Key Takeaways

- Intensifying competition and technological innovation demand ongoing R&D investment, risking margin pressure and product obsolescence if new offerings fail to gain traction.

- Heavy reliance on Asian markets and a concentrated customer base expose the company to revenue volatility amid regulatory risks and shifting global trade dynamics.

- Intensifying competition, customer and regional concentration, weak Chinese demand, rising costs, and geopolitical risks threaten margins, revenue stability, and growth prospects.

Catalysts

About Detection Technology Oyj- Engages in the provision of X-ray detector solutions for industrial, medical, and security applications in Finland and internationally.

- Although Detection Technology Oyj is positioning itself to benefit from rising global demand for advanced imaging in security, medical, and industrial applications, severe price erosion and intensifying competition in China-especially in flat panel and medical market segments-could suppress revenue growth and reduce average selling prices for an extended period.

- While the company is advancing its next-generation digital X-ray detectors and ramping up subsystem offerings for computed tomography to address the growing need for digitalization and automation, rapid technological innovation in the sector raises the risk of product obsolescence and necessitates high ongoing R&D spending, which may pressure net margins if new products fail to achieve expected market traction.

- Despite efforts to diversify geographically and operationally, the business remains highly exposed to Asia, particularly China, where regulatory reforms, anticorruption campaigns, and recovery from under-investment introduce significant uncertainty; a slow and uneven rebound in medical demand could limit both revenue and earnings visibility.

- Even with recent productivity improvements and cost optimization supporting higher operating profitability, heavy customer concentration and reliance on a few large accounts in healthcare and security continue to expose the company to potential revenue volatility if key customers' priorities shift or inventory corrections persist.

- While Detection Technology Oyj's expanded production footprint-through investments in Finland and the new India facility-provides some supply-chain resilience, ongoing global trade tensions and the potential for new tariffs in Europe could increase logistics costs, disrupt operations, and ultimately erode net earnings if geopolitical instability escalates.

Detection Technology Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Detection Technology Oyj compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Detection Technology Oyj's revenue will grow by 5.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.3% today to 10.7% in 3 years time.

- The bearish analysts expect earnings to reach €13.5 million (and earnings per share of €0.92) by about July 2028, up from €11.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, up from 14.4x today. This future PE is lower than the current PE for the FI Electronic industry at 25.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.88%, as per the Simply Wall St company report.

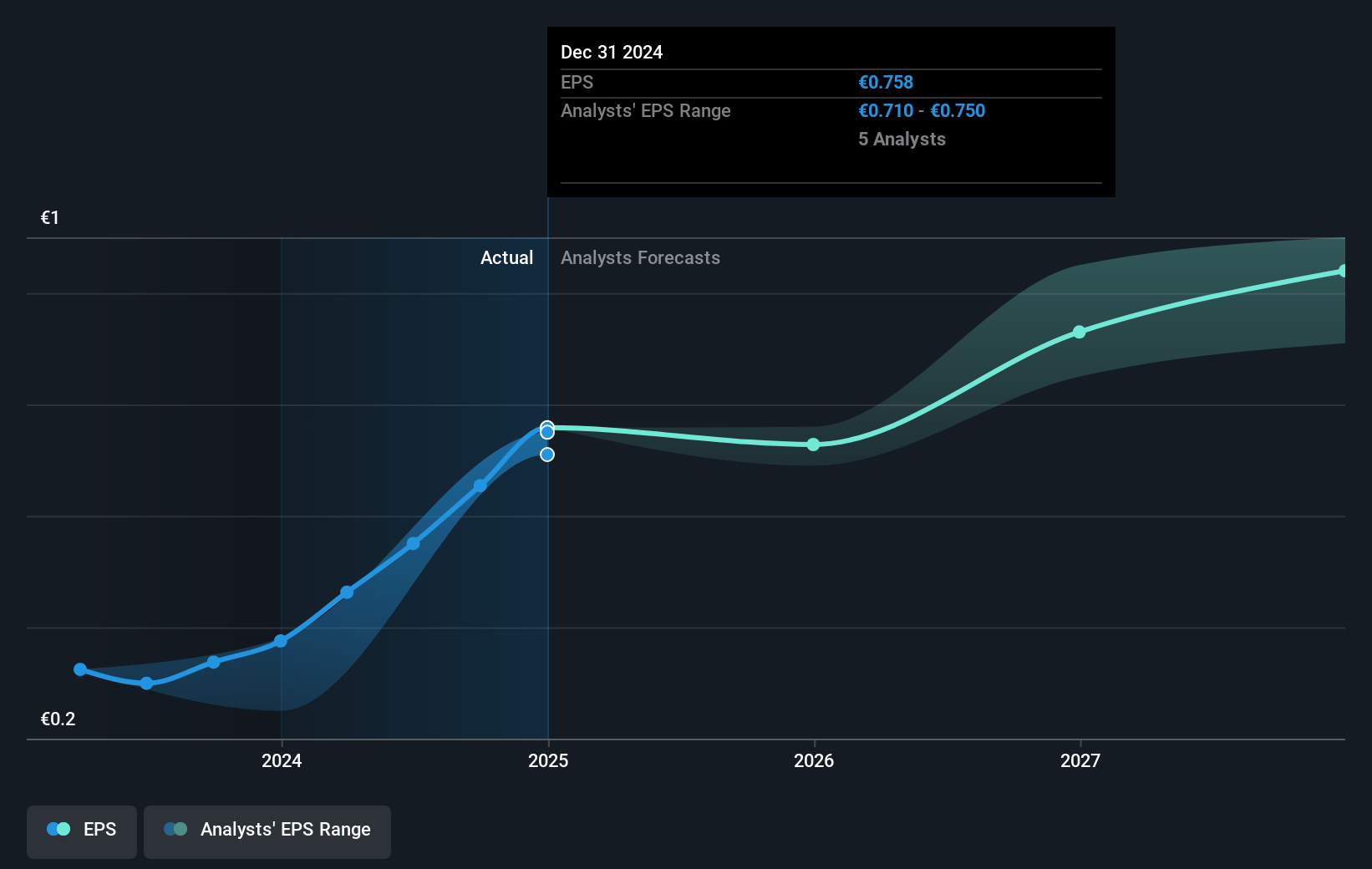

Detection Technology Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying price competition, particularly in China for TFT flat panel and industrial products, has driven a steep decline in prices-industrial flat panel prices have dropped by approximately thirty percent in the past 1.5 years-which directly pressures both revenues and gross margins.

- Long-term weakness in the Chinese medical imaging market, exacerbated by ongoing healthcare reforms and focus on supporting local vendors, risks continued underinvestment and slow recovery, thereby limiting growth in one of Detection Technology Oyj's largest regional markets and suppressing medical segment revenues.

- High exposure to a small set of large customers and to the APAC region increases revenue volatility and the risk of material earnings swings if any major accounts reduce orders, delay projects, or switch suppliers.

- Rising R&D and operational expenditures, such as the ramp-up of India production and ongoing investments into new product development, may not be matched by growth in sales if new products or market expansions fail to meet expectations, resulting in margin compression and lower net earnings.

- Global industrial and security end-markets remain sensitive to regulatory, supply chain, and geopolitical risks-including potential new tariffs, evolving trade barriers, and region-specific procurement policies-that may disrupt export flows, cause unpredictable swings in demand, and negatively impact top-line sales as well as net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Detection Technology Oyj is €12.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Detection Technology Oyj's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €24.0, and the most bearish reporting a price target of just €12.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €126.4 million, earnings will come to €13.5 million, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of €10.95, the bearish analyst price target of €12.0 is 8.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.