Last Update 01 Dec 25

Fair value Decreased 0.56%PRS: Higher Revenue Outlook And Discount Rate Shifts Will Drive Future Upside

Analysts have slightly lowered their price target for Promotora de Informaciones from €0.44 to €0.44. This adjustment is due to expectations of stronger revenue growth being offset by a higher discount rate and marginally reduced profit margin forecasts.

Valuation Changes

- Fair Value Estimate: Lowered marginally from €0.4425 to €0.44.

- Discount Rate: Increased slightly from 10.48% to 10.57%.

- Revenue Growth Forecast: Raised from 3.30% to 4.28%.

- Net Profit Margin: Reduced slightly from 4.81% to 4.71%.

- Future P/E Ratio: Decreased from 20.88x to 20.68x.

Key Takeaways

- Expansion in digital subscriptions and advertising enhances recurring revenue and market share, leveraging global demand for Spanish-language content.

- Streamlined operations, cost controls, and debt restructuring boost profitability and support reinvestment in digital growth.

- Persistent high leverage, structural industry shifts, and currency volatility threaten margins and earnings, while uncertain digital gains may not offset declining traditional revenues and order dependence.

Catalysts

About Promotora de Informaciones- Engages in the exploitation of media in Spain and internationally.

- Rapid growth in digital subscriptions for both Santillana (education) and EL PAÍS demonstrates the company's ability to capture a broader, digitally engaged audience, particularly as global broadband and smartphone usage expands; this boosts recurring revenue and improves revenue visibility.

- The company is benefitting from the ongoing migration of advertising budgets to digital platforms, with PRISA Media showing digital advertising outpacing declines in traditional channels and gaining market share in Spain and Latin America; this shift directly supports top-line growth and margin expansion.

- Rising global demand for Spanish-language content, especially among growing Hispanic populations in North and Latin America, gives PRISA's leading brands (EL PAÍS, Cadena SER, Santillana) a significant strategic advantage and monetization potential, which should positively impact long-term revenue and market share.

- Stringent cost controls, organizational restructuring, and the transition to a more digital-centric business model are improving operational leverage and EBITDA margins, indicating sustainable improvements in earnings and overall profitability.

- Recent debt refinancing extends maturities and lowers interest costs, enhancing financial flexibility and reducing near-term financial risk; this frees up cash flow for reinvestment in digital growth initiatives, supporting future net income growth.

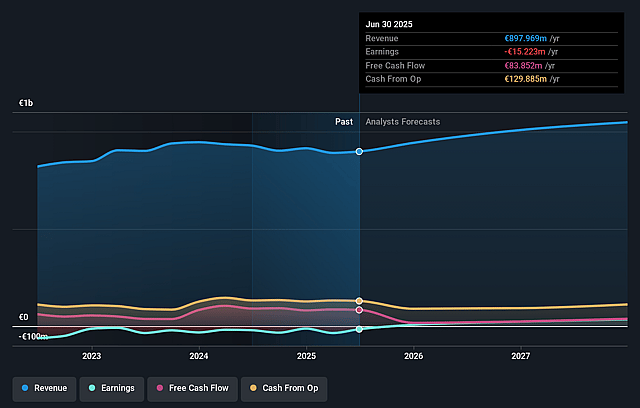

Promotora de Informaciones Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Promotora de Informaciones's revenue will grow by 6.7% annually over the next 3 years.

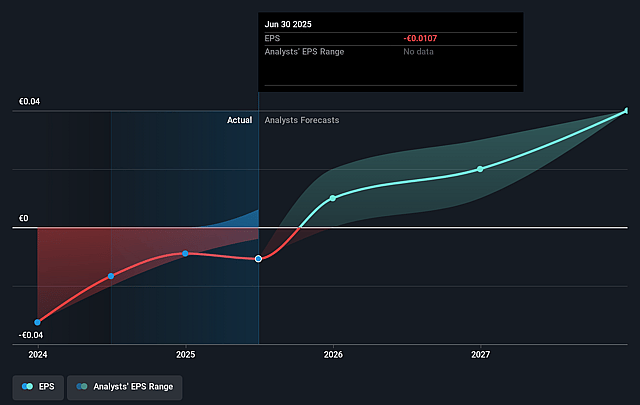

- Analysts assume that profit margins will increase from -1.7% today to 5.3% in 3 years time.

- Analysts expect earnings to reach €57.5 million (and earnings per share of €0.04) by about September 2028, up from €-15.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.4x on those 2028 earnings, up from -32.6x today. This future PE is greater than the current PE for the GB Media industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.32%, as per the Simply Wall St company report.

Promotora de Informaciones Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Promotora de Informaciones (PRISA) remains highly leveraged, with net financial debt at €777 million and a net debt-to-EBITDA ratio of 4.26x; persistent high leverage restricts financial flexibility, drives up interest costs, and puts pressure on net margins and earnings if deleveraging targets are not met.

- Structural challenges in the media industry, such as ongoing shifts from traditional media consumption and advertising (print and radio) to digital and social platforms, continue to undermine legacy revenue sources and put pressure on operating costs and margins.

- Intensifying FX headwinds in key Latin American markets (notably Argentina, Brazil, and Mexico) caused a €30 million negative impact on revenues and €8–9 million on EBITDA, and rapid or continued local currency devaluation could further erode revenue, net margins, and earnings from international operations.

- Dependency on large, cyclical, and unpredictable government education orders-such as the Brazilian Ensino Médio renewal and institutional sales to the Argentine government-introduces material revenue and earnings volatility; any delay or reduction in these orders can negatively impact top-line and EBITDA results.

- Despite progress in digital transformation and audience growth, there is ongoing uncertainty about whether subscription and advertising growth can offset print decline and fragmentation of consumer attention, which could limit long-term revenue growth and the company's ability to protect or raise margins as traditional business lines erode.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €0.49 for Promotora de Informaciones based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €0.65, and the most bearish reporting a price target of just €0.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.1 billion, earnings will come to €57.5 million, and it would be trading on a PE ratio of 19.4x, assuming you use a discount rate of 11.3%.

- Given the current share price of €0.37, the analyst price target of €0.49 is 24.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Promotora de Informaciones?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.