Key Takeaways

- Streamlined operations and acquisitions are expected to enhance earnings, boost AFFO per share, and improve margins.

- Rent growth and capital recycling support revenue expansion, balance sheet strength, and increased property appeal.

- Rent regulations and integration risks from BCP acquisition could impact revenue and net margins, while asset disposals are key to achieving LTV goals.

Catalysts

About LEG Immobilien- Operates as an integrated property company in Germany.

- The acquisition of the remaining shares in Brack Capital Partners (BCP) is expected to enhance earnings as LEG plans to streamline operations and improve margins, contributing to AFFO per share growth over the medium term. This will impact earnings positively.

- Rent growth momentum continues, evidenced by the strong rental growth figures and expectations for further increases in 2024 and 2025. This will support top-line growth and revenue expansion.

- Value-enhancing capital recycling through disposals at or above book value is aimed at optimizing the portfolio and reducing leverage, which will strengthen the balance sheet and support AFFO by lowering financial burdens and improving net margins.

- Investment in portfolio modernization and energy optimization strategies is expected to enhance property appeal and efficiency, supporting rental income growth and potential margin improvements.

- Continued use of favorable financing terms and refinancings facilitates cost control and efficiency, positively impacting net interest costs and supporting AFFO growth.

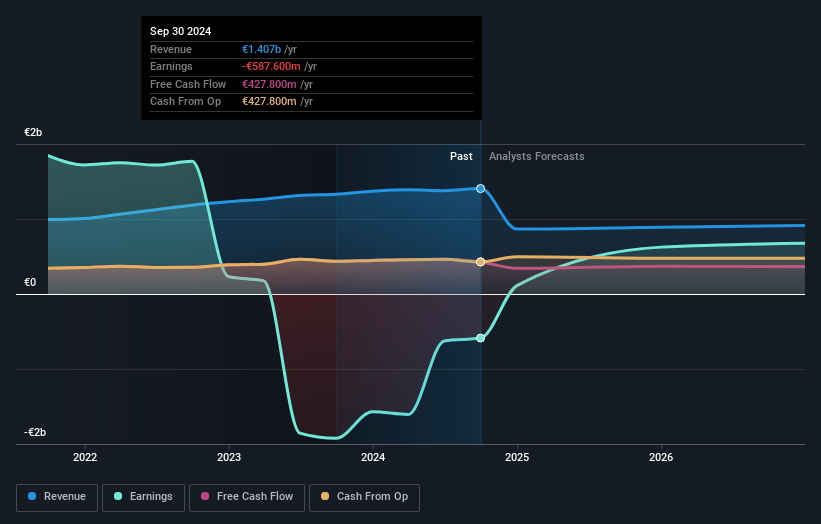

LEG Immobilien Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LEG Immobilien's revenue will decrease by -17.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -41.8% today to 98.8% in 3 years time.

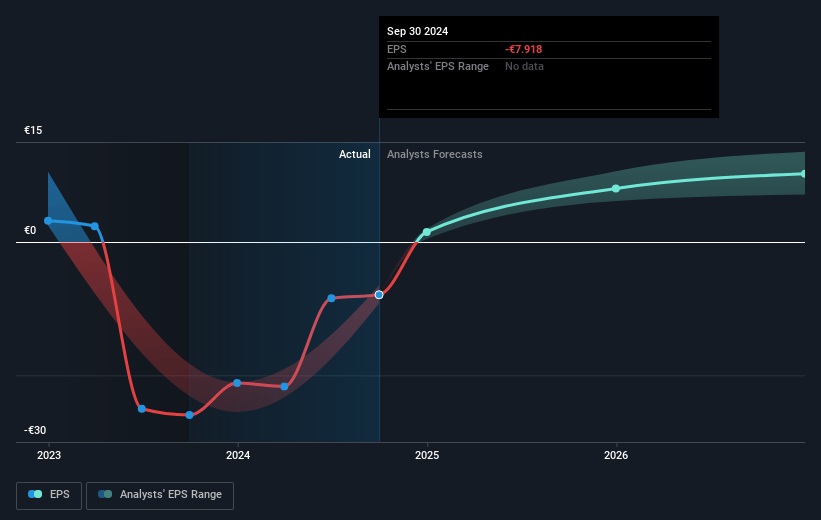

- Analysts expect earnings to reach €771.1 million (and earnings per share of €10.5) by about January 2028, up from €-587.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €529.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.3x on those 2028 earnings, up from -9.6x today. This future PE is lower than the current PE for the GB Real Estate industry at 13.9x.

- Analysts expect the number of shares outstanding to decline by 0.46% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.47%, as per the Simply Wall St company report.

LEG Immobilien Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a potential impact on the segment of the portfolio located in areas affected by rent regulations. If the rent cap is extended or becomes more stringent, it could limit rental growth and thus impact revenue.

- The acquisition of BCP could have integration risks, including higher personnel and administrative costs due to its complex corporate structure, potentially affecting net margins negatively in the short term.

- Estimated synergies from the BCP acquisition are expected to accrue over several years, and the near-term impact on AFFO (Adjusted Funds From Operations) may be neutral, delaying expected earnings benefits until 2027.

- Increased CapEx requirements for BCP properties compared to past investment levels could strain cash flow, challenging profitability targets and impacting net margins.

- The target of lowering the Loan-to-Value (LTV) ratio to 45% relies heavily on successful asset disposals, which could be challenging if market conditions deteriorate, potentially affecting future balance sheet stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €98.92 for LEG Immobilien based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €135.3, and the most bearish reporting a price target of just €80.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €780.3 million, earnings will come to €771.1 million, and it would be trading on a PE ratio of 11.3x, assuming you use a discount rate of 6.5%.

- Given the current share price of €75.46, the analyst's price target of €98.92 is 23.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives