Key Takeaways

- Konecranes is positioned for sustained market share and margin expansion due to supply chain resilience, favorable regulations, and strong pricing power.

- Investments in automation, digital services, and eco-efficient equipment are set to drive recurring revenue, diversification, and premium earnings quality.

- Exposure to weaker equipment demand, margin pressure from service contracts, currency headwinds, and structural shifts toward automation threaten profitability and long-term revenue growth.

Catalysts

About Konecranes- Manufactures, sells, and services material handling products in Europe, the Middle East, Africa, the Americas, the Asia-Pacific, and internationally.

- Analyst consensus expects Konecranes' flexible and multi-regional supply chain for port equipment to support growth, but this may materially understate the upside potential; ongoing geopolitical tensions and US legislation restricting Chinese competitors could drive a significant and sustained market share gain for Konecranes, which would accelerate revenue growth and improve gross margins far beyond consensus estimates.

- Whereas analysts broadly see price increases merely offsetting tariff impacts, early signs of positive pricing power and resilient demand point to the possibility that Konecranes can use pricing actions to structurally reset net margins at higher levels, particularly as cost inflation abates and as higher-margin services account for a greater share of mix.

- Konecranes is poised to unlock substantial long-term growth from the accelerating wave of automation and digitalization in global logistics and shipping, with its deep investments in smart, connected lifting solutions positioning it as a go-to partner for the coming era of automated ports and warehouses, potentially driving recurring revenue and margin expansion.

- The company's leadership in eco-efficient and hybrid/electric equipment, supported by rising global requirements for sustainability in port and industrial infrastructure, places Konecranes in a prime position to benefit from regulatory-driven replacement cycles, enabling robust top-line growth and sustainable improvement in gross margins over the next decade.

- Strategic expansion into new industry verticals such as aviation, energy, and process industries, combined with the roll-out of predictive maintenance and other advanced digital services, can significantly diversify Konecranes' revenue base and drive more resilient and higher-quality earnings growth, reducing cyclicality and supporting a higher earnings multiple.

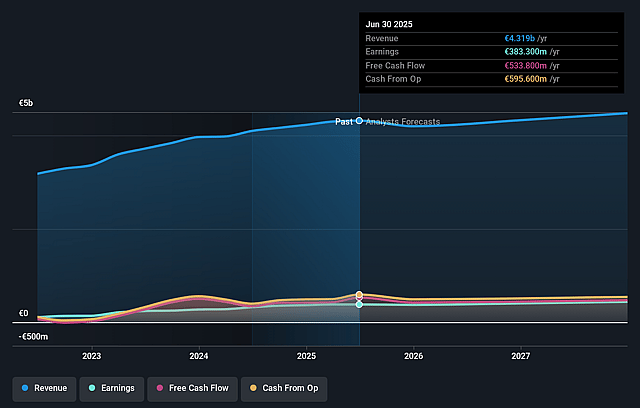

Konecranes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Konecranes compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Konecranes's revenue will grow by 2.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.9% today to 10.9% in 3 years time.

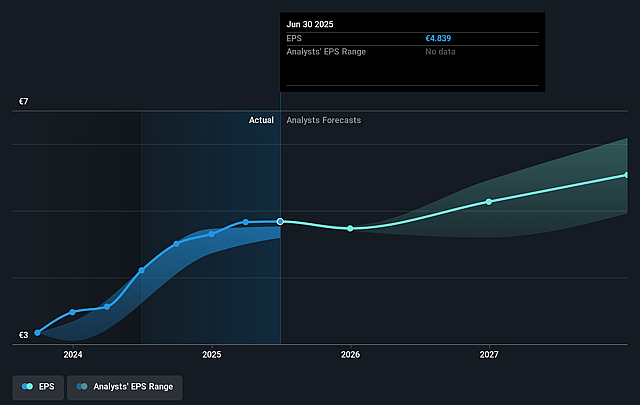

- The bullish analysts expect earnings to reach €508.5 million (and earnings per share of €6.83) by about September 2028, up from €383.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, up from 15.5x today. This future PE is lower than the current PE for the GB Machinery industry at 20.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

Konecranes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Konecranes' order book for the second half of 2025 is over €100 million lower than the same period in the prior year, reflecting declining backlogs in key segments, which may lead to a drop in revenue growth and a potential drag on future earnings.

- The company's Industrial Equipment segment reported falling sales and EBITA margin, with customer project delays and site acceptance issues attributed largely to cautious industrial clients in the U.S. and Europe, highlighting Konecranes' exposure to cyclical industrial capex and a risk to both near

- and long-term revenues and net margins.

- Service order intake turned negative year-over-year in both the Americas and EMEA, and while the contract base is growing, weaker spot and spare part sales could mean that lower-margin long-term service contracts will increasingly dilute company-wide profitability as equipment sales struggle to grow, putting pressure on net margins.

- Currency headwinds, including a strengthening euro, have significantly offset operating leverage gains and could continue to negatively impact both revenue and profit, as the company reports that hedging for FX will be increasingly less protective into the second half and future periods.

- While automation and advanced robotics adoption are recognized opportunities, they also pose a structural risk to demand for traditional lifting equipment, and Konecranes' reliance on legacy equipment sales in Industrial Equipment leaves it vulnerable to long-term secular shifts in customer buying preferences, threatening both revenue growth and future cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Konecranes is €95.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Konecranes's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €95.0, and the most bearish reporting a price target of just €68.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €4.7 billion, earnings will come to €508.5 million, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 6.9%.

- Given the current share price of €75.0, the bullish analyst price target of €95.0 is 21.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.