Key Takeaways

- Robust financial strength and strategic land acquisitions position Instone to benefit from urban housing demand and capture market share from weaker competitors.

- Upcoming policy incentives and digital construction methods could further boost margins and revenue growth beyond current analyst expectations.

- Demographic trends, high rates, regional concentration, and cost inflation pose risks to Instone's growth, profitability, and balance sheet efficiency.

Catalysts

About Instone Real Estate Group- Develops residential real estate properties in Germany.

- While analyst consensus focuses on the marketing and presales launch of new projects boosting revenue, current retail sales are up 52% year-on-year even in seasonally weaker quarters; with institutional demand set to revive and sales launches in 10 to 15 projects this year, Instone could easily surpass consensus revenue expectations and achieve pre-crisis growth rates sooner than expected.

- Analysts broadly acknowledge Instone's strong financial position as enabling growth, but underestimate just how impactful the company's €250 million liquidity and low leverage will be-this unique war chest allows Instone to secure premium urban sites at distressed-market prices, positioning it to capture exceptional medium-term earnings and margin expansion through high-IRR deals.

- Dynamic rent growth and ongoing urban migration in Germany are compounding the already critical undersupply of new housing; Instone's strong pipeline in top metropolitan regions ensures it will benefit from enduring demand, driving recurring revenue and enabling further gross margin resilience.

- Instone's rapid adoption of digital, modular, and energy-efficient construction-combined with proven cost leadership-positions the company to deliver high-quality homes below market construction costs and seize market share from weaker rivals, directly supporting net profit margin growth.

- Intensifying policy momentum for housing affordability, sustainability, and accelerated approvals in Germany represents untapped upside: pending regulatory changes and tax incentives not yet factored into current planning could sharply lower Instone's effective costs and supercharge future project volumes, driving both revenues and bottom-line growth beyond consensus forecasts.

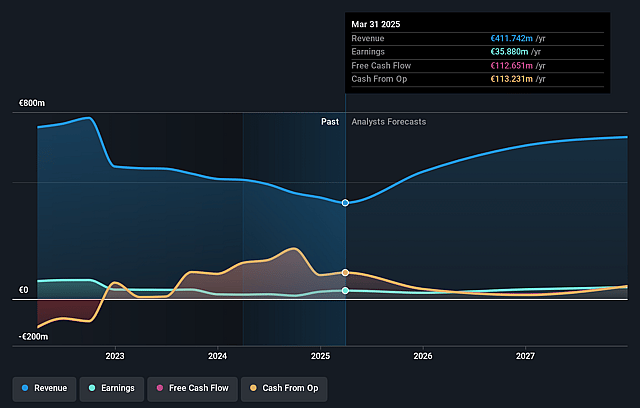

Instone Real Estate Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Instone Real Estate Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Instone Real Estate Group's revenue will grow by 24.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 8.7% today to 7.9% in 3 years time.

- The bullish analysts expect earnings to reach €62.5 million (and earnings per share of €1.44) by about July 2028, up from €35.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 11.1x today. This future PE is lower than the current PE for the DE Real Estate industry at 18.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.08%, as per the Simply Wall St company report.

Instone Real Estate Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent demographic decline and the aging population in Germany are likely to shrink the long-term demand for new residential properties, putting downward pressure on Instone's future revenue growth.

- Sustained high interest rates and reduced mortgage affordability could continue to depress sales velocity, particularly if institutional buyers do not return as expected, risking both near-term and long-term revenue and net earnings.

- Instone's high concentration in a few metropolitan areas leaves it exposed to regional downturns and local regulatory risks, which can amplify volatility and negatively impact overall earnings.

- A large land bank and ongoing acquisitions amid uncertain absorption rates may result in capital being tied up in slow-moving or impaired assets, threatening both balance sheet efficiency and future return on equity.

- Instone's reliance on fixed-price forward-sale contracts in an environment of ongoing construction cost inflation could compress gross margins over time, especially if cost pressures outpace the company's ability to manage or pass them on, thereby negatively affecting long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Instone Real Estate Group is €16.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Instone Real Estate Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €16.0, and the most bearish reporting a price target of just €9.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €789.8 million, earnings will come to €62.5 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 9.1%.

- Given the current share price of €9.21, the bullish analyst price target of €16.0 is 42.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.