Catalysts

About Banco Santander

Banco Santander is a global universal bank focused on retail, consumer, corporate and investment banking, wealth management and payments across Europe and the Americas.

What are the underlying business or industry changes driving this perspective?

- Ongoing rate cuts in key markets such as Europe and Brazil risk exposing how dependent profitability has become on currently strong net interest margins and hedge contributions, which could pressure revenue growth once NII moves past its trough.

- The heavy reliance on large scale, group wide technology programs like ONE Transformation and Gravity creates execution and decommissioning risk, where delays or duplication of platforms could erode the expected efficiency gains and weigh on net margins.

- The ambitious shift toward fee driven businesses in areas like CIB, Wealth and Payments requires sustained high capital investment and talent retention in increasingly crowded markets, raising the possibility that revenue growth slows while costs remain structurally higher.

- Expansion of digital and consumer platforms, including Openbank and integrations with Santander Consumer Finance, increases operational and regulatory complexity at a time of tightening conduct and product rules, potentially lifting compliance costs and constraining earnings.

- Growing exposure to unsecured and cyclical activities such as U.S. auto, consumer finance and Latin American corporates in a still volatile macro backdrop heightens the risk that currently benign credit trends reverse, forcing higher loan loss provisions and reducing net income.

Assumptions

This narrative explores a more pessimistic perspective on Banco Santander compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

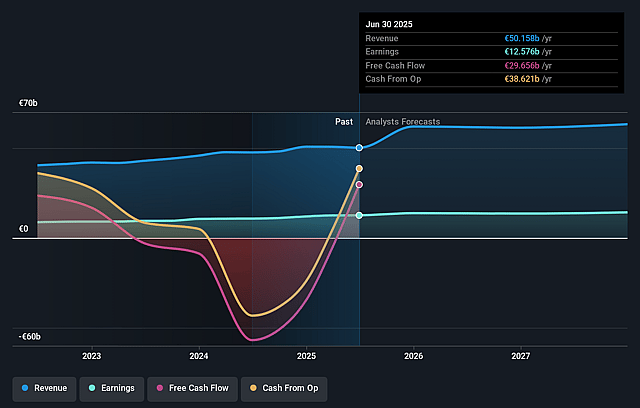

- The bearish analysts are assuming Banco Santander's revenue will grow by 8.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 25.3% today to 21.5% in 3 years time.

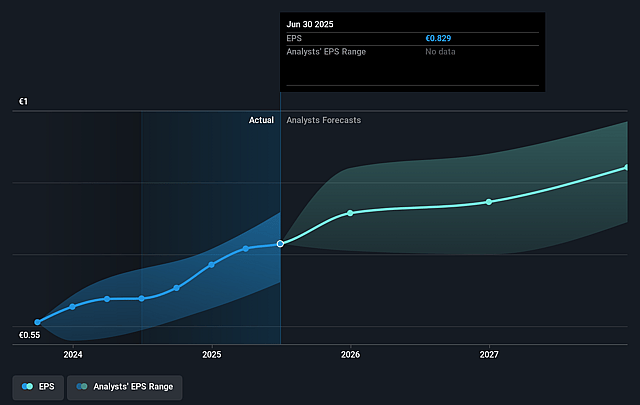

- The bearish analysts expect earnings to reach €14.0 billion (and earnings per share of €0.96) by about December 2028, up from €12.8 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as €16.7 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, down from 11.2x today. This future PE is lower than the current PE for the GB Banks industry at 11.3x.

- The bearish analysts expect the number of shares outstanding to decline by 2.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.44%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Santander is consistently delivering record profits with double-digit growth in earnings per share and a post AT1 RoTE already at 16.1% and trending toward 16.5%. If this is sustained, it would support higher valuations and long term earnings growth rather than a falling share price by reinforcing confidence in the durability of earnings.

- The bank is structurally shifting its mix toward fee driven businesses in CIB, Wealth and Payments. In these areas, fees are growing at high single to double digit rates and Wealth and Payments are posting very high RoTEs, which could underpin resilient revenue and net margins even as net interest income normalizes.

- ONE Transformation, Gravity and other global platforms are already lowering the cost base, improving the efficiency ratio to 41.3% and generating positive operating leverage. Further decommissioning of legacy systems and simplification could therefore expand net margins and long term earnings instead of compressing them.

- A strong capital position with a CET1 ratio at 13.1%, disciplined capital allocation and large scale buybacks equivalent to more than 15% of shares since 2021 provide capacity for ongoing distributions. This may support per share earnings and the share price even if headline revenue growth slows.

- Geographic and business diversification, with improving cost of risk across major markets, resilient labor markets and limited exposure to higher risk segments like private markets, could keep loan loss provisions contained and protect net income, mitigating downside from isolated macro or credit shocks.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Banco Santander is €7.1, which represents up to two standard deviations below the consensus price target of €9.53. This valuation is based on what can be assumed as the expectations of Banco Santander's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €11.1, and the most bearish reporting a price target of just €7.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be €65.0 billion, earnings will come to €14.0 billion, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 11.4%.

- Given the current share price of €9.78, the analyst price target of €7.1 is 37.6% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Banco Santander?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.