Key Takeaways

- Specialty Chemicals segment is set for outsized growth and margin improvement, fueled by strong demand, early contract wins, and new U.S. defense market opportunities.

- Innovations in green chemistry, crop nutrition, and operational optimization provide a lasting competitive edge, driving premium pricing and sustainable above-peer margin expansion.

- Robust specialty chemicals growth, supported capacity investments, strong customer demand, and favorable trade dynamics position the company for sustained earnings improvement despite industry risks.

Catalysts

About AlzChem Group- Develops, produces, and markets a range of chemical specialties in Germany, European Union, rest of Europe, Asia, NAFTA region, and internationally.

- While analyst consensus expects the Specialty Chemicals segment to deliver robust growth and margin expansion driven by capacity additions, the strong customer prepayments and significant early contract commitments indicate demand is likely to outpace current expectations, suggesting a far steeper ramp in revenue and EBITDA from 2027 accompanied by potential further upside in margins as utilization rates exceed plan.

- Analyst consensus believes the U.S. Nitroguanidine expansion and DoD collaboration could open new revenue streams, but early site selection, speed of negotiations, and the U.S. DoD's willingness to fund development imply a much swifter U.S. plant commissioning and larger profit pool, setting up AlzChem for substantial multi-year step-changes in earnings and global market share in defense chemicals.

- In light of growing global requirements for food security and sustainable agriculture, AlzChem's innovation in high-purity crop nutrition products positions it to rapidly accelerate revenue within the Specialty segment and capture a disproportionate share of gains as demand climbs due to population growth and regulatory tailwinds.

- The accelerated shift toward green chemistry and decarbonization in high-value industries is poised to benefit AlzChem's advanced synthesis platforms, allowing it to command premium pricing in pharma, electronics, and energy storage markets, which is set to materially increase EBITDA margins and shift the revenue mix towards higher-margin, specialty applications.

- AlzChem's expanding vertical integration, operational optimization with AI-driven energy management, and first-mover advantages from early strategic partnerships are giving it a durable cost and innovation lead, likely enabling scalable, capital-light growth and outperformance in net margins versus both peers and historic averages.

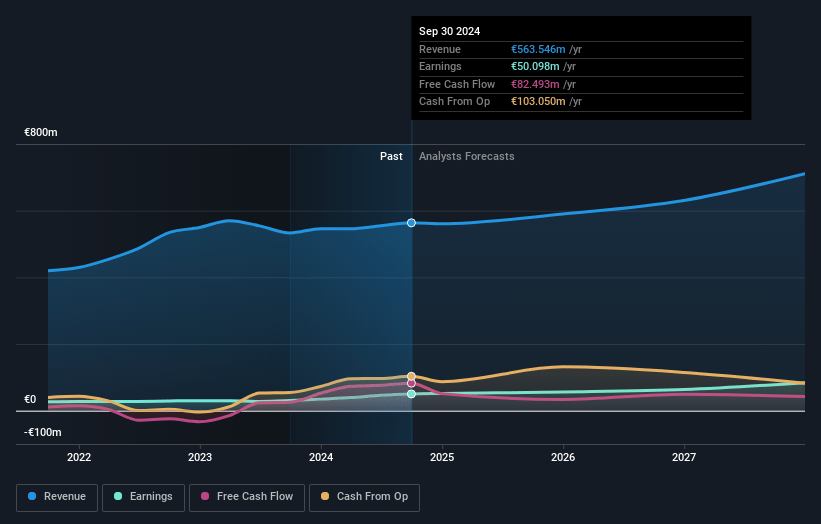

AlzChem Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AlzChem Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming AlzChem Group's revenue will grow by 12.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.1% today to 13.8% in 3 years time.

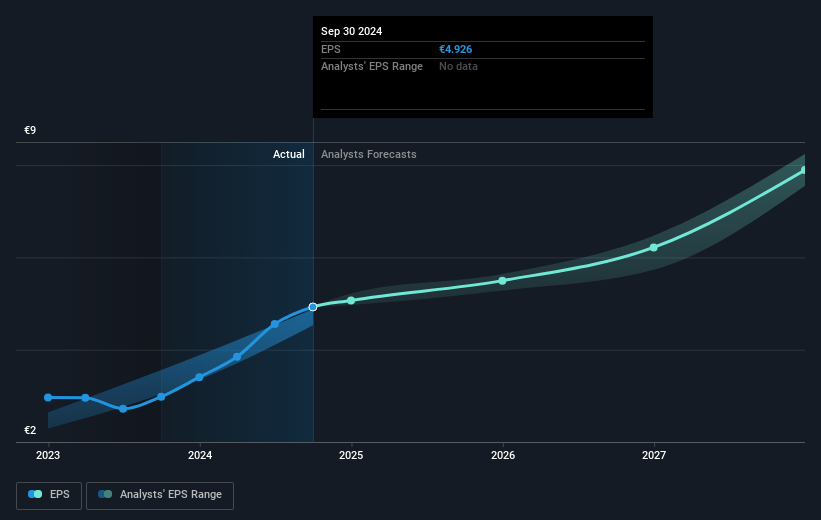

- The bullish analysts expect earnings to reach €111.2 million (and earnings per share of €10.96) by about July 2028, up from €56.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, down from 29.5x today. This future PE is lower than the current PE for the DE Chemicals industry at 18.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.18%, as per the Simply Wall St company report.

AlzChem Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AlzChem Group is experiencing robust and steady growth in its Specialty Chemicals segment, with record-high sales and EBITDA margins, which could provide resilience and even expansion in both revenue and net margins despite broader industry risks.

- The company's ongoing capacity expansions in nitroguanidine and creatine are substantially supported by customer prepayments and EU grants, reducing funding risk and potentially fueling significant medium-term revenue and profit growth as these new facilities come online.

- There is strong customer demand and project pipeline for creatine and custom manufacturing, as evidenced by broad-based volume increases and sustained innovation, which could drive continued improvement in earnings.

- Management remains optimistic about achieving aggressive long-term targets, specifically targeting €1 billion in revenues and €100 million in after-tax earnings by 2030, suggesting a positive earnings trajectory if sector trends remain constructive.

- Potential trade policy changes in the US that disproportionately target Chinese competitors could give AlzChem a pricing and market share advantage in North America, possibly supporting revenue expansion and net margin growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AlzChem Group is €145.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AlzChem Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €145.0, and the most bearish reporting a price target of just €97.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €803.2 million, earnings will come to €111.2 million, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 5.2%.

- Given the current share price of €164.4, the bullish analyst price target of €145.0 is 13.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.