Key Takeaways

- Rising environmental compliance costs and slow digital adoption threaten margins and long-term competitiveness across core segments.

- Heavy reliance on saturated markets and lagging diversification efforts limit revenue growth and strain balance sheet flexibility.

- Focus on specialty segments, local production, and efficiency efforts positions Evonik for resilient growth, improved profitability, and protection against global economic and regulatory challenges.

Catalysts

About Evonik Industries- Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

- Surging compliance and capital expenditures from tightening environmental regulations and the global shift toward sustainability are poised to erode net margins, as Evonik will be forced to absorb higher operating and upgrade costs that cannot be fully passed through to customers.

- Intensifying competition from emerging Asian chemical producers and the risk of increased imports to Europe due to shifting trade flows are likely to spark price wars and commoditization, driving down average selling prices and placing significant downward pressure on Evonik's long-term revenue growth.

- Persistently high exposure to mature specialty chemical markets and slow progress in diversifying away from legacy segments such as animal nutrition and basic performance materials constrains top-line growth, increasing the risk of revenue stagnation as these markets approach saturation.

- The necessity for substantial investment in energy transition technologies and circular economy production methods will require ongoing capital allocation, likely leading to balance sheet strain and limiting the company's ability to generate earnings growth while also maintaining dividend or buyback commitments.

- Slow adoption of digitalization and advanced automation relative to industry peers could leave Evonik with structurally higher production costs and operating inefficiencies, negatively impacting EBITDA margins and eroding competitive advantage over the long term.

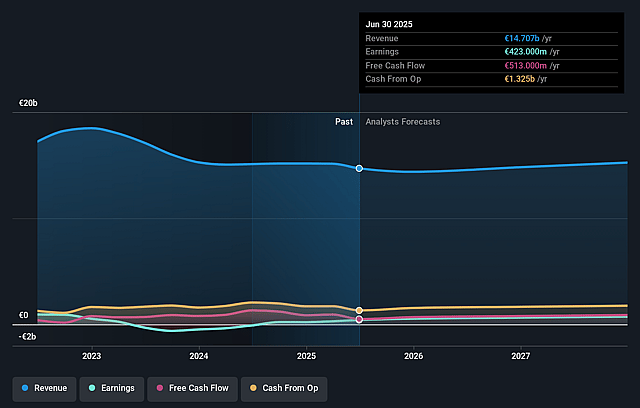

Evonik Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Evonik Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Evonik Industries's revenue will decrease by 0.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.0% today to 4.3% in 3 years time.

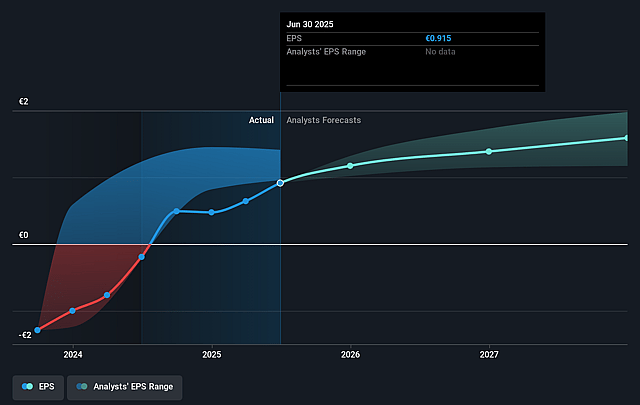

- The bearish analysts expect earnings to reach €661.5 million (and earnings per share of €1.42) by about June 2028, up from €299.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, down from 28.2x today. This future PE is lower than the current PE for the GB Chemicals industry at 20.0x.

- Analysts expect the number of shares outstanding to decline by 1.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.06%, as per the Simply Wall St company report.

Evonik Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing global demand for sustainable and specialty chemicals, combined with Evonik's strong focus on specialty additives and Nutrition & Care businesses, positions the company to benefit from structural volume growth and increased market share, which can support higher revenue over the long term.

- Strategic investments in local production across all major regions help shield Evonik from protectionist measures and tariffs, and offer resilience against global supply chain disruptions, likely protecting profitability and stabilizing margins.

- Participation in government-backed infrastructure programs, particularly in Germany and Europe, offers Evonik a substantial opportunity to benefit from policy-driven industrial growth and lower energy costs, which could boost both sales and operating margins.

- Robust cost-saving initiatives and disciplined cost control, as reflected in high double-digit million additional net savings and a focus on operational efficiency, strengthen operating results and support EBITDA and earnings growth even in challenging macro conditions.

- Sustained pricing power and record sales in core businesses such as methionine, supported by tight market conditions and successful global price increases of 5 to 8 percent, suggest continued strength in top-line growth and healthy net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Evonik Industries is €17.8, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Evonik Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €26.0, and the most bearish reporting a price target of just €17.8.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €15.3 billion, earnings will come to €661.5 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 6.1%.

- Given the current share price of €18.08, the bearish analyst price target of €17.8 is 1.6% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives