Key Takeaways

- Expanding the partner ecosystem, tech investment, and acquisitions are strengthening operational efficiency, revenue diversification, and long-term profitability.

- Broadening international reach and rapidly scaling product offerings are driving resilience and leveraging consumer demand for sustained revenue and earnings growth.

- Heavy reliance on partner acquisition and sector expansion, high return rates, transparency concerns, geographic concentration, and complex M&A integration all present significant operational and financial risks.

Catalysts

About Platform Group- Operates an online platform for premium and luxury fashion accessories in Germany, the Netherlands, Austria, the United Kingdom, Switzerland, France, Italy, and internationally.

- The ongoing expansion of Platform Group's partner ecosystem-including onboarding previously offline businesses and transforming acquisitions to platform models-positions the company to capture incremental revenue growth as e-commerce penetration deepens across traditional retail sectors.

- Investments in proprietary technology (such as platform software and the rollout of TPG Pay) and company-wide adoption of AI tools are expected to drive significant operational efficiencies and automation, supporting higher net margins and long-term profitability as cost structures improve.

- Targeted M&A (recent and pending acquisitions across new verticals like pharmaceuticals, optical/hearing, and international markets) enhances diversification of revenue streams and expands the addressable market, leading to a broader, more resilient top line over time.

- The company's ability to rapidly scale product assortment through a platform approach-shown by transformations such as Fashionette and Chronext-leverages consumer demand for convenience and a broader offering, directly translating into higher revenues and earnings.

- Platform Group's growing international presence (expansion beyond Germany/Austria/Switzerland/Netherlands with recent deals in France and prospective Eastern European moves) taps into rising middle-class consumer spending and urbanization in Europe, creating additional tailwinds for both revenue growth and earnings scalability.

Platform Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Platform Group's revenue will grow by 14.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.0% today to 4.2% in 3 years time.

- Analysts expect earnings to reach €40.6 million (and earnings per share of €2.1) by about September 2028, down from €44.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €67.6 million in earnings, and the most bearish expecting €31 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, up from 4.5x today. This future PE is lower than the current PE for the DE Specialty Retail industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 1.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.39%, as per the Simply Wall St company report.

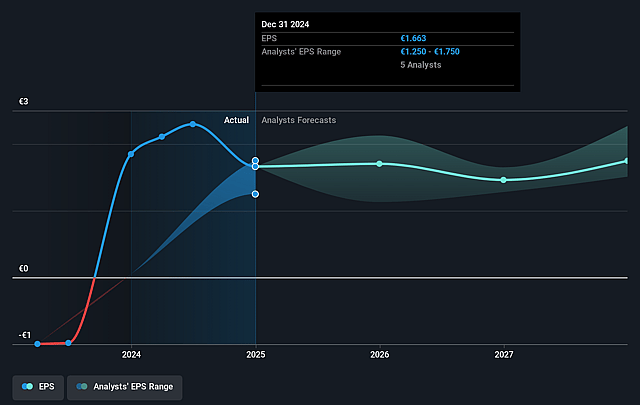

Platform Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Platform Group's heavy reliance on continuously onboarding new partners and products-especially in structurally stagnant or shrinking sectors like furniture and automotive-introduces execution risk; failure to maintain rapid partner acquisition or product expansion could stall growth and negatively impact long-term revenue.

- The company acknowledges sector-leading return rates (25–28% on average, up to 50% in some categories) that drive disproportionately high transportation and internal costs (over a third of logistics spend linked to returns), which could pressure net margins and reduce profitability if not effectively managed.

- Recent questions and media scrutiny regarding the company's accounts and auditor switches, combined with the shift from major audit firms (KPMG, EY) to a smaller boutique auditor, could undermine investor confidence, raising long-term risk over the accuracy or transparency of reported earnings and financials.

- Platform Group's current geographic concentration (75% of revenues in Germany, Austria, Switzerland, and Netherlands) exposes the company to regional macroeconomic, regulatory, or competitive risks; slow or unsuccessful international expansion could limit addressable market and constrain long-term revenue growth.

- Their M&A-driven growth strategy poses integration and scalability risks; as acquisitions increase, the complexity of consolidating diverse business models, adjusting to local market dynamics, and achieving promised synergies could weigh on operational efficiency, diluting earnings or leading to unexpected costs over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €18.417 for Platform Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €21.0, and the most bearish reporting a price target of just €16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €957.8 million, earnings will come to €40.6 million, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of €9.9, the analyst price target of €18.42 is 46.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.