Key Takeaways

- Heavy reliance on a narrow product portfolio exposes Lundbeck to vulnerabilities from patent expirations and generic competition, potentially limiting long-term growth.

- Expansion into neuro-rare therapies and international markets faces challenges from high R&D costs, regulatory hurdles, and limited emerging market penetration.

- Heavy reliance on key brands, mounting generic threats, rising R&D costs, and limited emerging market exposure threaten Lundbeck's growth, margins, and long-term profitability.

Catalysts

About H. Lundbeck- Engages in the research, development, manufacturing, and commercializing pharmaceuticals for the treatment of psychiatric and neurological disorders in Europe, United States, and internationally.

- While Lundbeck's strong first quarter revenue growth of 16% and expanding gross margins demonstrate the company's ability to capture rising demand for CNS therapies amid an aging population and increased mental health awareness, future earnings face headwinds as key products like Brintellix and Abilify Maintena approach loss of exclusivity and subsequent generic competition, which could lead to revenue erosion in stable, mature markets.

- Although strategic brands now represent 77% of revenues and show robust double-digit growth, Lundbeck remains heavily reliant on a concentrated product portfolio, making it vulnerable to patent cliffs and increasing prevalence of generics, which may cap long-term revenue growth despite positive global demographic and healthcare access trends.

- While the company is making significant pipeline advances in neuro-rare and neuro-specialty areas, including multiple late-stage clinical trials and regulatory designations that could support future growth, historically high R&D costs and uncertainties around clinical trial outcomes may pressure margins if experimental compounds underperform or face regulatory hurdles.

- Despite expansion efforts in Europe, Japan, and selected international markets, Lundbeck continues to record limited penetration into faster-growing emerging economies, risking missed opportunities for accelerating revenue growth as healthcare access broadens globally and competition intensifies in core Western regions.

- Although operational efficiencies and capital reallocation have driven margin expansion and increased profitability, Lundbeck's exposure to price controls by global healthcare payers and the regulatory risks associated with increasingly complex CNS drug approvals may undermine future net margins and earnings, offsetting the benefits of current cost optimization strategies.

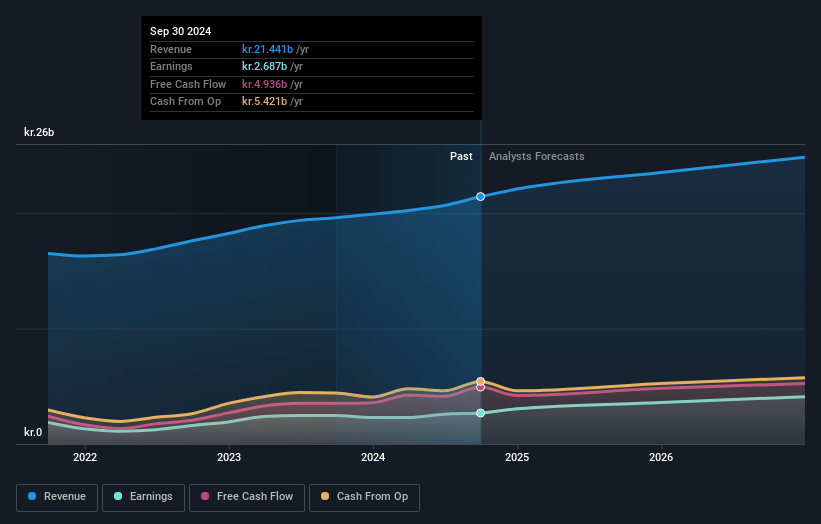

H. Lundbeck Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on H. Lundbeck compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming H. Lundbeck's revenue will grow by 2.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 14.3% today to 16.0% in 3 years time.

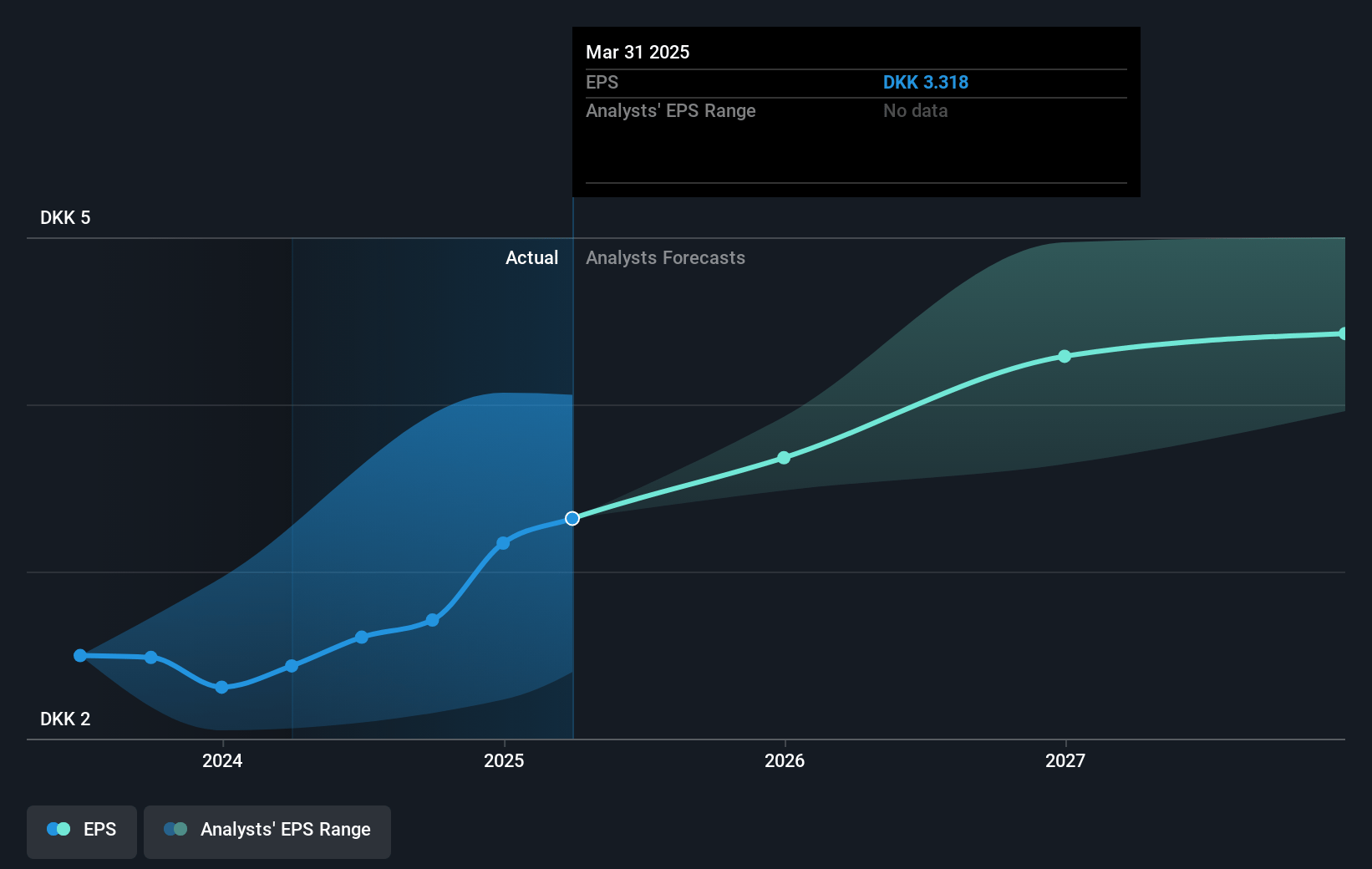

- The bearish analysts expect earnings to reach DKK 4.0 billion (and earnings per share of DKK 4.04) by about July 2028, up from DKK 3.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, up from 10.2x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 0.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.9%, as per the Simply Wall St company report.

H. Lundbeck Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lundbeck faces mounting risks from upcoming patent expiries and anticipated generic competition in key markets, including Brintellix in Canada and Abilify Maintena in Europe, which could lead to revenue declines and margin compression over the next several years.

- The company's commercial success remains heavily reliant on a handful of strategic brands such as Vyepti and Rexulti, and any underperformance, regulatory delays, or competitive launches in these franchises could significantly disrupt revenue and earnings.

- Long-term industry trends towards tighter drug pricing controls by global healthcare payers and potential policy changes like most favored nation pricing threaten Lundbeck's ability to maintain pricing power, thereby limiting future revenue growth and squeezing operating margins.

- Increased R&D costs, pipeline setbacks, and the slow progress or uncertain timelines in late-stage clinical trials (including bexicaserin and amlenetug) expose Lundbeck to ongoing risks of high expenses relative to potential returns, which may impact long-term profitability.

- The company's primary markets remain focused on North America and Europe, with limited exposure to high-growth emerging markets, restricting its ability to unlock new revenue streams and making it more vulnerable to mature market pressures on pricing and competition.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for H. Lundbeck is DKK38.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of H. Lundbeck's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK72.0, and the most bearish reporting a price target of just DKK38.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be DKK24.9 billion, earnings will come to DKK4.0 billion, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 4.9%.

- Given the current share price of DKK33.88, the bearish analyst price target of DKK38.0 is 10.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.