Key Takeaways

- Acquisition-led expansion and subsidiary collaboration uniquely position Solwers for accelerated cross-border growth and margin outperformance, surpassing traditional market expectations.

- Focus on smart infrastructure, recurring contracts, and digitalization secures stable earnings and competitive project delivery as European infrastructure investment surges.

- Heavy dependence on acquisitions, limited regional diversification, weak organic growth, margin pressures, and sector automation risk threaten long-term profitability and revenue sustainability.

Catalysts

About Solwers Oyj- Provides design and project management services in Finland, Sweden, and Poland.

- Analyst consensus sees acquisition-driven expansion and entry into Poland as mere growth drivers, but these moves could rapidly transform Solwers into the leading pan-Nordic and Central European platform for engineering and architecture, potentially doubling revenues within a few years as cross-border client wins and synergistic integrations outpace expectations.

- While analysts broadly recognize growing collaboration among subsidiaries as an efficiency lever, Solwers' unique "light integration" model actually positions it to unlock margin expansion and revenue acceleration well ahead of peers, as highly decentralized expertise combines with cross-selling to drive both top-line and sustained net margin growth far beyond current market forecasts.

- The company's deep entrenchment in smart city, sustainable infrastructure, and energy transition projects-exemplified by decades-long hospital, transport, and green transition contracts-positions Solwers to capture multi-year, high-visibility project pipelines just as European public and private infrastructure spending enters a secular boom, providing unparalleled earnings stability and upside.

- An outsized share of recurring revenues from framework agreements and multi-year consulting contracts shields earnings from cyclical downturns while providing a platform for automated pricing power as labor constraints intensify across Europe, further raising revenue per employee and net margins as demand for specialist skills accelerates.

- Accelerated investment in digitalization-leveraging next-generation tools like BIM, IoT integration, and proprietary digital platforms-will deliver step-change improvements in project delivery efficiency and transparency, reducing cost-to-serve and proportionally increasing EBIT as Solwers cements its competitive edge in an industry facing rapid technological adoption.

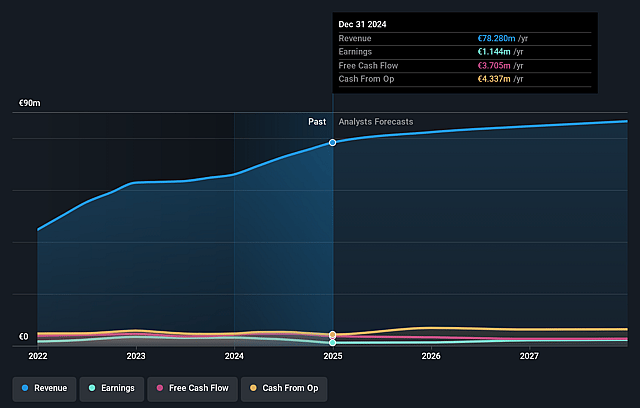

Solwers Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Solwers Oyj compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Solwers Oyj's revenue will grow by 3.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.2% today to 3.7% in 3 years time.

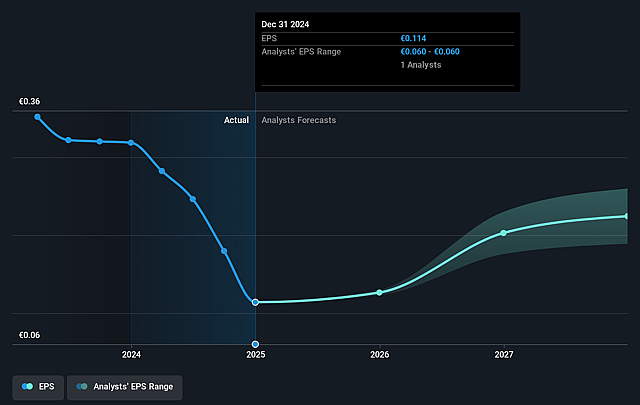

- The bullish analysts expect earnings to reach €3.3 million (and earnings per share of €0.33) by about September 2028, up from €-170.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from -140.6x today. This future PE is lower than the current PE for the FI Professional Services industry at 29.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.64%, as per the Simply Wall St company report.

Solwers Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Solwers Oyj relies heavily on acquisitions for growth, exposing the company to integration risks and the threat of underperforming acquisitions, which could lead to goodwill write-downs and negatively affect future earnings and net margins.

- The company's limited geographical diversification, with operations primarily in Finland and Sweden and only the early stages of expansion into Poland, leaves revenue vulnerable to regional economic downturns or prolonged slowdowns in these Nordic markets.

- Structural challenges in organic growth-demonstrated by slightly negative organic growth in H1 and admission that growth has mainly been acquisition-driven-raise concerns about the sustainability of long-term revenue expansion if acquisition opportunities dry up or integration becomes more difficult.

- Prolonged price competition, margin compression due to wage inflation not being fully passed onto clients, and a challenging market environment with delayed investments have already resulted in negative net profit in H1 and threaten to undermine future profitability if these pressures persist.

- The sector's exposure to automation and increasing adoption of AI could commoditize key consulting and engineering offerings, decreasing billing rates and pricing power, which may further erode revenue growth and operating margins in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Solwers Oyj is €3.25, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Solwers Oyj's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €3.25, and the most bearish reporting a price target of just €2.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €88.3 million, earnings will come to €3.3 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 8.6%.

- Given the current share price of €2.35, the bullish analyst price target of €3.25 is 27.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.