Key Takeaways

- Leadership in automation, sustainability, and innovation positions Konecranes for sustained revenue growth, premium pricing, and higher margins as industries modernize and decarbonize.

- Expansion of high-margin service contracts and favorable regulatory dynamics support increased recurring revenue, reduced volatility, and potential market share gains in the long term.

- Heavy exposure to cyclical end-markets, currency risks, softening service demand, supply chain disruptions, and geopolitical tensions threaten revenue stability, growth visibility, and margins.

Catalysts

About Konecranes- Manufactures, sells, and services material handling products in Europe, the Middle East, Africa, the Americas, the Asia-Pacific, and internationally.

- The intensifying shift toward automation and smart manufacturing is driving strong demand for advanced port and industrial solutions (like electrified, automation-ready cranes), as reflected in Port Solutions' record order intake and margins; this is likely to accelerate top-line revenue growth as global investment in Industry 4.0 and port modernization continues.

- Rising sustainability requirements and tightening environmental regulations are propelling demand for energy-efficient, electrified cranes and eco-friendly solutions, areas where Konecranes has a deep offering; this supports both long-term revenue growth and margin expansion as customers pivot away from legacy diesel solutions.

- Strategic expansion of high-margin, agreement-based service contracts-demonstrated by continued growth in the service agreement base despite short-term order softness-will increase recurring revenue, reduce earnings volatility, and structurally improve group net margins over time.

- Growing investment in product innovation (digitalization, predictive maintenance, remote monitoring) enables Konecranes to command premium pricing and maintain differentiation as industries migrate toward intelligent, connected lifting equipment, supporting higher average selling prices and improved net margins.

- Looming regulatory restrictions on Chinese-manufactured cranes in North America and Europe could shift large-scale replacement orders to Western suppliers such as Konecranes, representing a significant long-term tailwind for revenue and global market share-even if this catalyst will play out over several years.

Konecranes Future Earnings and Revenue Growth

Assumptions

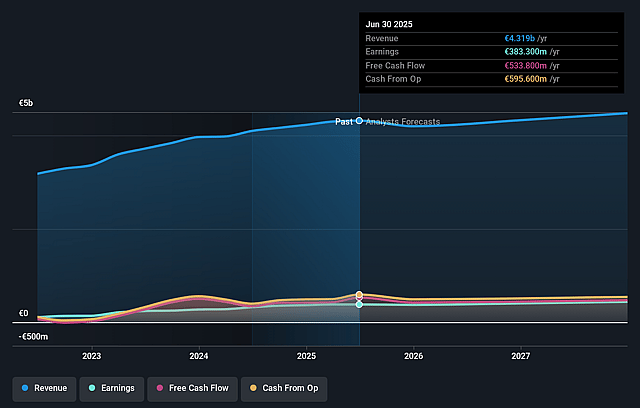

How have these above catalysts been quantified?- Analysts are assuming Konecranes's revenue will grow by 1.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.9% today to 9.8% in 3 years time.

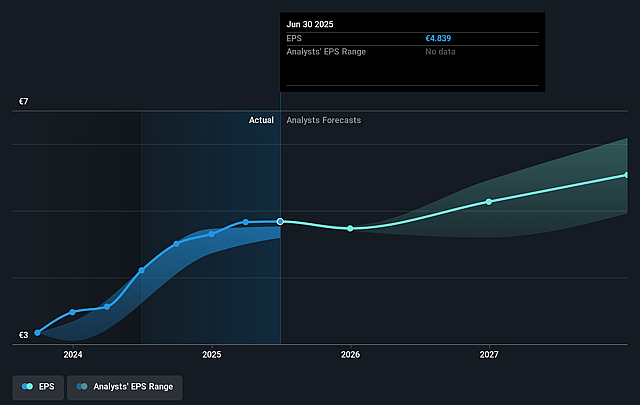

- Analysts expect earnings to reach €447.4 million (and earnings per share of €5.54) by about July 2028, up from €383.3 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €392.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 15.6x today. This future PE is lower than the current PE for the GB Machinery industry at 23.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.09%, as per the Simply Wall St company report.

Konecranes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Over-reliance on cyclical industrial and port end-markets exposes Konecranes to volatile order cycles and earnings instability, as highlighted by recent customer delays, cautious order placement, and lower second-half order book versus last year; this threatens revenue predictability and earnings visibility.

- Foreign exchange volatility and a strengthening euro are materially offsetting operating leverage gains and profit improvements, with hedging protections weakening in upcoming quarters; this creates a sustained risk to reported revenues and net margins.

- Early signs of softness and negative growth in Industrial Service and spare parts order intake across key markets (Americas and EMEA), along with only moderate agreement-base growth, signal possible structural weakness in long-term recurring revenues and service margins.

- Persistent delivery delays, logistical challenges, and customer hesitancy in both Americas and Europe reflect broader macroeconomic and supply chain uncertainties; if these trends persist, they may structurally lengthen sales cycles and impact both near-term and multi-year revenue growth.

- Heightened geopolitical and trade policy tensions (e.g., tariffs, U.S. restrictions on Chinese STS cranes) create both risks and uncertainties-despite long-term opportunities, timing remains unclear, and growing market fragmentation or regulatory change could diminish addressable market size and compress margins as supply chains shift.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €73.333 for Konecranes based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €93.0, and the most bearish reporting a price target of just €60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €4.5 billion, earnings will come to €447.4 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 7.1%.

- Given the current share price of €75.55, the analyst price target of €73.33 is 3.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.