Key Takeaways

- Strategic cost-reduction and streamlining measures are expected to boost margins and accelerate growth in key divisions.

- Shareholder returns may improve through share buybacks and dividends, with reduced CapEx enhancing future earnings potential.

- Challenges in the communication paper segment, cost pressures, and impairments threaten UPM's margins and earnings, especially in critical markets and biorefinery operations.

Catalysts

About UPM-Kymmene Oyj- Engages in the forest-based bioindustry in Europe, North America, Asia, and internationally.

- Full production at the Paso de los Toros mill in Uruguay is expected in 2025, adding approximately 300,000 tonnes of pulp production compared to 2024, which should boost both revenue and efficiency.

- Ongoing cost-reduction measures across various divisions, including a targeted €45 million annualized fixed cost savings in Communication Paper due to capacity closures, are expected to enhance net margins.

- Streamlining actions and strategic acquisitions in Raflatac aim to accelerate growth and return the division to double-digit EBIT margins, positively impacting earnings.

- The start-up and eventual ramp-up of the Leuna Biorefinery is expected to contribute positively to EBIT by 2027, potentially paving the way for new revenue streams in biochemicals.

- The introduction of a share buyback program and consistent dividends signal potentially stronger future EPS growth due to returning capital to shareholders amidst expected lower CapEx.

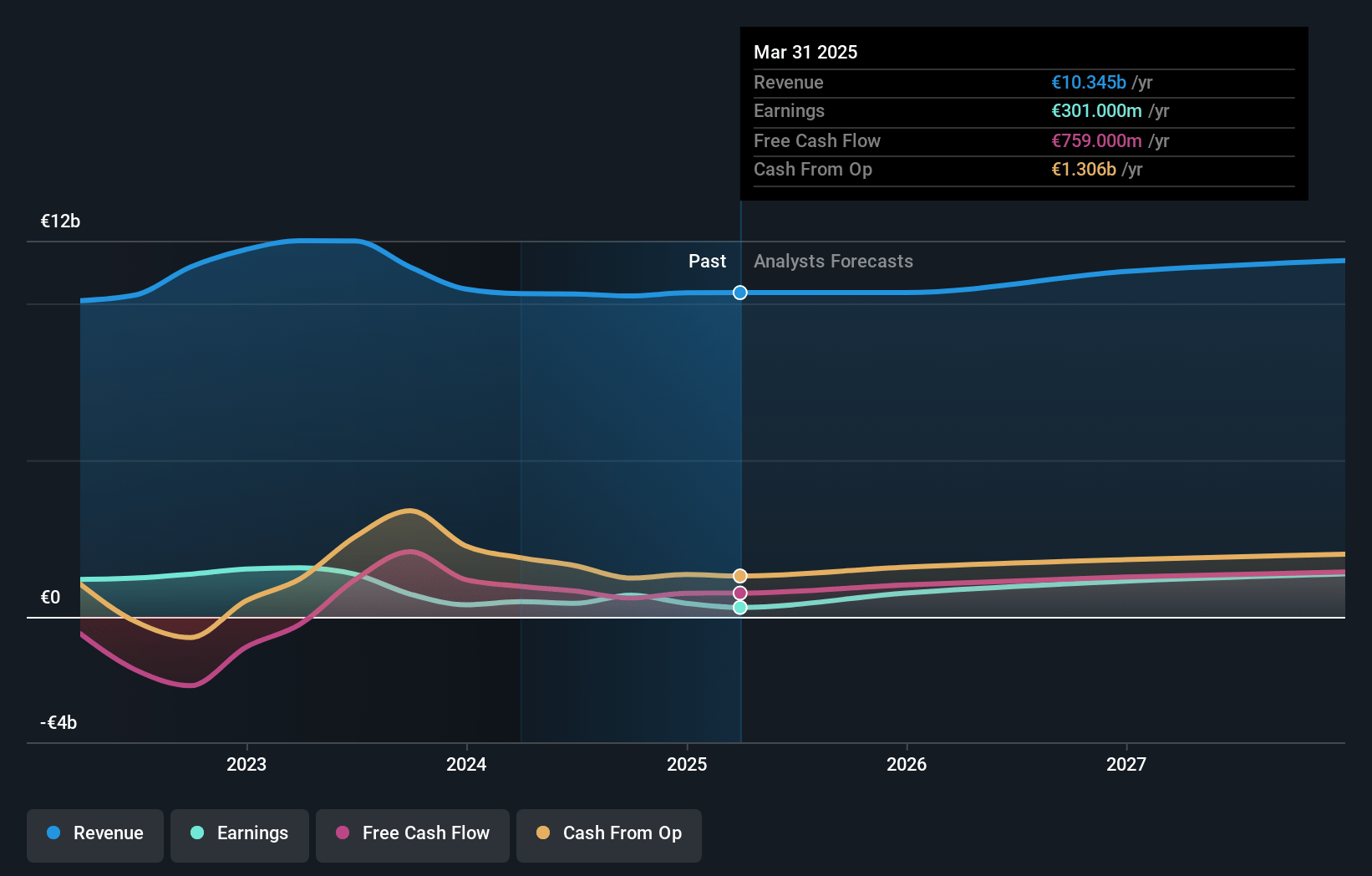

UPM-Kymmene Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming UPM-Kymmene Oyj's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.2% today to 13.1% in 3 years time.

