Key Takeaways

- Strong infrastructure investment and support for low-CO₂ steel production position Salzgitter to benefit from rising demand and margin expansion.

- Active cost management, digitalization, and a favorable shift in product mix are set to drive higher-quality, resilient earnings growth.

- Persistent weak demand, margin pressure, volatile sector exposure, heavy investment outlays, and rising uncertainty pose major challenges to future revenue stability and profitability.

Catalysts

About Salzgitter- Engages in steel and technology businesses worldwide.

- The anticipated increase in infrastructure investment in Germany (e.g., government-announced special funds) is expected to drive structural growth in demand for steel products like heavy plates and beams, which could bolster Salzgitter’s sales and revenue as these investments are converted into concrete orders over the coming quarters.

- Continued progress and strong public funding (€155m in Q1) for the SALCOS hydrogen-based steelmaking transformation positions Salzgitter to capture higher-margin, ESG-sensitive customer segments, potentially supporting revenue growth and margin expansion as global demand for low-CO₂ steel rises.

- The company’s active cost efficiency and strict inventory management programs have already demonstrated improvements in working capital and gross cash flow—even against a subdued macro backdrop—implying further upside to net margins and earnings as digitalization (Industry 4.0) initiatives deepen.

- Rising steel spot prices observed in the first quarter are not yet fully reflected in Salzgitter’s contracts (which typically roll over 6-12 months), suggesting upside potential for revenue and EBITDA in the second half of the year if the upward price trend continues.

- Increasing demand from the electrification (EVs) and renewable energy sectors should support a more favorable product mix and volume growth for Salzgitter’s value-added steel offerings, which could enhance average selling prices and provide more resilient, higher-quality earnings streams.

Salzgitter Future Earnings and Revenue Growth

Assumptions

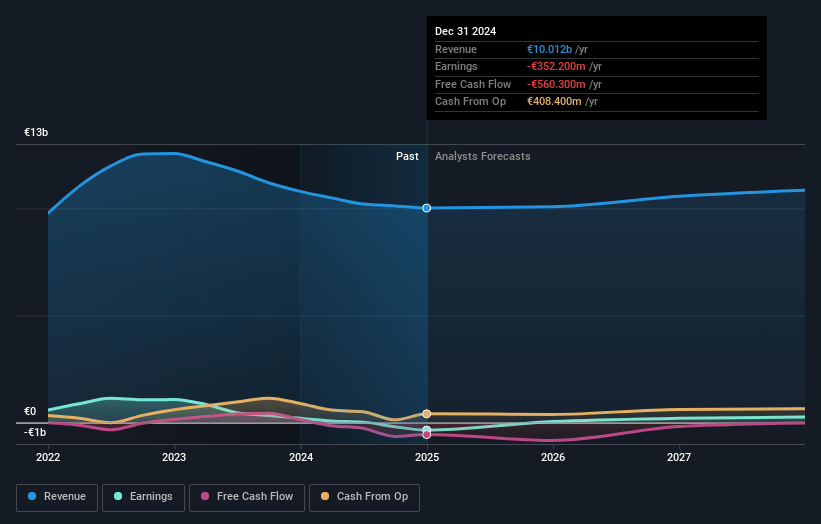

How have these above catalysts been quantified?- Analysts are assuming Salzgitter's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -4.1% today to 2.5% in 3 years time.

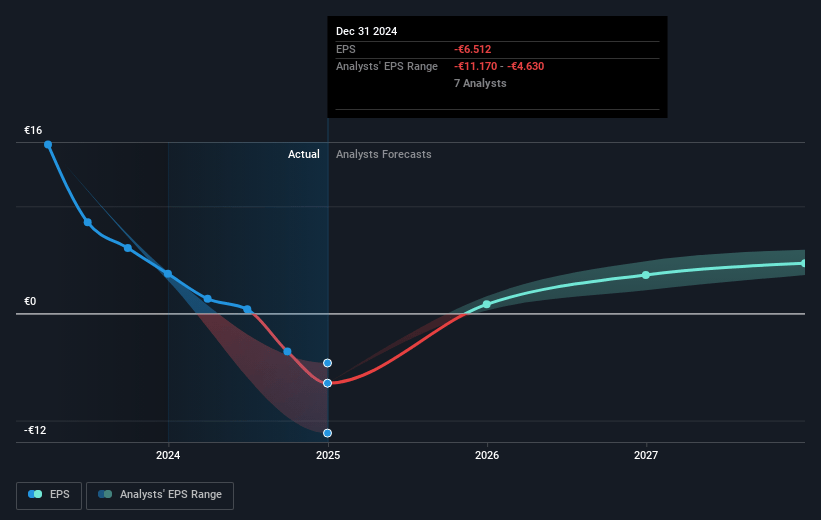

- Analysts expect earnings to reach €257.8 million (and earnings per share of €4.67) by about July 2028, up from €-400.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €323.5 million in earnings, and the most bearish expecting €139 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.6x on those 2028 earnings, up from -3.2x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 20.4x.

- Analysts expect the number of shares outstanding to decline by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.66%, as per the Simply Wall St company report.

Salzgitter Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing subdued economic forecasts for Germany and major economies, combined with delayed infrastructure spending and the absence of concrete order inflows, pose a risk of prolonged weak demand, which could continue to suppress Salzgitter’s revenues in the medium to long term.

- Decreasing average selling prices and lower sales volumes in the trading business, as reported for the first quarter, suggest persistent margin pressure and weaker top-line growth in the face of global overcapacity and rising competition from low-cost steel producers.

- Significant and sustained capital expenditures for SALCOS and other investment projects have pushed net debt to between -€1.5 billion and -€2 billion, with peak spending years straining free cash flow and potentially leading to higher financing costs and reduced net income if market conditions remain unfavorable.

- Heavy reliance on cyclical sectors such as automotive and construction, and the acknowledgment of OEM call-off behavior as a primary turnover driver, increases long-term earnings volatility; downturns or structural shifts in these sectors could result in sharp revenue and margin declines.

- Increasing operational and currency market volatility (as indicated by the €23 million negative effect from derivatives in Q1 and unpredictable FX trends), coupled with raw material price fluctuations, can introduce substantial unpredictability into earnings and margin planning, particularly if global trade tensions escalate.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €23.244 for Salzgitter based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €45.0, and the most bearish reporting a price target of just €15.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €10.2 billion, earnings will come to €257.8 million, and it would be trading on a PE ratio of 5.6x, assuming you use a discount rate of 5.7%.

- Given the current share price of €23.56, the analyst price target of €23.24 is 1.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.