Key Takeaways

- Legacy IT reliance and underperformance in core divisions constrain growth, as newer digital competitors erode market share and hinder innovation.

- Limited international success and tightening regulatory demands restrict diversification, keeping growth dependent on mature home markets and pressuring profitability.

- Chronic underperformance, legacy IT dependence, stalled international efforts, rising compliance complexity, and increasing competition threaten margins, revenue growth, and market differentiation.

Catalysts

About Cegedim- Operates as a technology and services company in the field of digital data flow management for healthcare ecosystem and B2B in France, rest of Europe, and internationally.

- While there is an accelerating shift toward digitalization in healthcare and Cegedim is investing in its sovereign cloud and secure service offerings, persistent underperformance and impairments in its core pharmacist software divisions in both France and the UK suggest revenue growth in key segments may remain constrained as newer entrants and interoperable platforms threaten market share, limiting topline expansion.

- Despite ongoing R&D investment and the adoption of digital-first strategies, Cegedim's capitalized development expenditure, relatively slow migration to cloud-native business models, and remaining dependency on legacy IT assets risk elevating future maintenance costs and depressing operating margins, challenging its ability to keep pace with industry leaders in innovation and cost structure competitiveness.

- While demographic trends and increased healthcare consumption create a larger addressable market, Cegedim's difficulty in scaling international activities-as evidenced by the exit of In Practice Systems and limited success outside of France-restricts geographic diversification, leaving future growth and earnings more exposed to muted or negative trends in mature domestic markets.

- Even as heightening data security and privacy requirements drive underlying demand for secure IT infrastructure, intensifying global regulations and rising compliance costs threaten to erode net margins and limit Cegedim's capacity to monetize advanced data analytics offerings, particularly if regulatory headwinds intensify for healthcare data handling.

- Although the company has demonstrated operational improvements, especially in cost control and recurring income margin gains, persistent talent shortages and inflationary labor pressure in technology and AI-related roles may impede the company's ability to accelerate automation, innovate new products at competitive speed, and thus sustain meaningful long-term margin or earnings growth.

Cegedim Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cegedim compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cegedim's revenue will grow by 4.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -2.2% today to 3.6% in 3 years time.

- The bearish analysts expect earnings to reach €26.9 million (and earnings per share of €1.97) by about July 2028, up from €-14.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.5x on those 2028 earnings, up from -10.0x today. This future PE is lower than the current PE for the GB Healthcare Services industry at 20.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.02%, as per the Simply Wall St company report.

