Key Takeaways

- Successful transformation of B2C products and rapid M&A integration could drive revenues and margins well above current expectations.

- Unique digital offerings and AI-powered tools position Scout24 for further market expansion and superior long-term profitability.

- Heavy dependence on the German property market, rising interest rates, and evolving digital competition threaten Scout24's growth, margins, and advertising-driven income stability.

Catalysts

About Scout24- Operates ImmoScout24, a digital platform for the residential and commercial real estate sectors in Germany and internationally.

- Analyst consensus projects strong revenue and margin growth from B2B and B2C subscriptions, but this underestimates the potential for sustained double-digit growth, as Scout24 is successfully transforming B2C subscriptions like Tenant+ into a mass-market, commodity product with a total addressable market exceeding three million users, which could drive revenue meaningfully above current expectations.

- While analysts broadly expect further margin expansion from integration and operational leverage, current commentary signals that margin accretion from M&A could be both faster and larger than anticipated, as management is rapidly scaling underperforming acquired assets toward core margin levels, pointing to an upside surprise in net margins and earnings power.

- Scout24's Homeowner Hub, with 2.8 million objects under management and a fast-growing user base, uniquely positions the company to own the digital interface for residential sellers in Germany, creating a future data and revenue engine through lead generation, ancillary services, and high-margin cross-selling, all of which are currently not fully monetized or priced in and will enhance top-line growth.

- The accelerating rollout of AI-driven and highly personalized property search and transaction tools is poised to fundamentally increase platform engagement, retention, and pricing power, resulting in structurally higher average revenue per user, improved unit economics, and further net margin expansion.

- Ongoing urbanization, rising mobility, and the continued migration of real estate transactions to digital channels indicate that the penetration of online real estate solutions in Scout24's core markets remains in its early stages, suggesting a far longer runway for organic revenue growth and margin increases than is currently reflected in the company's valuation.

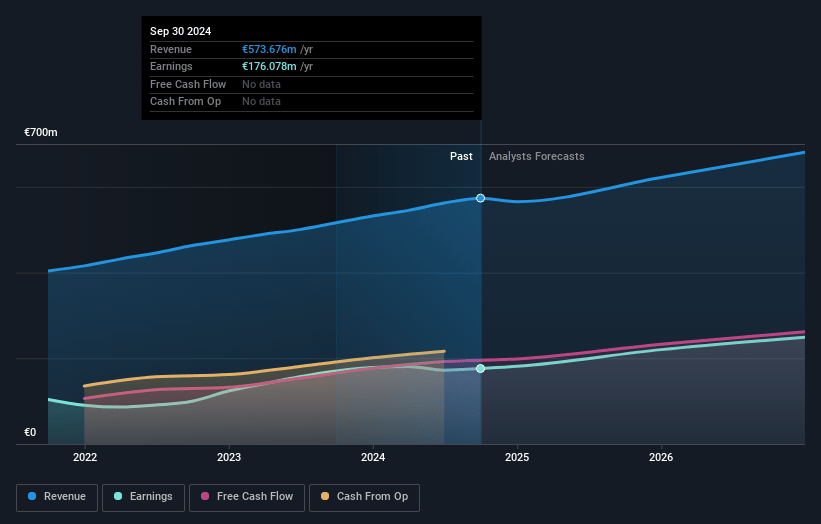

Scout24 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Scout24 compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Scout24's revenue will grow by 11.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 28.3% today to 41.9% in 3 years time.

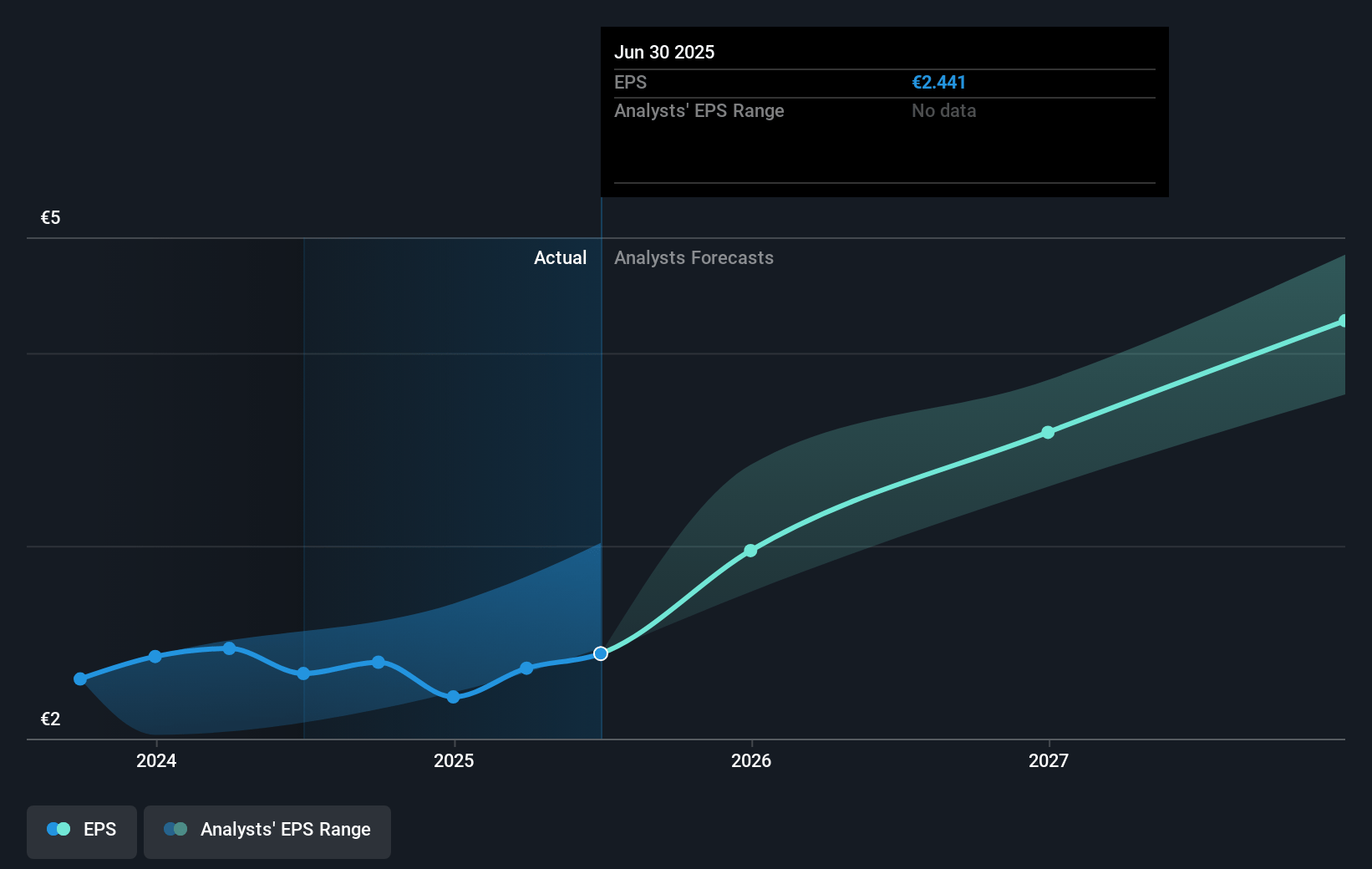

- The bullish analysts expect earnings to reach €354.5 million (and earnings per share of €4.93) by about July 2028, up from €172.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.9x on those 2028 earnings, down from 50.9x today. This future PE is lower than the current PE for the GB Interactive Media and Services industry at 50.1x.

- Analysts expect the number of shares outstanding to decline by 0.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Scout24 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent increases in German mortgage and interest rates, along with ongoing weakness in housing affordability and potential transaction slowdowns as buyers adopt a wait-and-see approach, raise the risk of declining property transaction volumes, which could negatively impact Scout24's core revenue and the growth trajectory of its transaction enablement and Professional segments.

- Heavy reliance on the German real estate market, with only early-stage expansion into Austria, exposes Scout24's revenues and earnings to local economic downturns, regulatory shifts, or housing market slumps, increasing the potential for revenue volatility and reduced net income.

- The digital advertising landscape faces ongoing downward pressure on pricing and effectiveness, as evidenced by year-on-year declines in third-party media revenues and greater focus on internal inventory, which may limit Scout24's average revenue per listing and slow advertising-driven income growth.

- Technological disruption in real estate, such as the rise of superapps, integrated marketplaces, or new digital transaction models, poses a competitive threat, and despite investment in AI and interconnectivity, Scout24's ability to sustain user attention and margin expansion could be diminished if newer entrants bypass traditional classifieds, leading to slower revenue growth and margin compression.

- The integration of recent acquisitions has been margin dilutive, with acquired assets entering at 10 to 20 percent margins, and although management expects improvement, continued M&A risk and the required investment in bringing margins up to group levels may suppress group profitability and delay earnings accretion, especially if synergies or integrations take longer than anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Scout24 is €140.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Scout24's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €140.0, and the most bearish reporting a price target of just €81.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €846.4 million, earnings will come to €354.5 million, and it would be trading on a PE ratio of 32.9x, assuming you use a discount rate of 5.9%.

- Given the current share price of €121.7, the bullish analyst price target of €140.0 is 13.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.