Key Takeaways

- Diversified global presence and operational efficiency support revenue growth and resilience as emerging markets expand and demand for advanced automotive components rises.

- Strong balance sheet, focus on sustainability, and ability to secure long-term contracts enable strategic growth and buffer against industry and regulatory challenges.

- Exposure to currency risk, market overcapacity, shifting global competition, reliance on mature regions, and underinvestment in innovation threaten CIE Automotive's growth and long-term competitiveness.

Catalysts

About CIE Automotive- Designs, manufactures, and sells automotive components and sub-assemblies.

- CIE Automotive's diversified global footprint and high capacity utilization in growth regions such as Brazil (near 90%+ utilization) and India (~80%) position the company to capture rising vehicle demand fueled by expanding middle classes and urbanization in emerging markets, which should drive revenue and provide resilience against regional downturns.

- The ongoing shift in the automotive sector toward electrification, evidenced by increasing sales of electrified vehicles in Europe and pro-EV policies in India, aligns with CIE's strategic focus on higher-value, technologically advanced components, supporting future revenue growth and expansion in net margins as content per vehicle rises.

- CIE's demonstrated operational excellence, with recurring EBITDA margins above 19% across all key geographies and disciplined cost control, supports sustained margin improvement and earnings resilience-mitigating headwinds from foreign exchange or slower traditional market growth.

- The company's robust balance sheet and reduced leverage (net debt/EBITDA at 1.2x, historic lows) create capacity for strategic M&A and further market consolidation, which, combined with strong cash flow, enables accretive growth and positions CIE to benefit from industry consolidation trends, likely driving future earnings accretion.

- CIE's proactive engagement in sustainability (benefiting from tightening ESG focus and emission regulations) and its established relationships with both legacy players and new entrants like Asian OEMs reinforce its ability to secure long-term contracts, thereby underpinning revenue visibility and reducing future margin volatility.

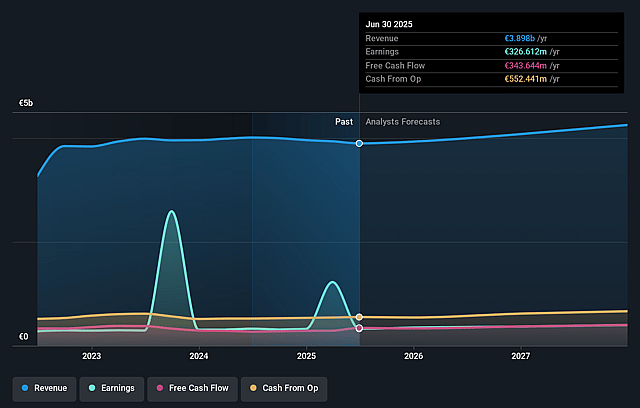

CIE Automotive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CIE Automotive's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.4% today to 9.6% in 3 years time.

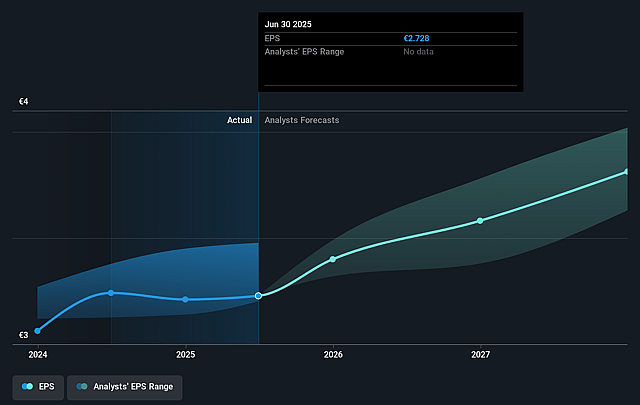

- Analysts expect earnings to reach €418.0 million (and earnings per share of €3.49) by about August 2028, up from €326.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, up from 9.6x today. This future PE is greater than the current PE for the GB Auto Components industry at 12.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.87%, as per the Simply Wall St company report.

CIE Automotive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Exchange rate volatility and persistent currency devaluations (notably in the dollar, rupee, and yuan) have already had a significant negative impact on sales and EBITDA, and if these trends continue or worsen in CIE's key growth markets (India, Brazil, China, North America), reported revenue, profits, and cash flow could remain under pressure, eroding shareholders' returns.

- Structural overcapacity and price wars in China-where capacity utilization rates are at historic lows, payment terms for suppliers are very long, and local competition is extremely fierce-threaten supplier margins and increase credit risk, while CIE's limited exposure to this growth driver (only 7% of the mix) means the company is unlikely to fully benefit from China's secular auto market expansion in revenue terms.

- Continued market share gains by Chinese OEMs in Europe and globally, as well as the increasing localization and self-sufficiency strategies of these entrants, may disrupt traditional supply chains, increase competition, erode CIE's bargaining power, and put downward pressure on future sales and margins.

- High reliance on cyclical markets in Europe and North America, which face ongoing production declines (forecasted drops of 3-4% in the coming years) due to transitionary consumer preferences (EVs/hybrids, urban mobility) and protectionist trade policies (tariffs, diminished exports), could cap medium-term revenue growth and expose CIE to greater demand volatility.

- Tight cost control and conservative CapEx have helped maintain historical margins, but underinvestment in innovation, R&D, and EV/hybrid technologies-especially as legacy ICE platforms decline-risks eventual product obsolescence and loss of competitive positioning, potentially reducing future earnings growth and ROIC.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €32.04 for CIE Automotive based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €34.5, and the most bearish reporting a price target of just €26.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €4.3 billion, earnings will come to €418.0 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 10.9%.

- Given the current share price of €26.3, the analyst price target of €32.04 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.