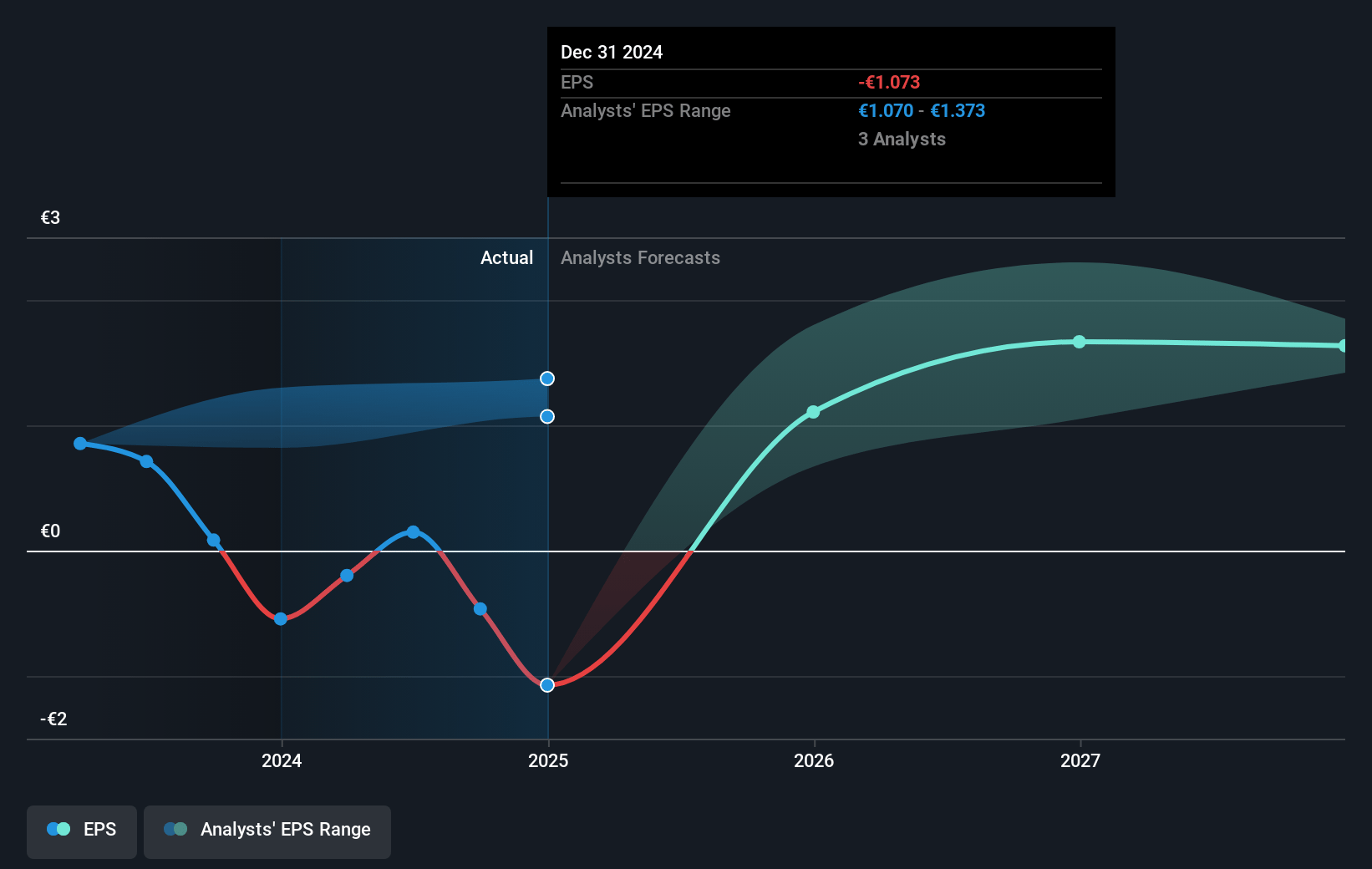

Cegedim Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Chronic underperformance in core divisions such as software for pharmacists and insurers, evidenced by impairments on pharmacist operations in France and the UK as well as negative effects from lower equipment sales and client churn, continues to constrain topline expansion and risks stagnating revenue growth in coming years.

- Persistent dependency on legacy IT platforms, highlighted by ongoing R&D amortization and slow transitions to cloud-native solutions, drives maintenance expenses higher and puts sustained pressure on operating margins, making Cegedim less cost-competitive versus more agile rivals.

- Inability to execute international expansion, seen through challenges and negative impacts related to the exit of In Practice Systems and underwhelming international data side performance, restricts geographic diversification and exposes earnings to adverse shifts in mature domestic markets.

- Intensifying data privacy regulations and compliance requirements, alongside elevated restructuring and legal fees as noted by exceptional items with tax litigation and compliance-related costs, increase operational complexity and could lead to surging compliance expenses that erode net profits.

- Competitive pressures from open-source solutions and large digital health platforms, combined with the commoditization risk of healthcare IT and process automation, may reduce Cegedim's pricing power and differentiation, threatening both future revenue levels and the company's ability to maintain or expand margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cegedim is €11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cegedim's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €17.0, and the most bearish reporting a price target of just €11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €750.3 million, earnings will come to €26.9 million, and it would be trading on a PE ratio of 7.5x, assuming you use a discount rate of 12.0%.

- Given the current share price of €10.7, the bearish analyst price target of €11.0 is 2.7% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.