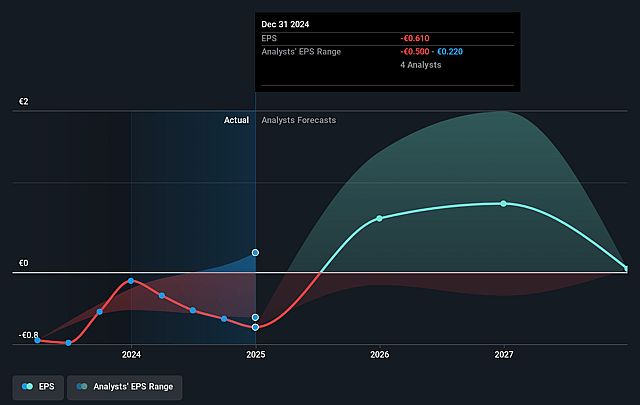

- If Innate Pharma's profit margin were to converge on the industry average, you could expect earnings to reach €2.1 million (and earnings per share of €0.02) by about September 2028, up from €-49.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 130.7x on those 2028 earnings, up from -3.5x today. This future PE is greater than the current PE for the GB Biotechs industry at 14.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.13%, as per the Simply Wall St company report.

Innate Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on securing future strategic partnerships or licensing deals, particularly for funding late-stage clinical studies like lacutamab's Phase III, creates volatility and uncertainty for both revenue and earnings growth if such partnerships are delayed or do not materialize.

- Insufficient current cash runway to self-fund pivotal Phase III trials for key assets such as lacutamab, meaning failure to secure timely external financing or a partner could result in equity dilution or forced cutbacks, putting net margins and long-term earnings at risk.

- Concentration of the clinical pipeline in early and mid-stage programs increases the risk that clinical failures or regulatory setbacks could sharply reduce the company's addressable market and impair top-line revenue projections in future years.

- Increasing competition in antibody drug conjugates and NK cell engagers, especially as noted with targets like B7-H3, makes it difficult for Innate Pharma to distinguish its products and retain future market share, pressuring long-term revenue growth and reducing the likelihood of substantial out-licensing income.

- Pipeline and strategy dependence on a limited number of assets returning from partners (such as Sanofi) and unknowns around the value or clinical viability of these assets increases uncertainty in asset prioritization and resource allocation, which can negatively affect R&D expense efficiency and ultimately earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Innate Pharma is €2.49, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Innate Pharma's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €6.2, and the most bearish reporting a price target of just €2.49.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €26.6 million, earnings will come to €2.1 million, and it would be trading on a PE ratio of 130.7x, assuming you use a discount rate of 6.1%.

- Given the current share price of €1.86, the bearish analyst price target of €2.49 is 25.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.