Last Update17 Sep 25Fair value Increased 1.46%

Analysts have raised Danone’s price target from €74.91 to €76.01, driven by stronger-than-expected performance in protein dairy and especially China Specialized Nutrition, which has led to a more optimistic and sustainable growth outlook.

Analyst Commentary

- Stronger than expected performance in protein dairy and China Specialized Nutrition segments.

- Previous concerns regarding U.S. creamers remain, but are now mitigated by improvements elsewhere.

- Positive momentum in China Specialized Nutrition has exceeded expectations.

- Analysts now see a more sustainable and consistent growth trajectory for Danone.

- Upgraded growth outlook underpins the significant upward revision in price target.

What's in the News

- Danone confirmed 2025 earnings guidance, expecting sales growth of +3% to +5% and recurring operating income to grow faster than sales.

Valuation Changes

Summary of Valuation Changes for Danone

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from €74.91 to €76.01.

- The Consensus Revenue Growth forecasts for Danone has risen slightly from 3.0% per annum to 3.1% per annum.

- The Future P/E for Danone remained effectively unchanged, moving only marginally from 21.08x to 21.32x.

Key Takeaways

- Focus on innovation, health-driven products, and strategic acquisitions solidifies Danone's leadership in premium nutrition and specialty segments amid changing consumer preferences.

- Expanding in emerging markets and shifting towards digital and healthcare channels enhances growth opportunities, operational efficiency, and long-term margin stability.

- Reliance on legacy products, operational inefficiencies, acquisition integration risks, currency volatility, and cost pressures from supply and regulation threaten Danone's sustained revenue and margin growth.

Catalysts

About Danone- Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

- Continued innovation and expansion in health-driven, functional foods and specialized nutrition-such as high-protein, probiotic, and medical nutrition products-positions Danone to capture above-market revenue growth as global consumers become increasingly focused on wellness and science-based nutrition.

- Geographic broadening in emerging markets, especially across Asia, Africa, and Latin America, leverages rising urbanization and the growing middle class to expand Danone's addressable market and drive long-term revenue and volume gains.

- Strategic investments and recent acquisitions (Kate Farms, The Akkermansia Company) strengthen Danone's leadership in plant-based, gut health, and medical nutrition, reinforcing differentiation and supporting both premiumization (higher revenue per unit sold) and improved long-term margin potential.

- Early supply chain digitalization and increased operational productivity-evidenced by best-in-class manufacturing upgrades and cost discipline-are set to drive efficiency gains and support sustainable margin expansion, improving recurring operating income and overall earnings.

- Shifting channel mix towards higher-growth segments, such as online/direct-to-consumer and specialized healthcare distribution, is expected to reduce reliance on traditional retail, increase brand control, and lift net margins and earnings resilience over time.

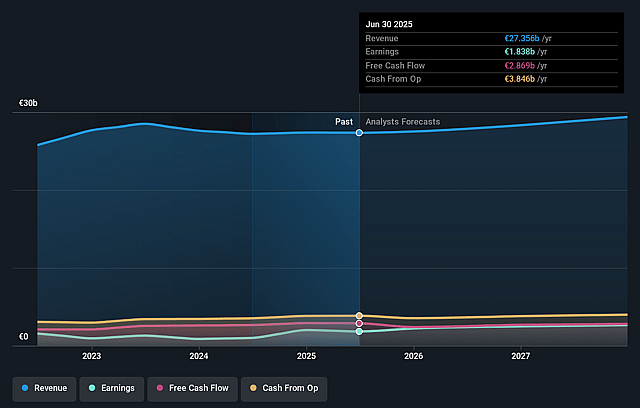

Danone Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Danone's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.7% today to 9.1% in 3 years time.

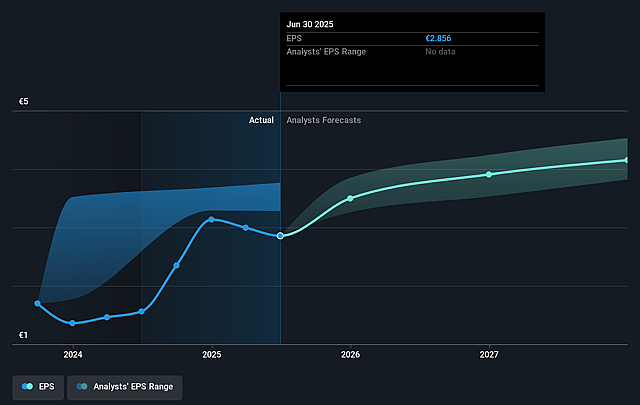

- Analysts expect earnings to reach €2.7 billion (and earnings per share of €4.25) by about September 2028, up from €1.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €2.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.1x on those 2028 earnings, down from 26.1x today. This future PE is greater than the current PE for the GB Food industry at 11.4x.

- Analysts expect the number of shares outstanding to decline by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.98%, as per the Simply Wall St company report.

Danone Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Danone continues to rely heavily on traditional dairy and bottled water segments, and while functional and high-protein innovations are growing, slow improvement and inconsistent leadership in core categories, particularly dairy in major markets like the U.S. and Europe, could constrain long-term revenue growth if consumer trends shift further towards fresh, unprocessed, and locally sourced foods.

- Structural challenges remain in North America, including execution issues and lagging plant-based brand performance (Silk), coupled with frustration from management about the speed of turnaround; this suggests ongoing operational inefficiencies and leadership uncertainty, which may suppress net margins and earnings if not fully resolved.

- While Danone's recent acquisitions (e.g., Kate Farms, Akkermansia) show promise, there are inherent execution risks involved in integrating these businesses and extracting synergies-failure to successfully leverage these deals or deliver innovation at pace could result in one-off charges and increased volatility in earnings.

- Persistent foreign exchange headwinds, particularly euro appreciation against the U.S. dollar and Chinese renminbi, have already offset like-for-like revenue growth, and ongoing currency volatility poses a material risk to both reported revenues and net profits, especially given Danone's broad geographic footprint.

- Commodity and ingredient price volatility, exacerbated by climate change and global supply chain disruptions, remains a risk for Danone's cost of goods sold; combined with potential regulatory changes targeting plastics and carbon emissions, this could increase operating costs and ultimately erode margins if not proactively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €74.914 for Danone based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €85.0, and the most bearish reporting a price target of just €62.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €29.9 billion, earnings will come to €2.7 billion, and it would be trading on a PE ratio of 21.1x, assuming you use a discount rate of 6.0%.

- Given the current share price of €74.32, the analyst price target of €74.91 is 0.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.