Catalysts

About Kempower Oyj

Kempower Oyj designs and manufactures fast and megawatt charging solutions for electric vehicles across passenger, bus and truck segments globally.

What are the underlying business or industry changes driving this perspective?

- Accelerating adoption of battery electric vehicles in Europe and North America, with double digit growth in new registrations, is expected to expand the addressable market for public and fleet fast charging, supporting sustained high revenue growth over the coming years.

- Rapid build out of public fast charging infrastructure, including NEVI funded sites and large grid connected hubs, positions Kempower to convert its strong order backlog into higher utilization of production capacity. This may lift absolute earnings as volumes scale.

- Early leadership in megawatt charging systems for e trucks, evidenced by first of a kind public deployments in Sweden, Norway and the U.S., creates a premium niche with higher value systems that can structurally enhance average selling prices and gross margins.

- Ongoing unit cost reduction and productivity programs across operations and supply chain are designed to offset price pressure while volumes grow. This may stabilize or improve gross margin and translate order growth more directly into operating profit.

- Rapid expansion outside the Nordics, particularly in North America where orders are approaching home market levels, diversifies revenue and offers a long runway for potential market share gains, supporting both top line growth and operating leverage as the regional footprint matures.

Assumptions

This narrative explores a more optimistic perspective on Kempower Oyj compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

- The bullish analysts are assuming Kempower Oyj's revenue will grow by 43.9% annually over the next 3 years.

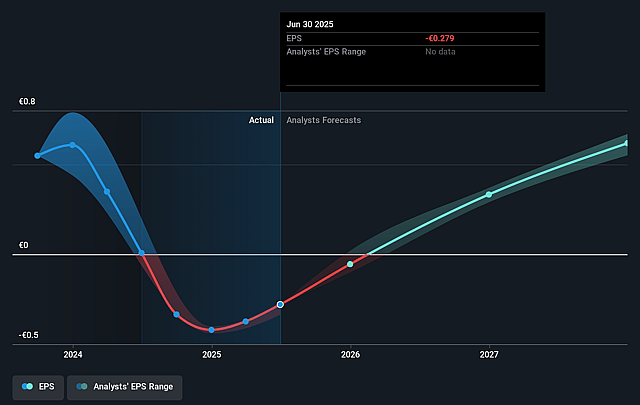

- The bullish analysts assume that profit margins will increase from -3.4% today to 9.3% in 3 years time.

- The bullish analysts expect earnings to reach €69.4 million (and earnings per share of €1.07) by about December 2028, up from €-8.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €36.8 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.2x on those 2028 earnings, up from -91.9x today. This future PE is lower than the current PE for the FI Electrical industry at 76.3x.

- The bullish analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Price competition in Europe and potential future pricing pressure in other regions could force Kempower to cut prices faster than it can reduce unit costs, eroding gross margins and limiting the improvement in operating EBIT and net earnings over time.

- The current growth is heavily driven by North America, NEVI funded projects and policy support, so any slowdown in subsidy disbursements, regulatory changes or clients delaying installations into later years could weaken order intake conversion and suppress near term revenue growth and cash flow generation.

- A growing share of the EUR 117 million order backlog is scheduled for 2026 delivery, and if this shift toward longer delivery times continues or customers reschedule projects, it may cap annual revenue growth rates and delay the scaling benefits needed to lift operating margins and earnings.

- Nordic markets are already showing declining sales after a period of heavy investment, and if similar saturation or overbuild dynamics emerge in other early adopter regions, it could slow long term demand for new fast chargers and limit both revenue expansion and utilization driven margin gains.

- Inventory scrapping, obsolescence costs and product mix shifts have already pressured gross margin in Q3, and if technology cycles in fast and megawatt charging keep shortening or reliability issues force higher aftersales commitments, recurring write downs and service costs could weigh on gross profit, operating EBIT and free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Kempower Oyj is €20.0, which represents up to two standard deviations above the consensus price target of €16.6. This valuation is based on what can be assumed as the expectations of Kempower Oyj's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €20.0, and the most bearish reporting a price target of just €13.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be €748.9 million, earnings will come to €69.4 million, and it would be trading on a PE ratio of 20.2x, assuming you use a discount rate of 7.9%.

- Given the current share price of €14.13, the analyst price target of €20.0 is 29.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Kempower Oyj?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.