Catalysts

About ProSiebenSat.1 Media

ProSiebenSat.1 Media is a European media group focused on TV broadcasting, streaming, advertising solutions and digital commerce assets.

What are the underlying business or industry changes driving this perspective?

- Joyn is scaling rapidly with double-digit growth in users, viewing time and AVoD revenues. However, the heavy dependence on a still small digital base compared to the shrinking high-margin linear TV business risks that overall entertainment revenues and group EBITDA remain under pressure for longer than expected, limiting earnings recovery.

- Investments in local and live sports content and expanded rights through 2031 should support long-term audience reach. However, persistently weak German GDP and structurally pressured TV ad budgets could prevent these content costs from being monetized fully, constraining net margins.

- The Everything on Joyn strategy and the NBCUniversal deal secure thousands of hours of premium content across TV and streaming. However, intensifying competition from global platforms and rising content costs may dilute pricing power in video advertising and slow revenue growth.

- Flaconi is delivering strong international expansion with improving EBITDA. However, e-commerce beauty remains highly competitive with ongoing marketing inflation, which could cap future margin gains and limit the contribution of Commerce & Ventures to group earnings.

- ParshipMeet’s refocus on the 40-plus demographic and cost measures are stabilizing profitability. However, structurally softer dating and video demand, plus changing user behavior, may delay any meaningful revenue turnaround and keep group net income subdued.

Assumptions

This narrative explores a more pessimistic perspective on ProSiebenSat.1 Media compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

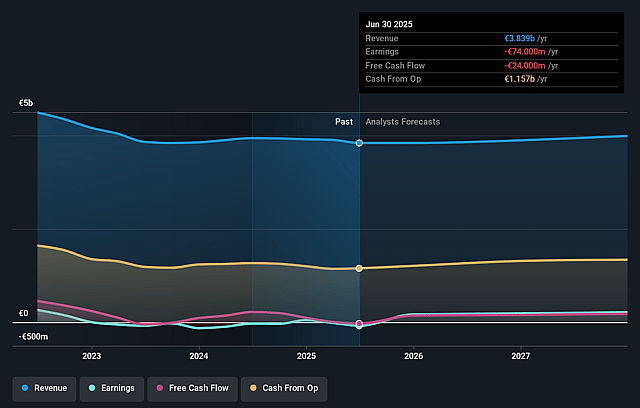

- The bearish analysts are assuming ProSiebenSat.1 Media's revenue will remain fairly flat over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.2% today to 4.1% in 3 years time.

- The bearish analysts expect earnings to reach €158.8 million (and earnings per share of €0.69) by about December 2028, up from €-6.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as €297.6 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.9x on those 2028 earnings, up from -177.7x today. This future PE is lower than the current PE for the GB Media industry at 29.9x.

- The bearish analysts expect the number of shares outstanding to grow by 2.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.38%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The long term shift of advertising budgets away from traditional linear TV towards digital formats, combined with ongoing macroeconomic weakness in Germany, could mean that TV advertising in the DACH region continues to decline rather than recover as hoped, putting persistent pressure on group revenue and adjusted EBITDA.

- Even though Joyn is growing users and AVoD revenues rapidly, its monetization may not scale fast enough to offset structurally shrinking high margin TV advertising, so the mix shift from linear to streaming could dilute profitability and keep net margins and earnings below expectations for several years.

- The Dating and Video segment is facing softer secular demand, intensifying competition and changing user behavior across multiple geographies, and if the strategic repositioning and cost actions fail to restore sustainable top line growth, this segment could remain a drag on consolidated revenue and earnings.

- Plans to utilize Joyn’s tax loss carryforwards and to reduce leverage depend on achieving sufficient future profits and executing portfolio disposals, so any prolonged earnings weakness, failed asset sales or an adverse change of control event could erode the anticipated tax and financing benefits, weighing on net income and free cash flow.

- Flaconi and the broader Commerce and Ventures portfolio are expected to deliver strong growth and improved margins, but if competitive intensity in beauty and lifestyle e commerce rises or international expansion underperforms, the segment may not generate enough incremental revenue and EBITDA to compensate for weakness in Entertainment and Dating.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for ProSiebenSat.1 Media is €5.5, which represents up to two standard deviations below the consensus price target of €6.74. This valuation is based on what can be assumed as the expectations of ProSiebenSat.1 Media's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €8.15, and the most bearish reporting a price target of just €5.5.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be €3.9 billion, earnings will come to €158.8 million, and it would be trading on a PE ratio of 10.9x, assuming you use a discount rate of 7.4%.

- Given the current share price of €4.7, the analyst price target of €5.5 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ProSiebenSat.1 Media?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.