Key Takeaways

- Market optimism around green steel and digitalization may be overstated, given execution risks, high costs, and potential delays impacting profit growth and cash flow.

- Key business segments face weak demand and restructuring headwinds, while external risks may limit expected gains from defense, US growth, and sustainability trends.

- Strategic investments in defense, green technologies, and cost efficiencies, backed by a strong financial position, position the company for stable, long-term growth and resilience.

Catalysts

About thyssenkrupp- Operates as an industrial and technology company in Germany and internationally.

- The market appears to be pricing in overly optimistic expectations for the green transition, assuming that thyssenkrupp's investments in hydrogen-based steelmaking and decarbonization technologies will deliver significant margin expansion and premium pricing in the near term-despite execution risk, high upfront CapEx, ongoing restructuring, and the possibility of delayed regulatory tailwinds impacting future earnings and returns.

- Investor enthusiasm for the global shift toward green infrastructure and rising demand for sustainable steel is likely driving overvaluation, even though the company's main steel and automotive businesses are still experiencing weak volumes and underutilization, potentially limiting revenue growth in the near-to-mid term.

- There may be inflated assumptions about revenue acceleration and margin stability from Marine Systems due to the segment's strong order backlog and ongoing defense tailwinds; however, reliance on long-cycle, volatile contracts and the planned minority spin-off could introduce variability in future cash flows and consolidated earnings.

- Elevated expectations for North American Materials Services and US growth, supported by supply chain localization trends, may be overlooking continued headwinds in European markets, tariff and de-globalization risks, and the operational complexities and restructuring still underway-potentially overstating group-level EBITDA improvement.

- The company's disciplined CapEx allocation and digitalization/automation investments are being viewed as levers for significant future EBIT uplift, but if the adoption of advanced technologies and the commercialization of green steel is slower than anticipated, net margin and free cash flow growth may disappoint versus current high valuation multiples.

