Key Takeaways

- Diversification into new industries, partners, and strategic acquisitions boosts sustained revenue growth while reducing dependence on any single vertical.

- Enhanced logistics, fintech offerings, and scalable operations drive margin expansion and unlock new revenue streams as customer and transaction volumes rise.

- Heavy M&A dependence, margin pressures, rising financing costs, intense competition, and limited geographic diversification could constrain profitability and sustainable growth.

Catalysts

About Platform Group- Operates an online platform for premium and luxury fashion accessories in Germany, the Netherlands, Austria, the United Kingdom, Switzerland, France, Italy, and internationally.

- The continued expansion into additional industries (from 14 to 26 in three years) and active recruitment of new retail/manufacturer partners (expected to surpass 16,000 this year) positions the company to benefit from the increasing consumer migration to online marketplaces-driving sustained growth in product listings, customer acquisition, and ultimately, top-line revenue.

- The launch of a dedicated logistics hub and consolidation of decentralized logistics is set to deliver efficiency gains and cost savings (~€1.2–1.5M/year), supporting margin expansion and improved EBITDA as operational scale grows.

- Strategic acquisitions in fast-growing and high-value verticals (e.g., SaaS/banking technology, luxury/vintage platforms, pet food, and outdoor goods) diversify the business and capitalize on the rising adoption of platform-based and asset-light retail models-supporting long-term revenue growth and reducing reliance on any single vertical.

- Rollout of fintech/payment solutions (TPG Payment, Fintus acquisition) and data-driven service models are expected to unlock new ancillary revenue streams and enhance the value proposition for partners-positively impacting both revenue and earnings.

- Growing average order value, all-time high active customer numbers, and a scalable cost structure (with stabilized distribution and marketing costs) indicate increasing operational leverage as transaction volumes grow, supporting further improvements in net profit and margin.

Platform Group Future Earnings and Revenue Growth

Assumptions

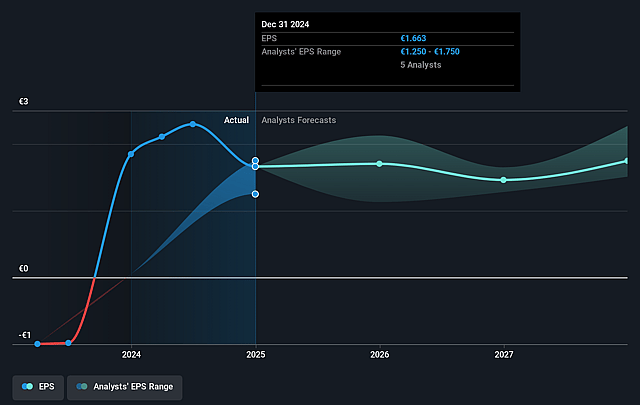

How have these above catalysts been quantified?- Analysts are assuming Platform Group's revenue will grow by 17.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.4% today to 4.1% in 3 years time.

- Analysts expect earnings to reach €35.6 million (and earnings per share of €1.75) by about July 2028, up from €33.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €46 million in earnings, and the most bearish expecting €30.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from 5.6x today. This future PE is lower than the current PE for the DE Specialty Retail industry at 14.5x.

- Analysts expect the number of shares outstanding to grow by 2.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.39%, as per the Simply Wall St company report.

Platform Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on continuous M&A for revenue and partner expansion may expose Platform Group to integration challenges, potential overpayment, and escalating operating expenses, ultimately pressuring net margins and future earnings if acquisition targets become less attractive or integration issues arise.

- Persistent gross margin contraction as a result of acquiring low-margin, high-GMV companies could signal structural profitability limitations, potentially constraining sustainable long-term earnings growth and reducing net margin quality over time.

- Elevated net leverage (projected at 2.3x year-end EBITDA) combined with steadily rising interest rates or tightening monetary conditions may increase financing costs and limit flexibility for future investments or acquisitions, weakening net profits and return on equity.

- Increased competition in key segments such as industrial goods-where margins are already low and competition is high-could erode pricing power and make further margin expansion difficult, directly impacting EBITDA and net profit growth.

- Risk of overdependence on European markets and limited presence in rapidly growing regions like the US may result in lost opportunities and higher vulnerability to European consumer confidence cycles, constraining revenue growth and earnings diversification in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €17.333 for Platform Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €865.7 million, earnings will come to €35.6 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of €9.3, the analyst price target of €17.33 is 46.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.