Key Takeaways

- Coface's focused investment in Business Information and technology enhances capabilities, driving potential revenue and operational efficiency improvements.

- Strong risk management and stable market conditions support future revenue growth, despite economic challenges and rising insolvencies.

- Strong client retention and strategic investments position Coface for stable growth, with improved profitability through reserve releases and efficient capital use.

Catalysts

About COFACE- Through its subsidiaries, provides credit insurance products and related services for microenterprises, small and medium enterprises, mid-market companies, international corporations, financial institutions, and clients of distribution partners.

- Coface is experiencing strong double-digit growth in its Business Information and debt collection services, with expectations for this trend to continue. This suggests potential for future revenue growth as these services further expand their client base.

- The company continues to invest significantly in growth and technology as part of its 'Power the Core' plan, expanding its capabilities in Business Information and supply chain risk management. This could lead to increased operational efficiencies and revenue diversification.

- Coface's strategic investment in expanding staff and data capabilities, like referencing 220 million companies and maintaining nearly 600 employees dedicated to Business Information, supports future revenue and earnings growth by enhancing their service offerings.

- Despite a challenging economic environment with rising insolvencies, Coface maintains a strong net combined ratio of 64.4% and has benefited from past reserve releases, indicating a disciplined risk management approach that positively impacts net margins and earnings.

- The company is seeing stable future revenue potential as the biggest part of the disinflation headwind seems to be behind them, complemented by stable pricing and improved demand in a more stressed market, which could fortify earnings if economic conditions stabilize or improve.

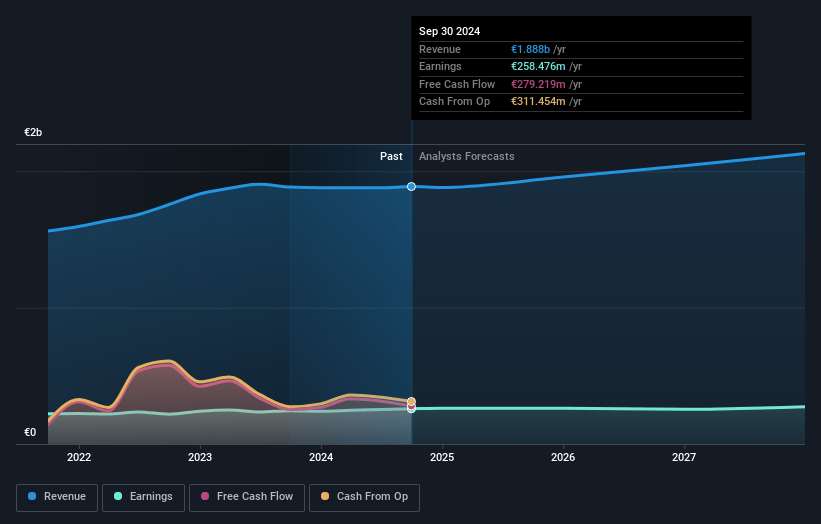

COFACE Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming COFACE's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 13.7% today to 11.8% in 3 years time.

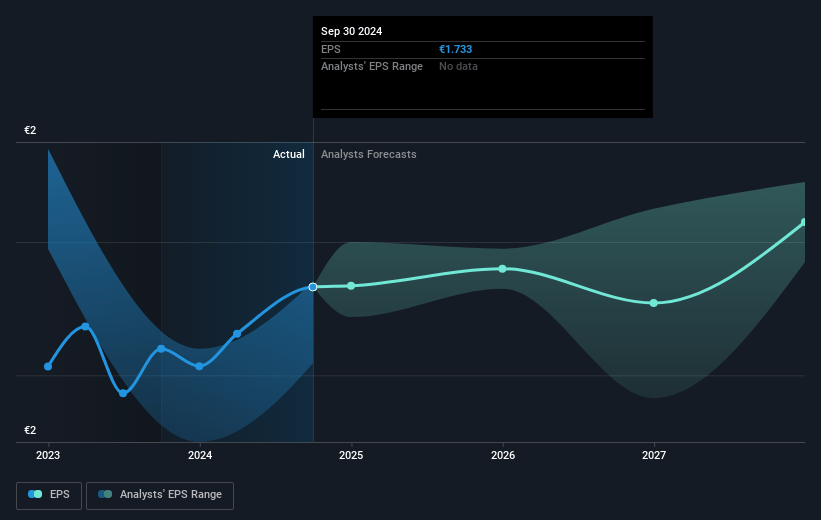

- Analysts expect earnings to reach €246.7 million (and earnings per share of €1.66) by about February 2028, down from €258.5 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as €275 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.5x on those 2028 earnings, up from 9.2x today. This future PE is greater than the current PE for the GB Insurance industry at 11.1x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.42%, as per the Simply Wall St company report.

COFACE Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Coface's Business Information segment has shown double-digit growth with a gross margin above 60%, which suggests a strong potential for revenue growth and profitability from expanding its services.

- A high client retention rate of 92.7% indicates stable revenue streams and customer satisfaction, which can mitigate the impact of pricing pressures and economic slowdowns on earnings.

- The company continues to make deliberate investments in growth and technology, positioning itself for future revenue enhancement despite current cost increases.

- Coface seems to benefit from strategic reserve releases, improving its net combined and loss ratios, which strengthens its financial performance and earnings profile.

- Coface's annualized Return on Average Tangible Equity (ROATE) at almost 15% is the highest in 9 years, indicating efficient capital utilization and strong potential for future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €16.075 for COFACE based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.1 billion, earnings will come to €246.7 million, and it would be trading on a PE ratio of 12.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of €15.93, the analyst price target of €16.08 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives