Key Takeaways

- Accelerating adoption of key products, premium pipeline assets, and global demand trends are set to drive sustained revenue growth and margin expansion beyond current expectations.

- Advanced R&D strategies and CNS biologics leadership position the company for resilient, high-margin growth and competitive differentiation in neurology markets.

- Heavy dependence on a few key drugs, looming patent expirations, pricing pressure, and high competitive and development risks threaten Lundbeck's future revenue stability and profitability.

Catalysts

About H. Lundbeck- Engages in the research, development, manufacturing, and commercializing pharmaceuticals for the treatment of psychiatric and neurological disorders in Europe, United States, and internationally.

- Analyst consensus expects strong revenue growth from Vyepti and Rexulti, but growth could surpass expectations given the accelerating adoption rates, best-in-class efficacy profiles, expanding indications, and fast-growing international presence, which together set the stage for Vyepti and Rexulti to achieve well beyond current peak sales assumptions, boosting both revenue and operating leverage.

- While analyst consensus highlights robust pipeline transformation, the rapid advancement and multi-indication potential of late-stage programs-such as the anti-PACAP antibody, bexicaserin, and amlenetug, which target large unmet needs in neurologic and rare CNS diseases-could drive a significant, sustained uplift in both revenue and net margins from premium pricing and potential orphan drug exclusivity well beyond consensus projections.

- Global neurological and psychiatric disorder prevalence is rising faster than forecasted, with destigmatization and improved mental health infrastructure in emerging markets set to unleash substantial untapped demand for Lundbeck's portfolio, supporting exponential long-term revenue growth and reducing earnings volatility.

- Lindbeck's early and aggressive adoption of innovative R&D approaches, including leveraging AI for drug discovery and biomarker-driven trial optimization, is accelerating time-to-market, lowering development failure rates, and enabling cost-effective scaling of cutting-edge assets-unlocking higher returns on R&D investment and expanding profit margins.

- The integration of Longboard and a diverse biologics/antibody pipeline positions Lundbeck as a leader in CNS biologics, a segment that is projected to command premium pricing and resilient demand, resulting in structurally higher average selling prices and long-term margin expansion compared to peers.

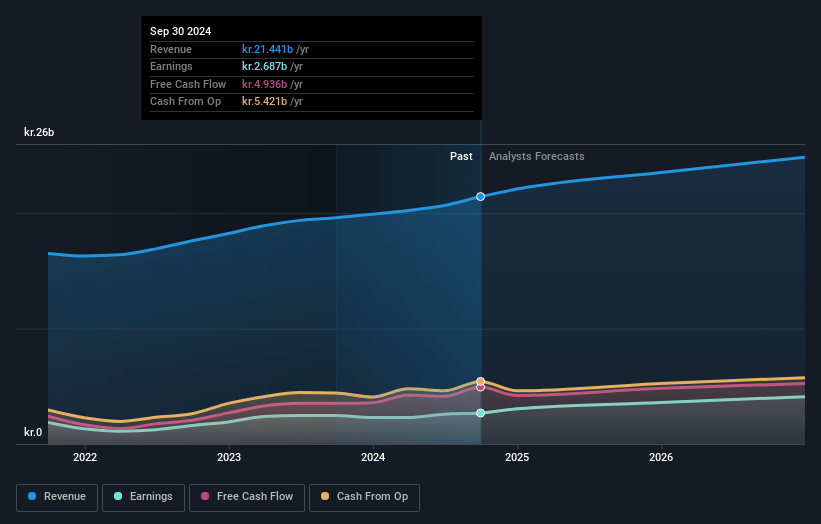

H. Lundbeck Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on H. Lundbeck compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming H. Lundbeck's revenue will grow by 6.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 14.3% today to 18.3% in 3 years time.

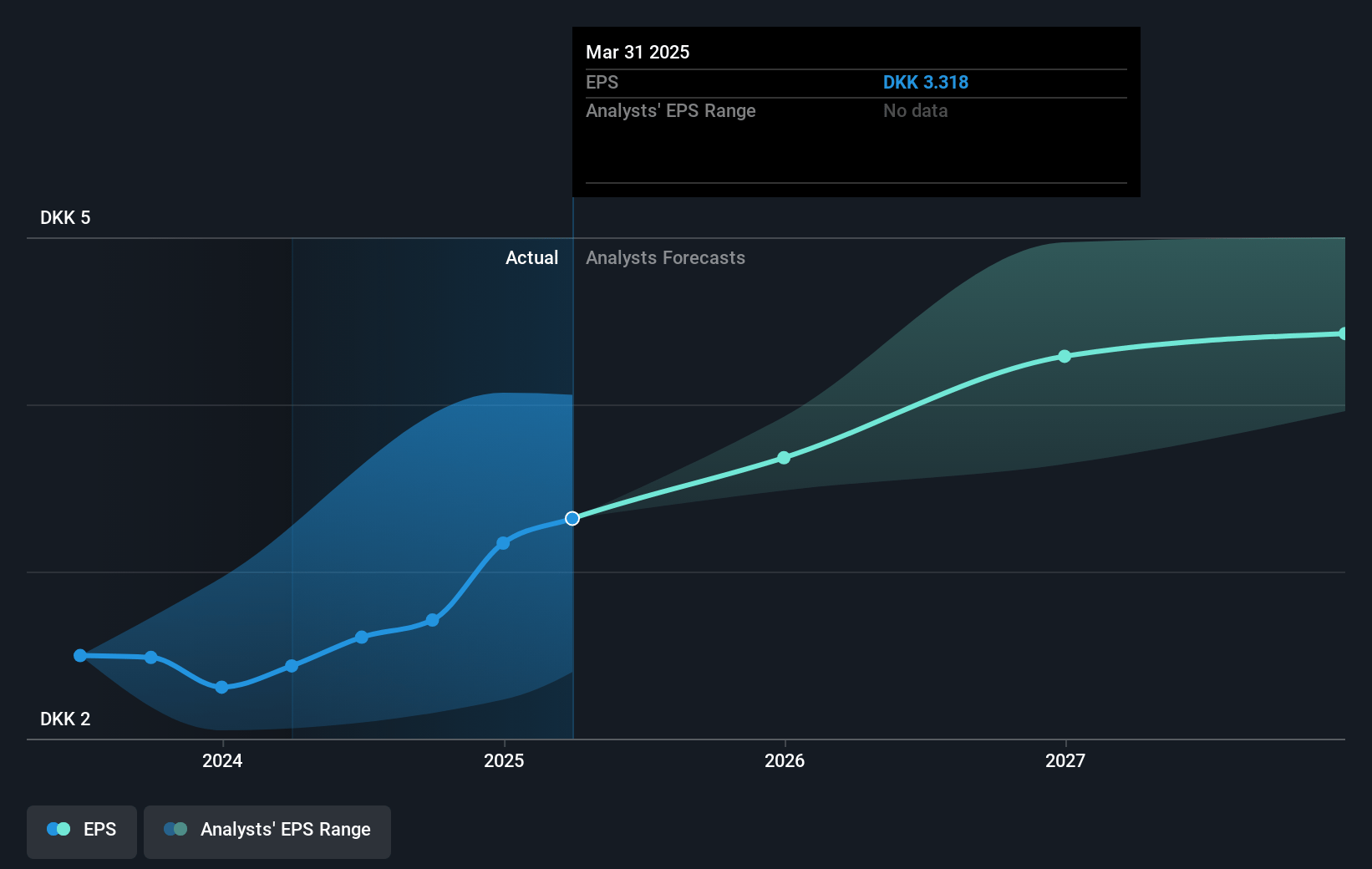

- The bullish analysts expect earnings to reach DKK 5.1 billion (and earnings per share of DKK 5.1) by about July 2028, up from DKK 3.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, up from 10.2x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 0.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.9%, as per the Simply Wall St company report.

H. Lundbeck Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lundbeck faces significant revenue and earnings risk from upcoming patent expirations and expected generic competition for major products like Brintellix (beginning in Canada during 2025), Abilify Maintena (expected in Europe in the latter half of 2025), and eventual loss of exclusivity for Rexulti, which could sharply erode revenue and compress net margins once generics launch.

- Over 77% of Lundbeck's revenue is concentrated in a handful of strategic brands, meaning any adverse events, regulatory changes, or competitive developments affecting these brands could lead to substantial revenue volatility and jeopardize earnings stability.

- Rising healthcare cost pressures and intensifying government scrutiny over global drug pricing, as highlighted in questions about drug price controls and most favored nation proposals, may limit Lundbeck's ability to increase prices for its CNS therapies, putting long-term revenue growth at risk and tightening net margins.

- Long and uncertain development timelines for new CNS drugs, combined with historically low R&D success rates in the field, mean Lundbeck's pipeline could underdeliver; setbacks such as delays in the anti-PACAP or bexicaserin programs or clinical trial failures would weigh heavily on future revenue and suppress earnings growth.

- The industry landscape is rapidly evolving, with increased competition from both large pharma and biotech entrants developing novel CNS technologies (such as gene therapies and digital therapeutics), potentially reducing Lundbeck's market share, putting pressure on future sales, and challenging the company's ability to maintain or grow profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for H. Lundbeck is DKK64.79, which represents two standard deviations above the consensus price target of DKK47.38. This valuation is based on what can be assumed as the expectations of H. Lundbeck's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK72.0, and the most bearish reporting a price target of just DKK38.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be DKK27.7 billion, earnings will come to DKK5.1 billion, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 4.9%.

- Given the current share price of DKK33.88, the bullish analyst price target of DKK64.79 is 47.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.