Key Takeaways

- Accelerating infrastructure growth and regulatory shifts may let Detection Technology outpace expectations, capturing substantial market share and diversified revenue across key regions.

- Innovation in AI-driven security and recurring revenue solutions positions the company for higher-quality earnings, margin expansion, and a stronger valuation profile.

- Intensifying price competition, customer concentration, sluggish innovation, geopolitical risks, and disruptive technologies threaten Detection Technology Oyj's revenue growth, market share, and profitability.

Catalysts

About Detection Technology Oyj- Engages in the provision of X-ray detector solutions for industrial, medical, and security applications in Finland and internationally.

- While analyst consensus sees the India factory ramp-up as a growth driver, it may be understating the potential given India's massive airport, harbor, and rail expansion over the next decade, which could enable Detection Technology to capture a dominant market share and generate long-term revenue compounding well above current projections.

- Analyst consensus expects gradual recovery in medical imaging, but this could be much sharper as the severely underinvested Chinese healthcare market normalizes and medical backlogs clear, enabling a step-change in revenue and net margin, especially as Detection Technology's new product portfolio is already moving through international regulatory approvals.

- Detection Technology's continually high R&D investment and strong innovation track record uniquely positions it to capture outsized gains from the increasing global adoption of AI-driven security, smart logistics, and automated inspection-substantially expanding total addressable market and supporting durable high EBITA margins.

- Global regulatory tightening and high-profile public security incidents are accelerating demand for advanced detection and imaging, and Detection Technology's recognized Western brand status is likely to yield disproportionate contract wins in Europe, the US, and new geographies, driving outsized, diversified revenue growth with insulation from region-specific economic shocks.

- As the market shifts toward service, software, and recurring revenue models in medical and industrial segments, Detection Technology's expanding solutions portfolio will enable not just higher-quality, more predictable earnings but also significant margin expansion over time, supporting a notable rerating in valuation multiples.

Detection Technology Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Detection Technology Oyj compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Detection Technology Oyj's revenue will grow by 9.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.3% today to 13.3% in 3 years time.

- The bullish analysts expect earnings to reach €18.8 million (and earnings per share of €1.16) by about July 2028, up from €11.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.8x on those 2028 earnings, up from 14.6x today. This future PE is lower than the current PE for the FI Electronic industry at 26.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

