Last Update 24 Sep 25

Fair value Decreased 13%Despite a substantial improvement in net profit margin and a much lower future P/E ratio indicating stronger earnings and more attractive valuation, Citycon Oyj's consensus analyst price target has been cut from €4.00 to €3.50.

What's in the News

- CEO Oleg Zaslavsky will step down; Eshel Pesti appointed as new CEO, bringing extensive experience in European shopping centers.

- Completed share buyback of 694,801 shares (0.38% of shares) for €2.6 million.

- Earnings guidance for 2025 reaffirmed with EPRA EPS (basic) expected at €0.41–€0.50.

Valuation Changes

Summary of Valuation Changes for Citycon Oyj

- The Consensus Analyst Price Target has significantly fallen from €4.00 to €3.50.

- The Net Profit Margin for Citycon Oyj has significantly risen from 23.43% to 48.60%.

- The Future P/E for Citycon Oyj has significantly fallen from 13.54x to 5.74x.

Key Takeaways

- Resilient urban asset demand and improved tenant activity support higher occupancy, rental income, and potential revenue growth.

- Sustained cost efficiencies and proactive financial management enhance operating margins, stabilize asset values, and position the company for future growth.

- Reliance on asset sales, rising financial costs, volatile energy savings, and significant share collateralization expose Citycon to earnings, balance sheet, and share price risks.

Catalysts

About Citycon Oyj- A real estate investment company, owns and develops mixed-use centers in Finland, Norway, Sweden, Denmark, and Estonia.

- Strong like-for-like net rental income growth (5.2% overall, 7.6% in Finland and Estonia) and high occupancy (95%) reflect the resilience and demand for centrally located, necessity-based urban assets, positioning Citycon to benefit from ongoing urban migration and population growth-likely supporting future revenue growth.

- Continued improvement in tenant sales and footfall, along with the ability to achieve positive leasing spreads and rent increases with new tenants, indicates growing consumer demand for mixed-use and experiential retail environments, which should lead to higher occupancy and rental income, positively impacting revenue and operating margins.

- Successful execution of cost-saving initiatives, particularly in Finland and Estonia, has led to record NOI margins demonstrated as sustainable, suggesting ongoing operating efficiency and margin improvement, which supports future net margins and earnings stability.

- Asset values are stabilizing with a recent fair value gain of €33.5 million, driven by improved cash flows in key properties and external appraisers' more optimistic view on growth prospects, especially in Sweden; this aligns with growing institutional investor interest in resilient, transit-oriented real assets, potentially supporting higher portfolio valuations and return on equity.

- Proactive balance sheet management, including substantial debt repayment, refinancing at attractive terms, and a highly flexible unencumbered asset base, positions Citycon to better manage its cost of capital and pursue redevelopment or green initiatives-likely to reduce interest expenses and enhance earnings growth over the medium term.

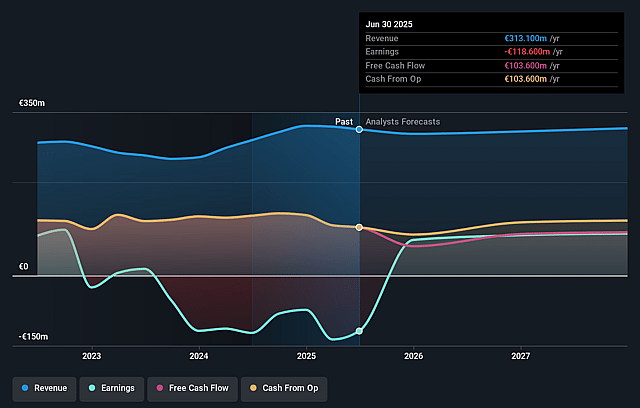

Citycon Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Citycon Oyj's revenue will decrease by 0.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -37.9% today to 23.4% in 3 years time.

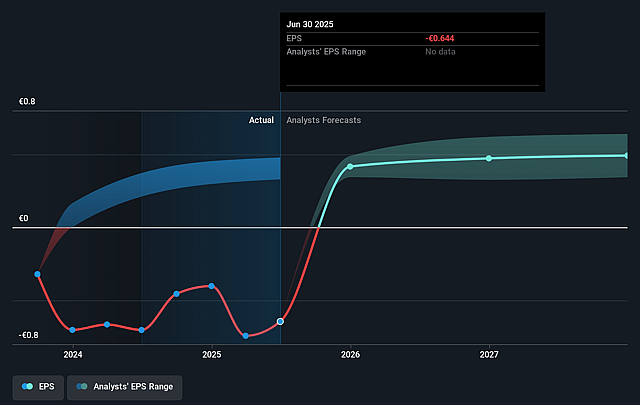

- Analysts expect earnings to reach €73.6 million (and earnings per share of €0.4) by about September 2028, up from €-118.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €117 million in earnings, and the most bearish expecting €63 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.5x on those 2028 earnings, up from -5.5x today. This future PE is lower than the current PE for the GB Real Estate industry at 30.4x.

- Analysts expect the number of shares outstanding to decline by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.03%, as per the Simply Wall St company report.

Citycon Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Citycon's reported net rental income for the quarter was €1.4 million below the previous year, and EPRA earnings fell by €7.8 million year-over-year, largely due to asset disposals-signaling pressure on revenue base and future earnings if replacement of disposed income streams lags or proceeds from divestments are inadequate.

- Increased financial costs following the issuance of a €400 million green bond and refinancing at higher interest rates have compressed net earnings, and ongoing inflation or further rate hikes could continue to erode margins and limit retained earnings growth.

- The company's bottom line was supported by significant cost savings, particularly in energy and operational expenses-however, management acknowledges that fluctuations in energy prices may reverse some of these gains, introducing volatility to operating margins and net income.

- The strategy of asset sales remains critical for balance sheet derisking, but recent failed disposals (e.g., a buyer walking away last-minute) highlight execution risks; further dependence on asset sales at potentially unfavorable prices could depress book value and long-term revenue streams.

- A substantial portion of the company's shares is pledged by its main shareholder as collateral (about 30% of all Citycon shares), raising concerns about forced selling risk in adverse scenarios, which could pressurize share price and increase volatility for remaining shareholders.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €4.0 for Citycon Oyj based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €314.0 million, earnings will come to €73.6 million, and it would be trading on a PE ratio of 13.5x, assuming you use a discount rate of 11.0%.

- Given the current share price of €3.53, the analyst price target of €4.0 is 11.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.