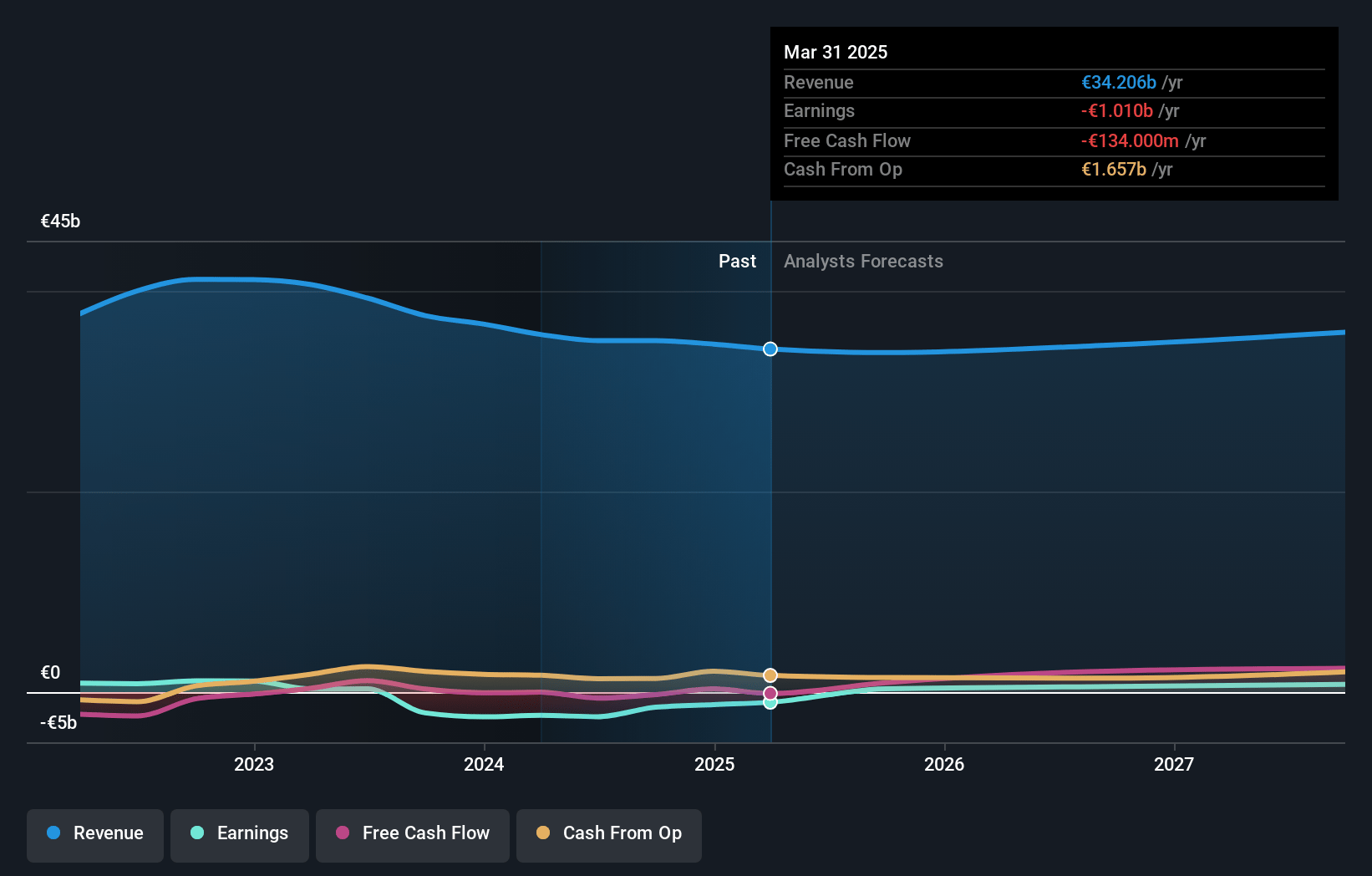

thyssenkrupp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming thyssenkrupp's revenue will grow by 2.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -3.0% today to 3.6% in 3 years time.

- Analysts expect earnings to reach €1.3 billion (and earnings per share of €1.25) by about July 2028, up from €-1.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.2x on those 2028 earnings, up from -6.9x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 20.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.57%, as per the Simply Wall St company report.

thyssenkrupp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Thyssenkrupp's Marine Systems business has secured significant new orders (including an extension for 2 submarines from Singapore) and holds a robust order book (>€16 billion), positioning this unit for sustained growth, enhanced profitability, and stable cash flows-supporting group earnings as global defense demand persists.

- Ongoing and accelerating investments in green technologies-such as the DRI plant at Steel Europe and Ude's NVinOx emission reduction technology-align the company with long-term decarbonization trends, improving regulatory positioning and unlocking higher-margin "green" contracts, which may uplift long-term revenue and net margins.

- The company's strong balance sheet, now effectively debt-free with €4 billion net cash and significant "hidden value" in the Elevator stake, provides financial flexibility for capex, restructuring, and strategic growth initiatives; this can cushion volatility and enable investments that enhance future earnings potential.

- Thyssenkrupp's restructuring (2,600 FTE reduction and ongoing cost-cutting programs) and procurement initiatives are already yielding operational efficiencies; such measures, alongside targeted growth investment-especially in profitable North American Material Services-are expected to drive margin improvement and EBIT growth over time.

- Management continues to emphasize discipline in capital allocation, focusing capex on business lines with demonstrated market demand (e.g., Marine Systems, North American Material Services, green steelmaking), suggesting long-term revenue growth and earnings resilience even as some core markets (like Steel Europe) undergo challenges.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €9.312 for thyssenkrupp based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €13.0, and the most bearish reporting a price target of just €6.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €36.8 billion, earnings will come to €1.3 billion, and it would be trading on a PE ratio of 5.2x, assuming you use a discount rate of 5.6%.

- Given the current share price of €11.14, the analyst price target of €9.31 is 19.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.