Last Update01 May 25

Key Takeaways

- Strategic cost-saving initiatives and focused portfolio management may drive improved margins and operational efficiency.

- Expansion in China and shareholder-focused actions could enhance growth and investor confidence despite short-term operational challenges.

- BASF faces potential revenue risks and margin pressures due to currency headwinds, declining volumes, and challenging market conditions across segments.

Catalysts

About BASF- Operates as a chemical company worldwide.

- BASF is expected to achieve substantial cost savings, with plans to reach €2.1 billion in annual cost savings by the end of 2026. This should help improve net margins as cost reduction initiatives continue to unfold.

- The startup of the Zhanjiang Verbund site in China in the second half of 2025 is anticipated to drive future growth. Though it will initially create a burden on EBITDA, once operational, it is expected to support revenue growth and enhance production capacity.

- BASF's active portfolio management, including the sale of the decorative paints business and exploration of strategic options for Coatings activities, aims to unlock value and focus on core businesses, potentially leading to improved earnings and operational efficiency.

- The company's commitment to attractive shareholder returns, including planned billion-euro share buybacks and increasing dividends, may boost investor confidence and enhance earnings per share.

- Rebuilding Nutrition & Care production capabilities following the iso-Phytol plant outage is expected to restore volumes and revenues in the second half of 2025, aiding recovery and future growth within that segment.

BASF Future Earnings and Revenue Growth

Assumptions

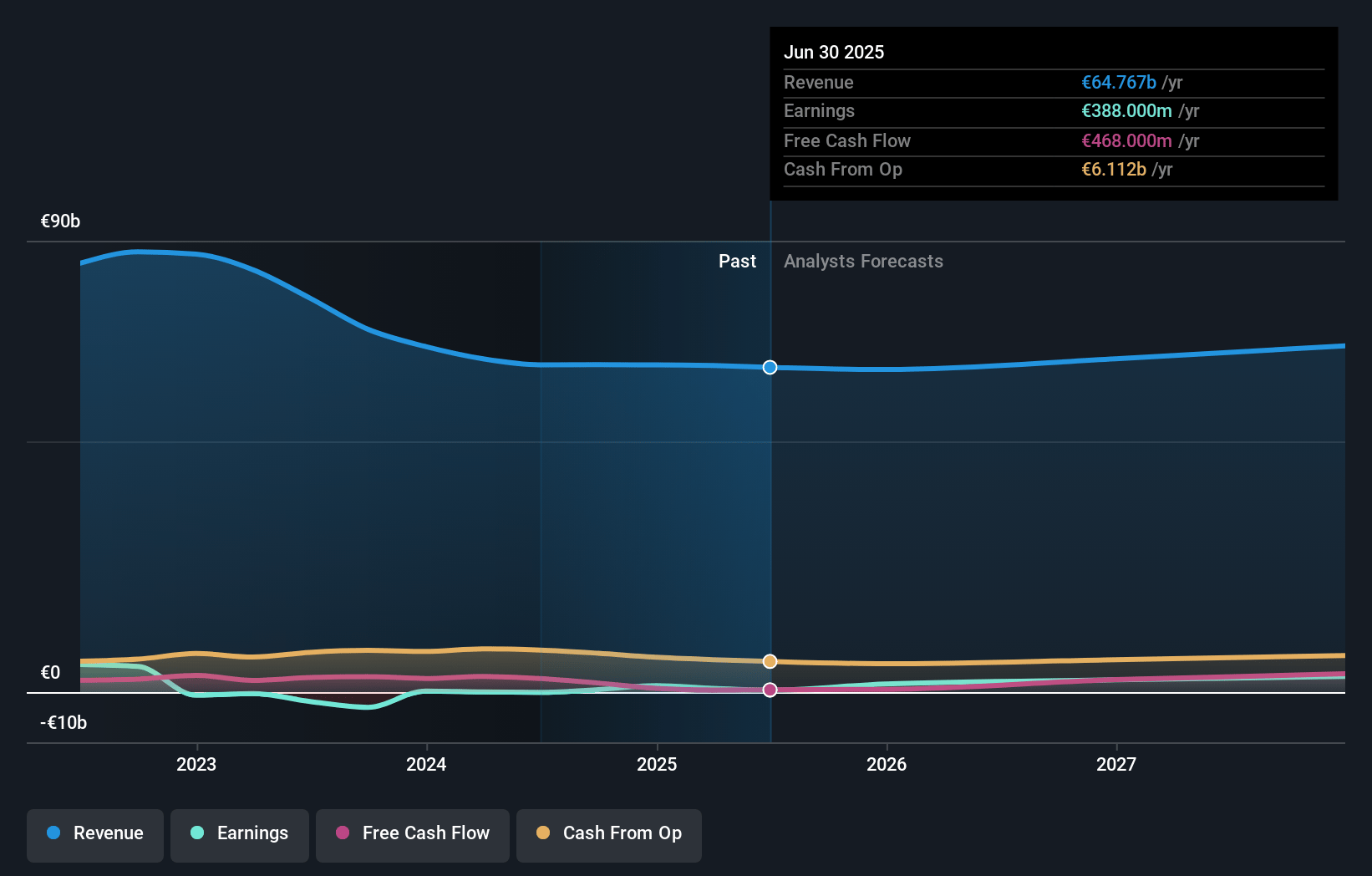

How have these above catalysts been quantified?- Analysts are assuming BASF's revenue will grow by 3.3% annually over the next 3 years.