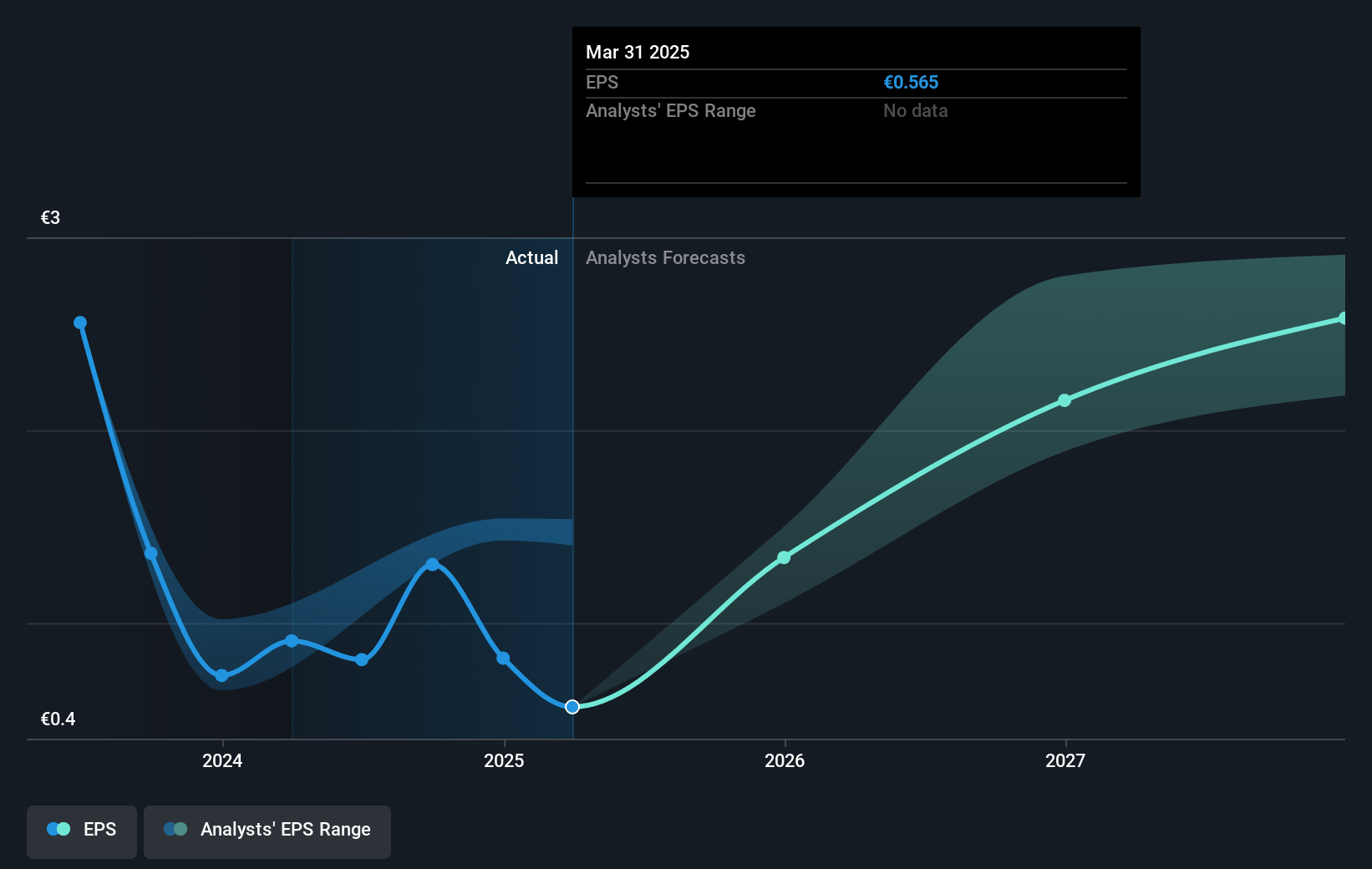

- Analysts expect earnings to reach €1.5 billion (and earnings per share of €2.89) by about March 2028, up from €436.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €1.7 billion in earnings, and the most bearish expecting €1.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, down from 33.9x today. This future PE is lower than the current PE for the GB Forestry industry at 27.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.99%, as per the Simply Wall St company report.

UPM-Kymmene Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UPM faces growing challenges in the communication paper segment, as deliveries for communication paper and energy decreased, impacting revenue growth and potentially leading to future profit declines.

- Increased variable costs, particularly from fiber costs, alongside the flat sales prices on a group level, are putting pressure on UPM's margins, thereby risking a reduction in net earnings.

- The impairment of €373 million in the Leuna Biorefinery assets, caused by cost overruns and construction delays, suggests significant financial risks that could continue to impact earnings and increase net debt.

- The high wood costs and tight wood market in Finland could lead to decreased profitability in UPM's Finnish Fibres platform, affecting total net margins.

- The slow recovery in Raflatac, with EBIT slightly down sequentially, indicates potential revenue issues, as key markets like Europe have not yet recovered to pre-COVID levels, which could slow overall earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €31.56 for UPM-Kymmene Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €38.0, and the most bearish reporting a price target of just €25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €11.7 billion, earnings will come to €1.5 billion, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 9.0%.

- Given the current share price of €27.81, the analyst price target of €31.56 is 11.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives