Key Takeaways

- Migration of operations to Morocco and enhanced cost control are expected to significantly improve long-term margins and sustain operating income growth.

- Cloud investments, AI integration, and compliance-ready solutions position Cegedim for leadership in healthcare digitization, supporting high-margin, recurring revenue streams and market share gains.

- Heavy reliance on legacy technology, the French market, and increasing debt expose the company to operational, financial, and regulatory risks that threaten sustainable growth.

Catalysts

About Cegedim- Operates as a technology and services company in the field of digital data flow management for healthcare ecosystem and B2B in France, rest of Europe, and internationally.

- Analyst consensus expects internalization of the Allianz contract workforce to incrementally improve margins, but the significant shift to Moroccan operations and broader cost discipline across divisions could deliver a step-change in long-term net margins and sustained operating income expansion, driven by labor arbitrage and scalability benefits.

- While analysts broadly see the ramp-up and software migration on the Allianz contract as a Q4 2024 inflection, accelerating digital transformation and proven execution in other large-scale projects suggest that Allianz could become an outsized contributor to both revenue and recurring operating income well ahead of expectations, further enhancing visibility on earnings momentum.

- Cegedim's sustained investment in cloud and sovereign digital infrastructure, including its recent SecNumCloud certification, uniquely positions the company to capture high-value, recurring SaaS contracts across Europe as healthcare digitization accelerates, supporting structurally higher revenue growth and margin expansion.

- The integration of advanced AI-driven analytics with proprietary platforms such as Cegedim Santé and Maiia is opening access to the expanding real-world data market, enabling premium-priced solutions for clinical research and outcomes measurement and creating new high-margin revenue streams.

- With increasing healthcare digitalization and regulatory demand for secure, interoperable systems, Cegedim's established footprint and ability to offer integrated, compliance-ready solutions should support material market share gains during industry consolidation, driving robust multi-year revenue and free cash flow growth.

Cegedim Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cegedim compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cegedim's revenue will grow by 4.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -2.2% today to 3.6% in 3 years time.

- The bullish analysts expect earnings to reach €26.9 million (and earnings per share of €1.97) by about July 2028, up from €-14.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.6x on those 2028 earnings, up from -10.0x today. This future PE is lower than the current PE for the GB Healthcare Services industry at 20.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.02%, as per the Simply Wall St company report.

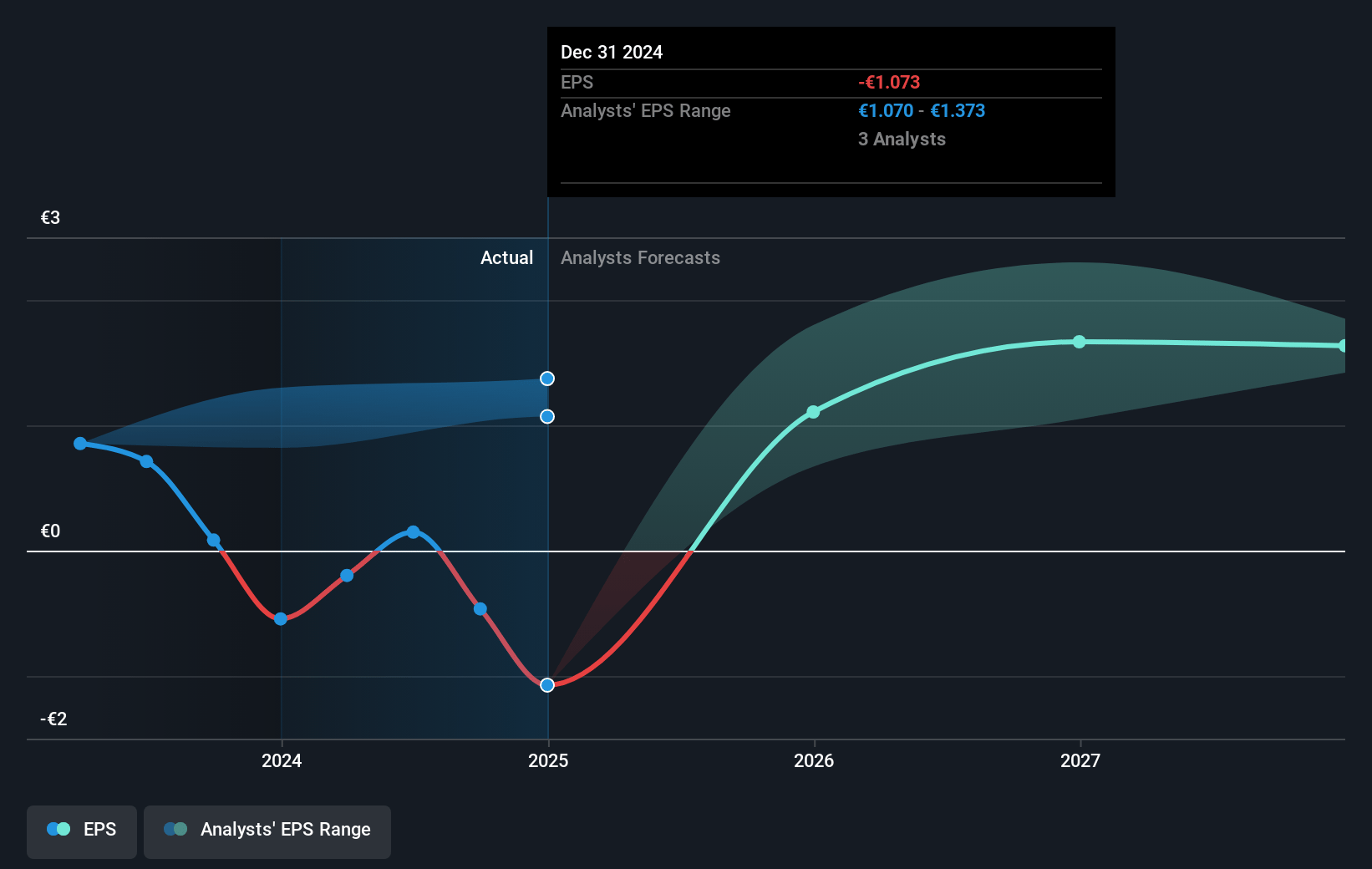

Cegedim Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's dependence on legacy software, as seen in the impairment of its pharmacist operation in France and the UK and the capital loss from in-practice systems, highlights the risk that its existing technology could fall behind more innovative competitors, which would likely require ongoing high R&D investments and could negatively affect long-term profitability and recurring operating income.

- Heavy reliance on the French market, visible from several operational comments and the impact of French tax litigation, means that adverse economic or regulatory changes in France could introduce volatility into earnings and cash flow, given the company's regional concentration.

- The substantial increase in net debt, now at 185 million euros following the Visiodent acquisition, along with higher interest expenses, diminishes financial flexibility and could restrict essential future investments in modernization or scale, weighing on net margins and potentially limiting revenue growth.

- The reduction in equipment sales at Smart Rx and the negative Ségur base effect for Cegedim Santé demonstrate vulnerability to shifting structural or policy-related headwinds in healthcare IT markets, which may curtail revenue growth and put pressure on operating margins over time.

- The growing focus on internalization and cost control as primary drivers of improved margins may not be sustainable in the long term, especially as escalating compliance demands from global data privacy regulations and rising competition from low-cost digital solutions threaten to compress net margins and challenge future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cegedim is €17.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cegedim's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €17.0, and the most bearish reporting a price target of just €11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €750.3 million, earnings will come to €26.9 million, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 12.0%.

- Given the current share price of €10.7, the bullish analyst price target of €17.0 is 37.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.