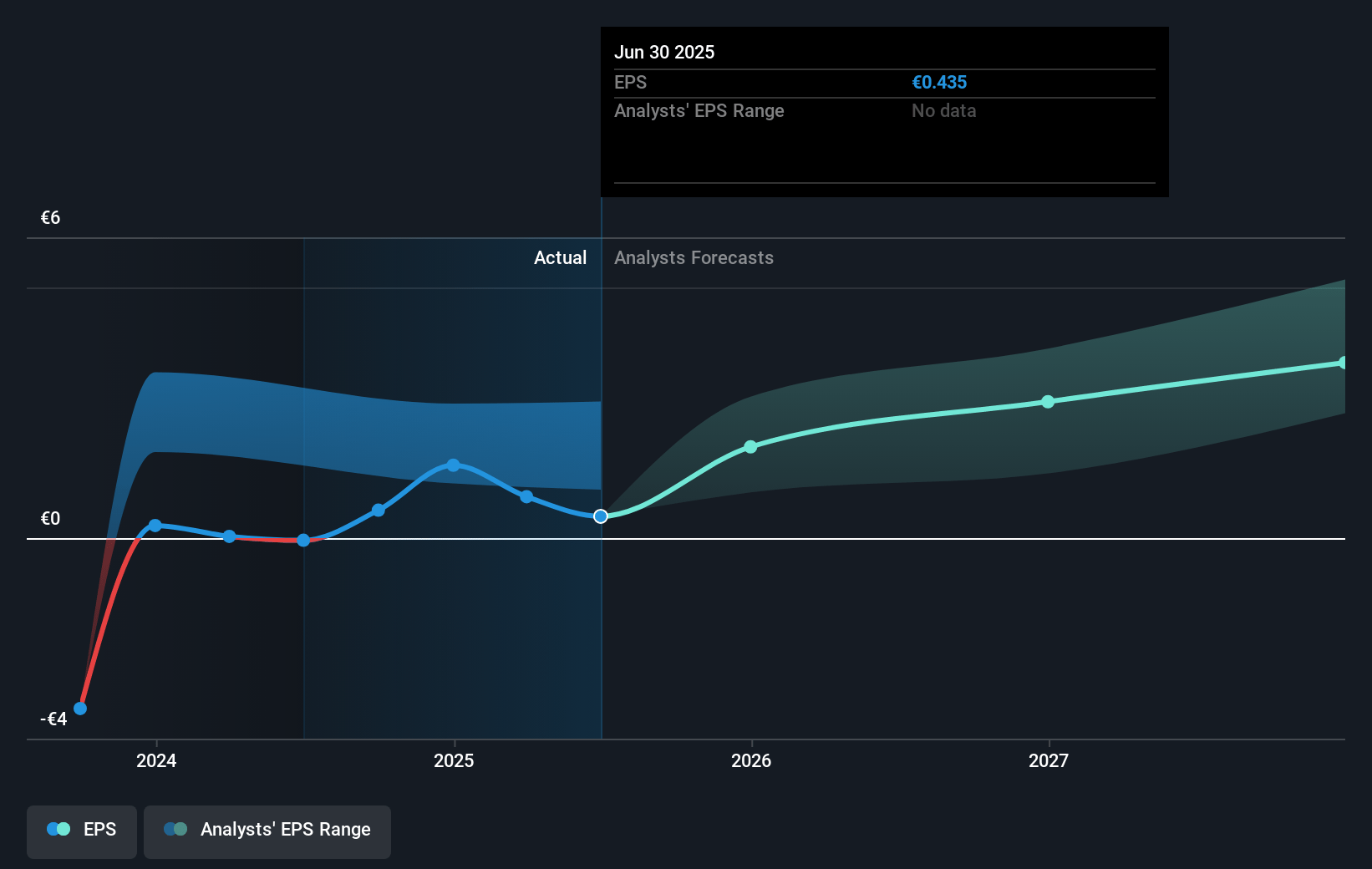

- Analysts assume that profit margins will increase from 2.0% today to 4.9% in 3 years time.

- Analysts expect earnings to reach €3.5 billion (and earnings per share of €4.03) by about May 2028, up from €1.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €4.6 billion in earnings, and the most bearish expecting €2.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, down from 30.7x today. This future PE is lower than the current PE for the GB Chemicals industry at 17.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.11%, as per the Simply Wall St company report.

BASF Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Currency headwinds were mentioned as a factor that slightly dampened sales growth, particularly related to the Brazilian real, which could impact revenues.

- In the Materials segment, decreased volumes in the Monomers and Performance Materials divisions were observed, and specific margins improved, yet overall EBITDA before special items declined slightly, indicating potential pressure on future earnings.

- Despite the slight volume growth in some segments, the Industrial Solutions segment experienced a decline in specific margins and EBITDA before special items due to lower contributions from both divisions, potentially affecting net margins.

- The Surface Technologies segment faced challenges with lower volumes in mobile emission catalysts and precious metals services, which could affect future revenues and net margins as the ICE vehicle proportion continues to decline.

- Market conditions in the Agricultural Solutions segment, characterized by high channel inventories, low customer demand, and falling prices, resulted in earnings decline compared with a record prior year, posing risks to revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €52.318 for BASF based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €65.0, and the most bearish reporting a price target of just €37.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €71.9 billion, earnings will come to €3.5 billion, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 6.1%.

- Given the current share price of €44.63, the analyst price target of €52.32 is 14.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.