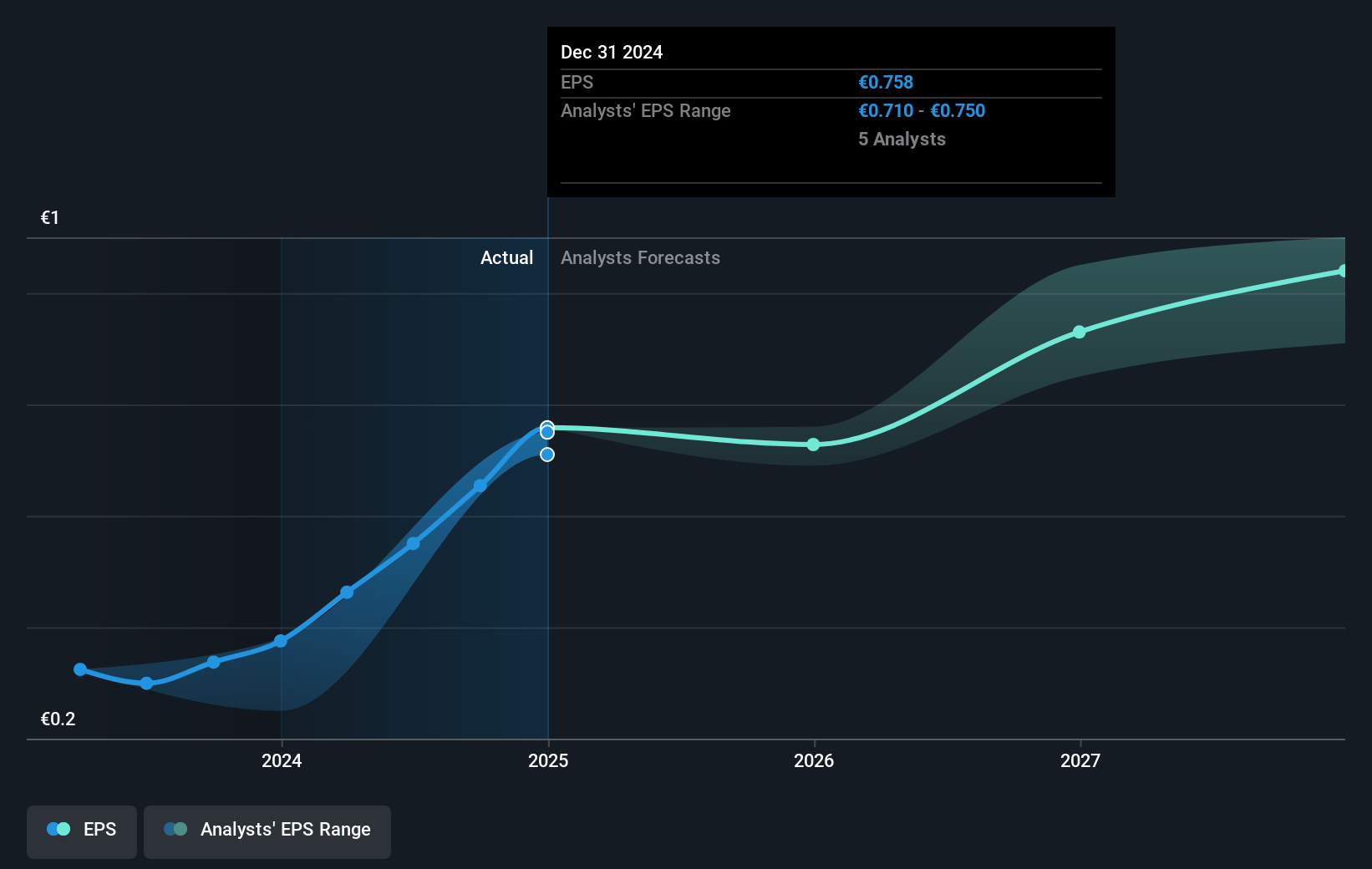

Detection Technology Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Detection Technology Oyj is experiencing severe price erosion and heightened price competition in China, particularly in industrial and TFT panel segments, which has already led to a 30 percent decline in industrial flat panel prices over 18 months and will continue to pressure revenues and net margins if this trend persists or worsens globally.

- There is high customer concentration, especially in the medical and security imaging segments, and recent commentary points to volatile sales in the Americas due to large customer inventory situations, exposing future revenue and earnings to significant risk if key contracts are lost or not renewed favorably.

- The pace of product approvals in regulated markets is slow and the company's significant investment into newly acquired business lines like Haobo's TFT panels is not yet contributing proportionately to EBITA, raising concerns that a sustained lag in innovation or integration could reduce future revenue growth and weaken net margins over time.

- Geopolitical risks, such as rising protectionism, increased tariffs, and uncertain trade relations-especially between the US, China, and Europe-create the potential for sudden additional costs or loss of market access, which may negatively impact both revenue and profitability.

- The risk of rapid technological disruption looms as major competitors, some with deeper R&D budgets, increasingly integrate detection solutions into broader platforms and deploy advanced AI-driven capabilities, potentially eroding Detection Technology Oyj's market share and compressing future earnings and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Detection Technology Oyj is €24.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Detection Technology Oyj's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €24.0, and the most bearish reporting a price target of just €12.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €141.3 million, earnings will come to €18.8 million, and it would be trading on a PE ratio of 21.8x, assuming you use a discount rate of 6.9%.

- Given the current share price of €11.05, the bullish analyst price target of €24.0 is 54.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.