Key Takeaways

- Strong expansion in North America, diversified customer base, and advanced technology drive robust revenue and margin growth prospects.

- Temporary regulatory challenges are offset by supportive government policies and internal efficiency improvements, strengthening long-term outlook.

- Unpredictable industry dynamics, reliance on non-recurring orders, and shifting regulatory support create heightened uncertainty for future revenue stability and margin performance.

Catalysts

About Kempower Oyj- Manufactures and sells electric vehicle (EV) charging equipment and solutions for cars, buses, trucks, boats, aviation, and machinery in Nordics, rest of Europe, North America, and internationally.

- The accelerating electrification of transport in both Europe and North America, supported by ongoing government incentives and emissions targets, is structurally expanding demand for DC fast-charging infrastructure-Kempower's record-high and broad-based order intake (up 37% YoY, with 150% order growth in North America) demonstrates direct exposure to this growth driver, which is likely to lift future revenues.

- Strong momentum in new market entries (notably North America, with a localized team and manufacturing), coupled with growing customer diversification (over 90 new customers in 1.5 years; 30% of order intake now from new clients), points to reduced dependency on mature Nordic markets and opens significant potential for sustained multi-year revenue expansion.

- Ongoing investment and leadership in modular scalable fast-charging technology and integrated software platforms (e.g., Kempower MORE and Chargie SaaS) enable the company to command premium pricing, win large and high-value fleet and infrastructure contracts, and build high-margin recurring revenues, supporting future gross margin and earnings growth.

- Regulatory headwinds in the US (e.g., shifting subsidy timelines) are mostly near-term in nature; the structural release of significant NEVI funding for fast-charging networks, and continuing vehicle electrification mandates, are expected to boost public and fleet charging deployment, underlining a clear revenue and order backlog catalyst for Kempower.

- Operational excellence initiatives-including cost controls and automation-have begun to improve cash flow and profitability despite sector-wide pricing pressures, suggesting further margin and EBIT improvement as scale increases and cost productivity initiatives mature.

Kempower Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kempower Oyj's revenue will grow by 32.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.7% today to 8.0% in 3 years time.

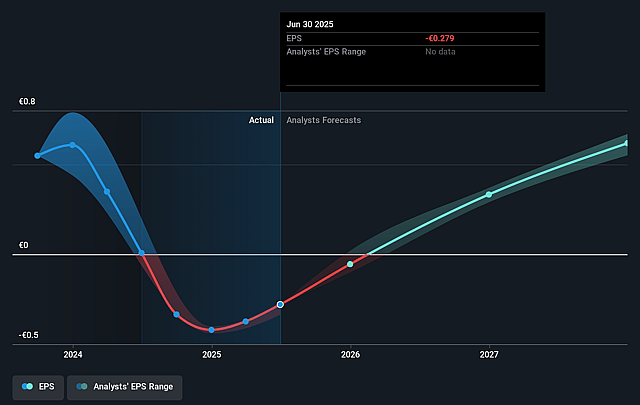

- Analysts expect earnings to reach €42.3 million (and earnings per share of €0.75) by about September 2028, up from €-15.4 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €30.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.0x on those 2028 earnings, up from -57.3x today. This future PE is lower than the current PE for the FI Electrical industry at 85.5x.

- Analysts expect the number of shares outstanding to grow by 0.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

Kempower Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company operates in a new, rapidly evolving, and highly competitive industry, with persistent price pressure in some markets and volatility in demand, which could compress gross margins and lead to greater unpredictability in earnings.

- Structural tailwinds such as government regulation and public subsidies are acknowledged to ebb and flow by region, and recent US policy changes (like expiring tax credits) pose a mid

- to long-term risk for demand, which could negatively affect revenue growth and order intake from critical markets.

- The order intake is supported partly by sizable, non-recurring orders and frame agreements that do not represent concrete, long-term financial commitments, potentially resulting in uneven revenue recognition and less predictable future revenue streams.

- Older, long-term customers still hold excess inventory, with normalization not expected until 2026, raising the risk of delayed purchases or lower future orders from this segment, which could impact near-term revenue and cash flow.

- The wide guidance range and company statements about ongoing industry volatility and uncertainty in market conditions imply significant forecasting risk, which can undermine market confidence and pressure the share price if expectations are not met or if guidance is further revised.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €16.75 for Kempower Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €20.0, and the most bearish reporting a price target of just €13.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €531.4 million, earnings will come to €42.3 million, and it would be trading on a PE ratio of 27.0x, assuming you use a discount rate of 7.4%.

- Given the current share price of €15.96, the analyst price target of €16.75 is 4.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.