Key Takeaways

- Project delays, subdued investments, and weak pricing power threaten stable revenue growth and margin recovery, despite positive long-term trends and integration progress.

- High exposure to Finland and Sweden increases vulnerability to local economic shifts, while rising costs and competition put sustained pressure on profitability.

- Margin pressures, regional concentration, reliance on acquisitions, increased financial risk, and industry digitalization trends collectively threaten sustainable growth and long-term profitability.

Catalysts

About Solwers Oyj- Provides design and project management services in Finland, Sweden, and Poland.

- While accelerating urbanization and the rising emphasis on sustainable infrastructure projects in Northern Europe should support long-term demand for Solwers' services, the company faces continued project delays and a subdued investment environment, which could hold back revenue growth if investment decisions remain postponed or clients significantly slow the pace of new initiatives.

- Although ongoing digitalization in construction and infrastructure is set to boost demand for advanced design and project management offerings, Solwers remains exposed to intense price competition and has not yet managed to fully pass increased salary costs onto clients, putting persistent pressure on net margins even as the sector evolves.

- While heightened ESG requirements could open up new consulting revenue streams related to energy efficiency and sustainability, Solwers' heavy focus on Finland and Sweden increases vulnerability to localized economic downturns, potentially resulting in volatile earnings as public budgets fluctuate and private investment cycles remain uncertain.

- Despite successful integration of acquisitions and some evidence of cross-selling and expanded service offerings, the company continues to report challenges with integration and was forced into cost-cutting initiatives and temporary layoffs to protect profitability, signaling ongoing risks to stable margin recovery and future earnings quality.

- Although a robust pipeline of public sector infrastructure projects and megatrend-driven needs (like green transition and urban growth) suggest a favorable long-term backdrop, the continued commoditization of engineering and consultancy services means pricing power remains weak, threatening sustained improvements in both revenue and net profit if differentiation efforts and digital transition do not accelerate meaningfully.

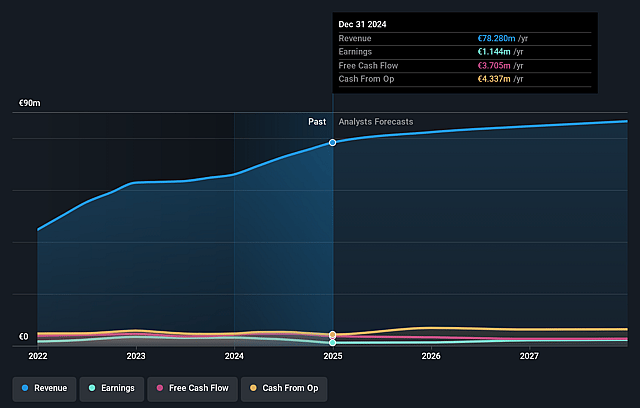

Solwers Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Solwers Oyj compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Solwers Oyj's revenue will grow by 2.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.2% today to 3.2% in 3 years time.

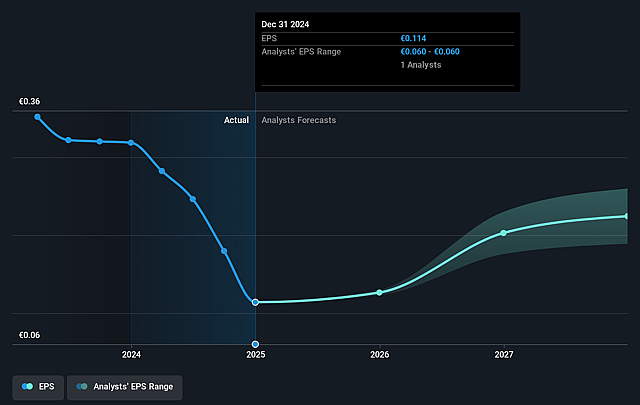

- The bearish analysts expect earnings to reach €2.8 million (and earnings per share of €0.23) by about September 2028, up from €-170.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.3x on those 2028 earnings, up from -139.4x today. This future PE is lower than the current PE for the FI Professional Services industry at 29.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

Solwers Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing price competition and margin compression, especially amid persistent low investment levels and slow transfer of salary cost increases to customer pricing, threaten sustained profitability and could negatively impact net margins and earnings.

- Solwers has a heavy operational focus on Finland and Sweden, making it highly vulnerable to regional economic downturns or prolonged weakness in Nordic real estate and industry sectors, which could lead to volatile revenues and earnings.

- Growth has been primarily acquisition-driven, while organic growth was slightly negative in H1, suggesting potential limits to future expansion and top-line revenue growth if acquisition opportunities falter or integration challenges rise.

- Rising net debt and recent breach of a financial covenant, requiring a waiver and reclassification of long-term debt as short-term, increase financial risk and may constrain investment in core business activities, thereby pressuring both future earnings and liquidity.

- Industry-wide trends towards digitalization and possible in-housing of engineering and consulting functions by clients could erode the external addressable market, driving down project volumes and compressing long-term revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Solwers Oyj is €2.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Solwers Oyj's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €3.25, and the most bearish reporting a price target of just €2.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €87.5 million, earnings will come to €2.8 million, and it would be trading on a PE ratio of 11.3x, assuming you use a discount rate of 8.5%.

- Given the current share price of €2.33, the bearish analyst price target of €2.5 is 6.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.