Key Takeaways

- Rising automation and economic uncertainty threaten core product demand, while operational delays and hesitancy increase execution risks and earnings volatility.

- Intensifying competition, protectionism, and tariff risks may limit global expansion, exert ongoing margin pressure, and hinder revenue diversification.

- Global infrastructure trends, automation demand, and green technology adoption are positioning Konecranes for recurring, higher-margin growth and increased earnings resilience.

Catalysts

About Konecranes- Manufactures, sells, and services material handling products in Europe, the Middle East, Africa, the Americas, the Asia-Pacific, and internationally.

- Rising economic uncertainty, weakening industrial demand, and cautious investment behaviors-particularly among customers in the Americas and select European segments-are expected to depress order pipeline visibility and drive intermittent volume declines, directly constraining revenue growth for several consecutive quarters.

- The accelerating automation and adoption of advanced robotics in logistics and manufacturing could structurally depress demand for traditional crane and manual material handling solutions, undercutting Konecranes' core product sales and eroding long-term top-line potential.

- Heightened global protectionism, persistent tariff risks, and the potential for further fragmentation of trade policy may severely restrict Konecranes' access to critical growth markets, curtailing both revenue diversification and international expansion opportunities.

- Intensifying competition, especially from low-cost manufacturers in Asia, is likely to apply sustained downward pressure on pricing and net margins, while the risk of service commoditization threatens the company's higher-margin digital and lifecycle services over the medium to long term.

- Operational delays, ongoing customer hesitancy, and persistent delivery bottlenecks are compounding order conversion issues and increasing execution risk, which may drive operational disruptions and lower realized earnings versus expectations, especially if recent record margins prove unsustainable in a lower growth environment.

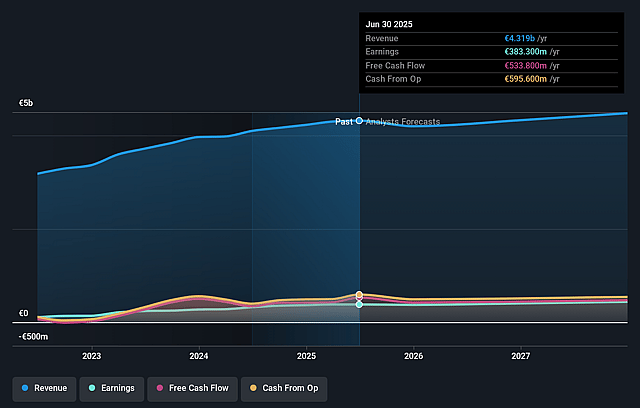

Konecranes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Konecranes compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Konecranes's revenue will grow by 1.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.9% today to 9.1% in 3 years time.

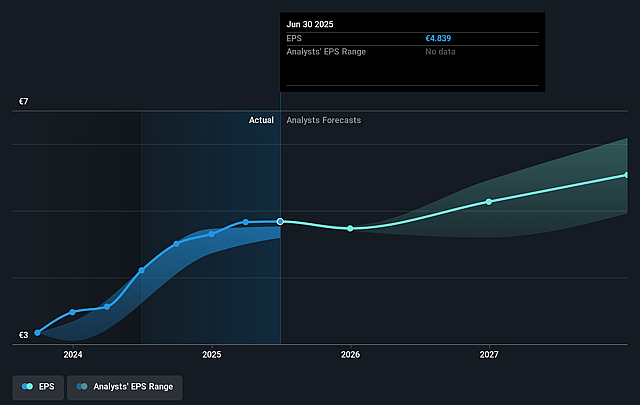

- The bearish analysts expect earnings to reach €406.7 million (and earnings per share of €5.13) by about August 2028, up from €383.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, down from 14.9x today. This future PE is lower than the current PE for the GB Machinery industry at 20.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.95%, as per the Simply Wall St company report.

Konecranes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Secular global trends in urbanization and infrastructure investment, particularly in emerging markets, are expected to sustain long-term demand for Konecranes' equipment and services, supporting revenue growth despite short-term macro volatility.

- The rapid growth in global trade and increasing port and supply chain complexity are driving higher need for advanced port solutions and automation, which aligns with Konecranes' strong Q2 order intake and record-high margins in the Port Solutions segment, potentially boosting both future revenues and profitability.

- Konecranes' ongoing expansion of lifecycle services and digital offerings, such as predictive maintenance and agreement-based growth in Industrial Service, is leading to recurring, higher-margin revenues and an improved EBITA margin, strengthening net earnings resilience.

- Industry-wide movement towards electrification, automation, and green technology-including regulatory support and environmental mandates-is increasing demand for electrified and automated lifting equipment, where Konecranes has a well-developed portfolio, positioning it for incremental sales growth and margin expansion.

- Strategic portfolio optimization, disciplined cost control, and a strong balance sheet give Konecranes financial flexibility for bolt-on acquisitions and operational improvements, which are likely to deliver further integration synergies and enhance long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Konecranes is €60.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Konecranes's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €93.0, and the most bearish reporting a price target of just €60.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €4.5 billion, earnings will come to €406.7 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of €71.9, the bearish analyst price target of €60.0 is 19.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.